India misses chance to tackle UK carbon tax in trade pact. Why is it concerning?

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

India misses chance to tackle UK carbon tax in trade pact. Why is it concerning?

UK’s CBAM, which is set to come into effect from January 1, 2027, is expected to impact India’“CBAM is not a trade measure. It is not part of trade,” Delphin told the newspaper. The UK government has said that the UK government will apply to both “direct and indirect emissions” and “including those. of the most emissions-intensive industrial sector.” “The sectoral and product-level scope of the CBAM will be kept under review beyond 2027 as new evidence comes to light, as well as. changing to a point further up the value chain,’ a statement read. (Photo: AP) UK Prime Minister Keir Starmer and Prime Minister Narendra Modi for a photo after the free-trade agreement was signed on Thursday. ( photo: AP) UK PM Narendra Modi and Prime Ministers of India and India for a picture.

The UK’s CBAM, which is set to come into effect from January 1, 2027, is expected to impact India’s exports of steel, aluminium and other carbon-intensive goods. India’s steel and aluminium exports are already facing steep tariff restrictions from the US after US President Donald Trump raised the tariffs on the items to 50 per cent.

An absence of a resolution not only weakens India’s position—as it missed the opportunity to address the levy within a legal framework—but also casts a shadow over the duty concessions won for 99 per cent of its exports to the UK under the long-negotiated trade deal as UK could raise tariffs on industrial imports once it implements CBAM.

Story continues below this ad

Trade experts believe that if the UK has not conceded ground on the carbon tax, the EU may also refuse to offer any concessions on its own carbon measures. Hervé Delphin, EU Ambassador to India, told The Indian Express last month that the EU’s CBAM is not part of negotiations. “CBAM is not a trade measure. It is not part of trade and the FTA. It’s about compliance with our climate agenda to accelerate decarbonisation,” Delphin told the newspaper.

While the Ministry of Commerce and Industry claims that the UK trade deal will allow around 99 per cent of Indian exports to benefit from zero-duty access to the UK market, CBAM significantly could alter that. The UK government has said that the carbon tax will apply to both “direct and indirect emissions” embodied in imported CBAM goods, “including those emissions embodied in relevant precursor goods at a point further up the value chain”.

Story continues below this ad

This means that London, based on its carbon calculations, could impose duties on Indian intermediate exports as well as finished products. Indian goods exports worth at least $775 million to the UK, therefore, continue to face the risk of higher duties under its carbon tax mechanism.

CRAM’s scope could widen

As per the CBAM regulation, the UK will place a carbon price on some of the most emissions-intensive industrial goods imported to the UK—covering the aluminium, cement, fertiliser, hydrogen, and iron & steel sectors—which are considered at risk of carbon leakage. But the scope will increase going forward.

“The sectoral and product-level scope of the CBAM will be kept under review beyond 2027 as new evidence comes to light to reflect changes to carbon leakage risk, as well as methodological and technological advances,” a statement read.

Story continues below this ad

India’s exports to the UK rose by 12.6 per cent to $14.5 billion, while imports grew by 2.3 per cent to $8.6 billion in 2024–25. Bilateral goods trade between India and the UK increased to $21.34 billion in 2023–24 from $20.36 billion in 2022–23.

