CK Hutchison wants Chinese firm to join bidding for its $22.8 billion ports business

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

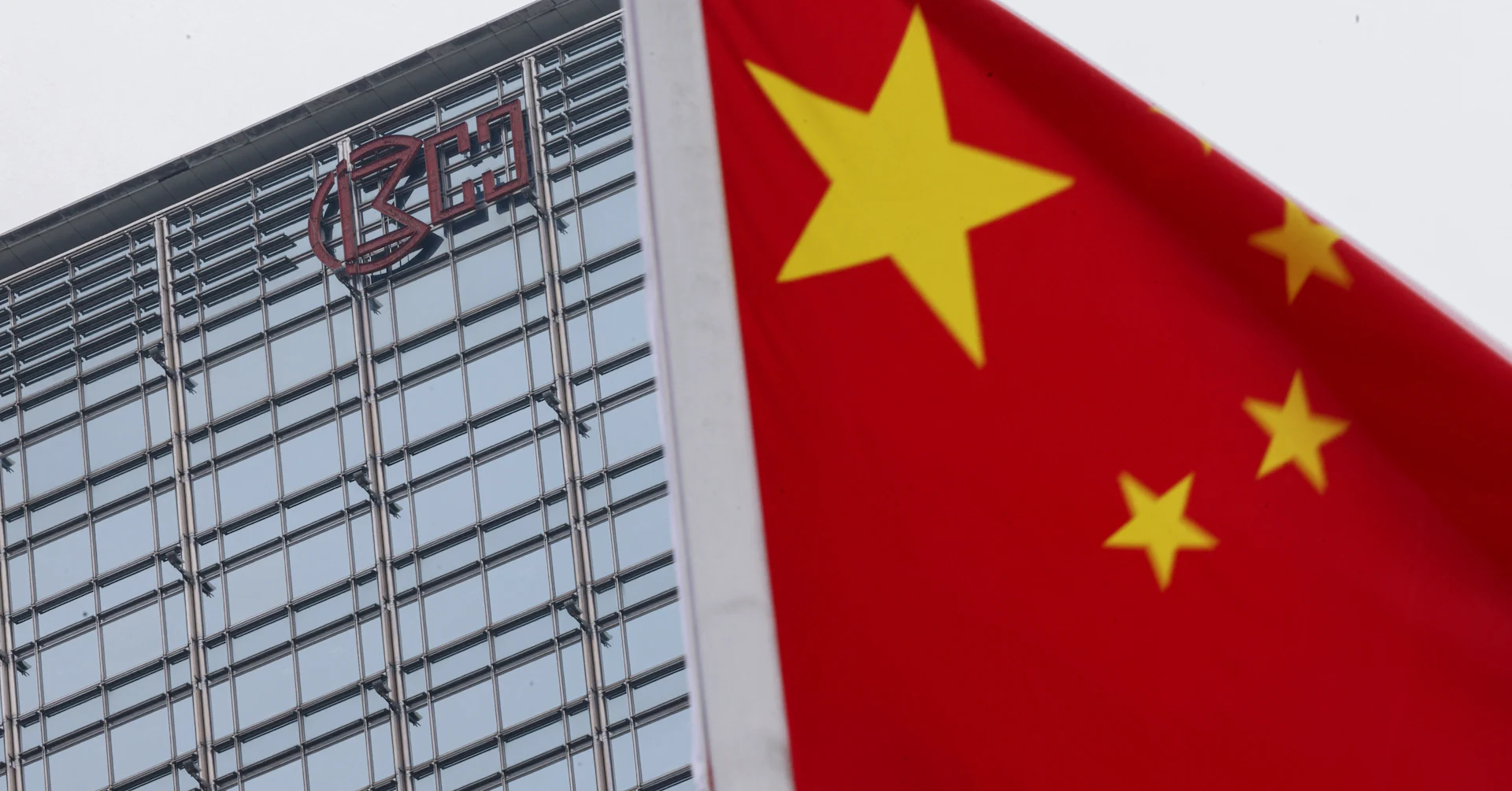

CK Hutchison wants Chinese firm to join bidding for its $22.8 billion ports business

CK Hutchison wants a major Chinese strategic investor to join the BlackRock-led consortium bidding for its $22.8 billion ports business. Media reported that state-owned China COSCO Shipping Corp aims to join group. Deal would cover 43 ports in 23 countries including two ports near the Panama Canal which links the Atlantic and Pacific oceans. U.S. President Donald Trump initially hailed the sale as “reclaiming” the Canal after his administration called for the removal of what it said was Chinese ownership of some ports. A PRC investor with majority control of the consortium sounds like a non-starter in my view.

HONG KONG, July 28 (Reuters) – CK Hutchison (0001.HK) , opens new tab said on Monday it wants a major Chinese strategic investor to join the BlackRock-led consortium bidding for its $22.8 billion ports business, after media reported that state-owned China COSCO Shipping Corp aims to join the group.

The Hong Kong conglomerate in a statement said changes to the composition of the consortium and structure of the transaction will be necessary to secure regulatory approval, and that it will allow as much time as needed to achieve that.

Sign up here.

CK Hutchison’s Hong Kong-listed shares were due to open higher just shy of 1% on Monday.

A deal would cover 43 ports in 23 countries including two ports near the Panama Canal which links the Atlantic and Pacific oceans.

U.S. President Donald Trump initially hailed the sale as “reclaiming” the Panama Canal after his administration called for the removal of what it said was Chinese ownership of some ports.

U.S. investment firm BlackRock (BLK.N) , opens new tab declined to comment. COSCO, Italian consortium member MSC and the White House did not immediately respond to requests for comment.

China views the potential sale as a threat to its interests, seeing the consortium as a proxy for growing American influence in a region it considers economically and geopolitically significant.

State-backed media, in criticism of the sale, said China has significant national interests in the matter and that selling the ports would be a betrayal of the country.

China’s top market regulator said it was paying close attention to developments and stressed the deal would be subject to a Chinese antitrust review.

CK Hutchison in its statement said any new investor must be a “significant” member of the consortium.

“This is an interesting development. A PRC (China) investor with majority control of the consortium sounds like a non-starter in my view. An investor with a less than 50% stake you would think should keep everyone happy,” said strategist David Blennerhassett of Ballingal Investment Advisors who publishes on SmartKarma.

Reporting by Rishav Chatterjee and Clare Jim; writing by Scott Murdoch. Editing by Tom Hogue and Christopher Cushing

Our Standards: The Thomson Reuters Trust Principles. , opens new tab