India Offers INR Loan, Partial Debt Write-Off During Modi’s Visit to the Maldives

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

India Offers INR Loan, Partial Debt Write-Off During Modi’s Visit to the Maldives

Modi’s third visit is seen as a symbolic affirmation of restored normalcy in Indo-Maldivian ties after a rocky start. On his first visit to the Maldives since Mohamed Muizzu came to power, Indian Prime Minister Narendra Modi arrived on Friday (July 25) with a $565 million line of credit. A partial loan write-off to ease Malé’s debt burden, and a promise to explore a free trade pact also part of the deal. Modi landed at the Velanaa international airport on Friday morning to be welcomed by Muzzu. The Indian leader was the first foreign leader to visit the Maldivian since MuZZu took office in November 2023. Bilateral ties had appeared to sour during the first six months of MuizzU’S presidency. However, relations began to stabilise after he attended Modi’‘s third-term swearing-in ceremony in June 2024, followed by his own state visit to India in October 2024.

Modi’s third visit is seen as a symbolic affirmation of restored normalcy in Indo-Maldivian ties after a rocky start.

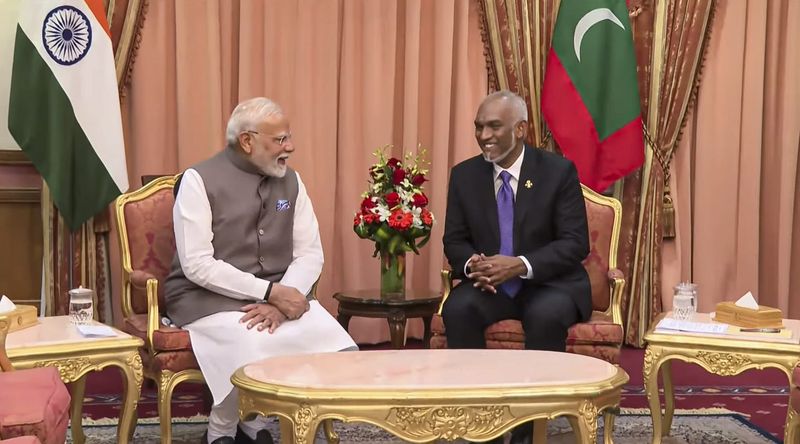

In this screengrab via the PMO’s website, Prime Minister Narendra Modi with Maldivian President Mohamed Muizzu during a meeting in Male on July 25, 2025. Photo via PTI.

New Delhi: On his first visit to the Maldives since Mohamed Muizzu came to power, Indian Prime Minister Narendra Modi arrived on Friday (July 25) with a $565 million line of credit, a partial loan write-off to ease Malé’s debt burden, and a promise to explore a free trade pact.

On the last leg of his two-nation foreign trip, Modi landed at the Velanaa international airport on Friday morning to be welcomed by Muizzu. The Indian leader was the first foreign leader to visit the Maldives since Muizzu took office in November 2023.

Bilateral ties had appeared to sour during the first six months of Muizzu’s presidency. However, relations began to stabilise after he attended Modi’s third-term swearing-in ceremony in June 2024, followed by his own state visit to India in October 2024.

This visit, Modi’s third to the Maldives as prime minister, is seen as a symbolic affirmation of restored normalcy after a rocky start. He will also attend the Maldives’ Independence Day celebrations on Saturday as guest of honour.

Following restricted and delegation-level talks, Muizzu announced that India had extended a line of credit worth Rs 4,850 crore ($565 million).

“This LOC will be utilised for priority projects of my government across key sectors, including defence, sports, healthcare, education and housing,” he said.

This will be the first line of credit to the Maldives to be denominated in Indian rupees.

Modi, describing the India-Maldives relationship as “older than history and as deep as the ocean”, confirmed the new line of credit and said both countries had begun discussions on a free trade agreement and a bilateral investment treaty.

“We have taken several steps to accelerate our economic partnership. To encourage mutual investment, we will soon work towards finalising a bilateral investment treaty. Talks have also begun on a free trade agreement. Our aim now is – from paperwork to prosperity!” he said.