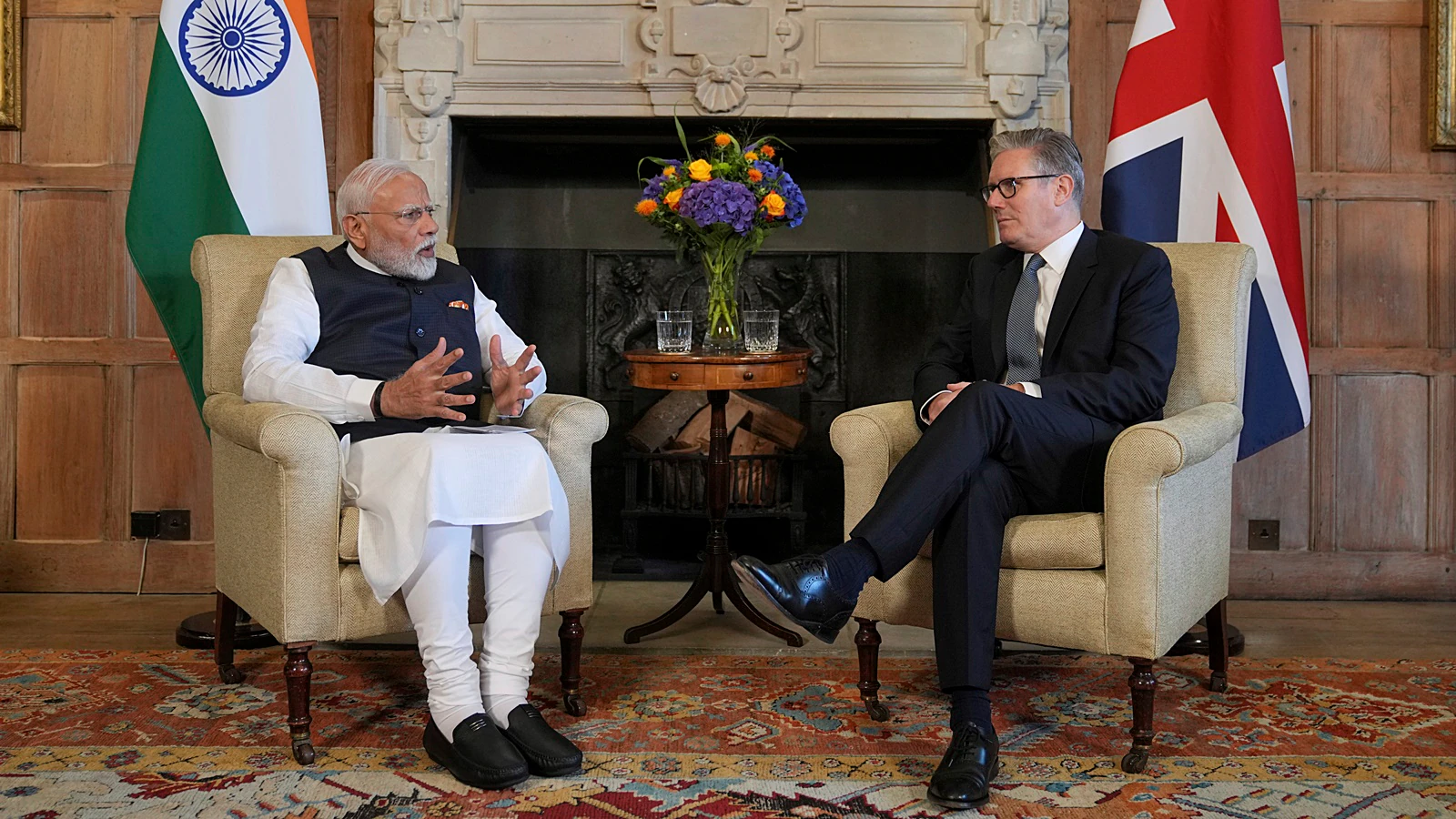

UK Prime Minister Keir Starmer and Prime Minister Narendra Modi pose for a photo after the free trade agreement was signed on Thursday. (Photo: AP) UK Prime Minister Keir Starmer and Prime Minister Narendra Modi pose for a photo after the free trade agreement was signed on Thursday. (Photo: AP)

Challenge at the WTO

As no concession was secured under the FTA, India could challenge the regulation at the WTO on the grounds that CBAM violates special and differential treatment (SDT) provisions, which advocate longer implementation periods for developing countries to safeguard their trade interests.

However, trade law experts warn that the CBAM regulations in both the UK and EU may be in effect by the time the WTO rules on the matter, given the dysfunction of the organisation’s Dispute Settlement Body (DSB).

Story continues below this ad

They also said there is limited likelihood of an adverse ruling on CBAM at the WTO, as the EU remains one of the strongest supporters of the institution. A more probable outcome would be adjustments to the regulation rather than its complete withdrawal.

Source: https://indianexpress.com/article/business/india-uk-carbon-tax-trade-pact-10148660/