Global oversight needed for the tokenization of currency: Nirmala Sitharaman

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Global oversight needed for the tokenization of currency: Nirmala Sitharaman

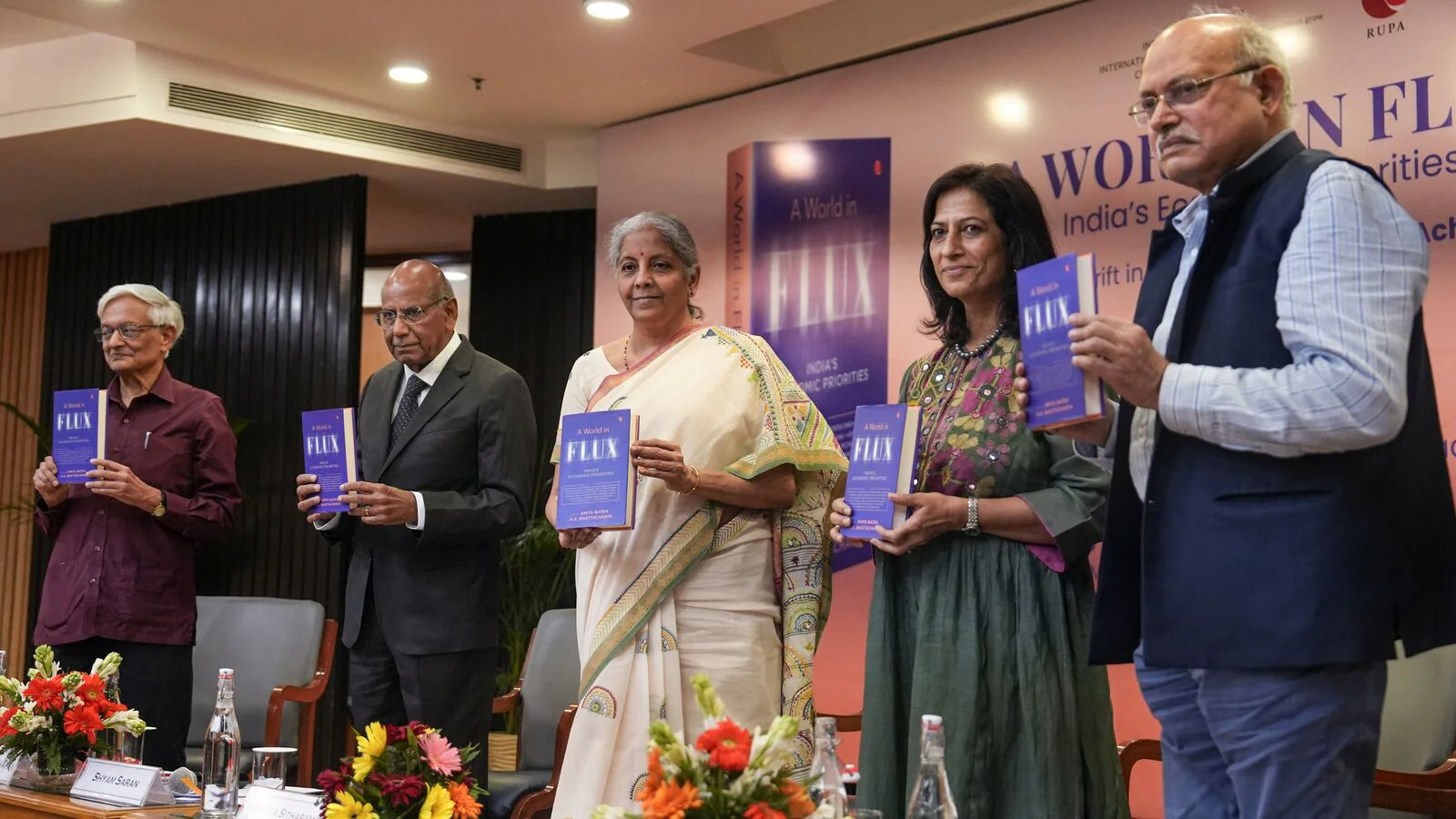

Finance minister Nirmala Sitharaman called for a redefinition of multilateral institutions to provide effective oversight. She spoke at the release of a book, A World in Flux: India’s Economic Priorities, in New Delhi. Her concerns about the tokenization of currency come at a time when cryptocurrencies are increasingly making their way into the financial world. The Reserve Bank of India has cautioned multiple times that virtual currencies are risky. However, the US government under President Donald Trump is encouraging more innovation in this area. The book, by Amita Batra and A.K. Bhattacharya, is published by Rupa Publications India Pvt. Ltd (Rupa) (www.rupa.co.in) The book is edited by Amit Batra, former chairperson at the Centre for South Asian Studies.

Speaking at the release of a book, A World in Flux: India’s Economic Priorities, in New Delhi, she said that multilateral institutions have never been left in limbo in the last 100 years.

Also Read | Our approach to the regulation of cryptocurrency needs clarity

The finance minister said this is true for financial as well as strategic institutions. Every multilateral institution that has successfully served earlier is now wondering where it is, what its immediate future will be, and how it will redefine itself.

Her concerns about the tokenization of currency—the transformation of money into digital tokens on a blockchain or distributed ledger—come at a time when cryptocurrencies are increasingly making their way into the financial world.

The Reserve Bank of India has cautioned multiple times that virtual currencies are risky.

However, the US government under President Donald Trump is encouraging more innovation in this area.

In January, Trump signed an executive order to ensure Washington’s leadership in digital financial technology. He then set up a working group to develop a federal regulatory framework governing digital assets, including stablecoins, and to evaluate the creation of a strategic national digital assets stockpile.

Also Read | Act now: Crypto regulation cannot be left for another day

Trump also revoked the Treasury Department’s “Framework for International Engagement on Digital Assets, which suppressed innovation and undermined US economic liberty and global leadership in digital finance”.

The US is also trying to become the “crypto capital of the planet”, according to the presidential order.

Sitharaman said multilateral institutions have to be redefined. “If you could go for a currency with no gold backing sometime in the 70s, now it is already moving towards tokenization and is that something on which we see the depth of?”

The minister also asked if there was any framework under which any country could unilaterally take that route. “Who is going to have oversight on these sorts of things?”

The minister said the depth and the complexity of the situation were increasing.

The book, A World in Flux: India’s Economic Priorities, edited by Amita Batra, former chairperson at the Centre for South Asian Studies and A.K. Bhattacharya, editorial director at Business Standard is published by Rupa Publications India Pvt. Ltd.

Sitharaman also said in response to a question about the normalization of economic ties with China that it was right to point out that there are calls for greater access and interaction with China, and possibly to open some windows.

“That is not just from our side, even the Chinese have been approaching through the ministry of external affairs,” the minister said, referring to external affairs minister S. Jaishankar’s recent visit to China.

“There is some kind of beginning. As to how far it will go, it is something we will have to wait and see,” the minister said, adding it might help the economy, and a sense of caution would have to be built in.

To a question on investments in the economy, she said that companies’ and banks’ balance sheets have become healthier, and the corporate tax rate was cut to boost investments.

Referring to what the minister was hearing from observers and her own interactions with business leaders, Sitharaman asked if businesses were sitting on passive, investible funds. “That is, investible funds that are being engaged passively rather than investing and expanding capacity. That is an issue that I would obviously want the industry to speak about.”

Also Read | Mint Quick Edit: Time to rescue crypto from policy limbo

On trade, she said bilateral trade has now taken priority over multilateral trade, though she could not comment on the merits of this trend.