The shift in tone from the Muizzu administration had come amid deepening economic challenges, including a foreign exchange crunch driven by rising external debt-servicing requirements.

“We appreciate the pivotal role played by India in supporting the Maldives to manage economic and liquidity challenges through a $400 million US dollar currency swap facility and interest-free one-year rollover of the treasury bill in May 2025,” Muizzu said.

Due to the Maldives’ economic issues, one of the key eight agreements signed was an “amendatory agreement” on reducing the Maldives’ annual debt repayment obligations on India’s line of credit.

Foreign secretary Vikram Misri later explained to reporters that it would bring down the annual debt repayment obligations of the Maldives towards India by a sharp 40%, from nearly $51 million annually to about $29 million.

This debt repayment had been for a line of credit worth $800 million that had been extended by India to the previous Mohamed Solih government in 2019.

Misri elaborated that while a number of projects had been implemented under that credit line, the Maldives had been unable to finalise others and utilise the remaining balance.

“But given the way the LOCs [lines of credit] work and the terms and conditions of the LOCs, the repayment obligations had kicked in,” he said.

The Wire has learnt that only about $460 million of the original $800 million had been utilised.

Taking into account the Maldives’ financial difficulties, both sides “came to the conclusion that a rationalisation of the LOC was necessary”. He added that while such a revision would normally be more complex, the “special circumstances” allowed both governments to reach a quicker solution.

The result was the amendatory agreement signed on Friday, which “reduces the obligations of the Maldives towards debt repayment by closing out this particular LOC”.

At the same time, Misri noted that Malé’s development needs remain. “There are other projects that they need to do,” he said. To enable this, the old credit line was replaced by the new agreement denominated in Indian rupees.

This new LOC, he said, is more aligned with the Maldives’ “current financial circumstances”.

Sources explained to The Wire that the INR loan is critical at this moment as “it is very difficult for the Maldives to raise money given their credit ratings”.

Both Fitch and Moody’s have issued negative ratings for the country, citing a high risk of default due to its debt burden.

Indeed, the broader economic picture remains challenging. According to official data from the Maldives’ finance ministry, public debt reached 121% of GDP in the first quarter of 2025. External debt repayments for this year are projected at around $700 million, rising sharply to $1.07 billion in 2026.

These amounts far exceed the country’s gross international reserves, which stood at $815.8 million at the end of May.

Notably, those reserves include $400 million extended by India under a currency swap agreement signed with the Reserve Bank of India in September 2024.

Given this financial strain, it is not surprising that the Muizzu administration has moved closer to India, the Maldives’ largest trading partner.

However, the pivot is still particularly notable given that one of the most widely circulated images from Muizzu’s campaign showed him in a red T-shirt emblazoned with the slogan ‘India Out’, leading a protest against the presence of Indian troops in the Maldives.

Within a day of taking office in 2023, Muizzu formally requested the withdrawal of Indian personnel operating a Dornier aircraft and two helicopters donated for humanitarian and rescue operations.

The demand had set the tone for a tense phase in bilateral ties. His government also declined to renew a hydrography pact and raised concerns about excessive dependence on a single foreign partner for essential goods.

Muizzu’s early China visit, breaking with tradition, fuelled perceptions of a tilt towards Beijing.

The first signs of a thaw came in April 2024, when India renewed its traditional quota for the supply of essential commodities to the Maldives.

In May, the Maldivian foreign minister visited New Delhi. His visit coincided with the departure of the final batch of Indian soldiers from the Maldives on May 10. The Dornier and helicopters they had operated remain in the country, now staffed by Indian civilian personnel.

This arrangement has allowed Muizzu to claim that he fulfilled his campaign promise to remove foreign troops, while India continues to maintain a strategic presence through the operation of its aircraft.

The Wire is now on WhatsApp. Follow our channel for sharp analysis and opinions on the latest developments.

Source: https://m.thewire.in/article/diplomacy/india-inr-loan-partial-debt-write-off-modi-maldives