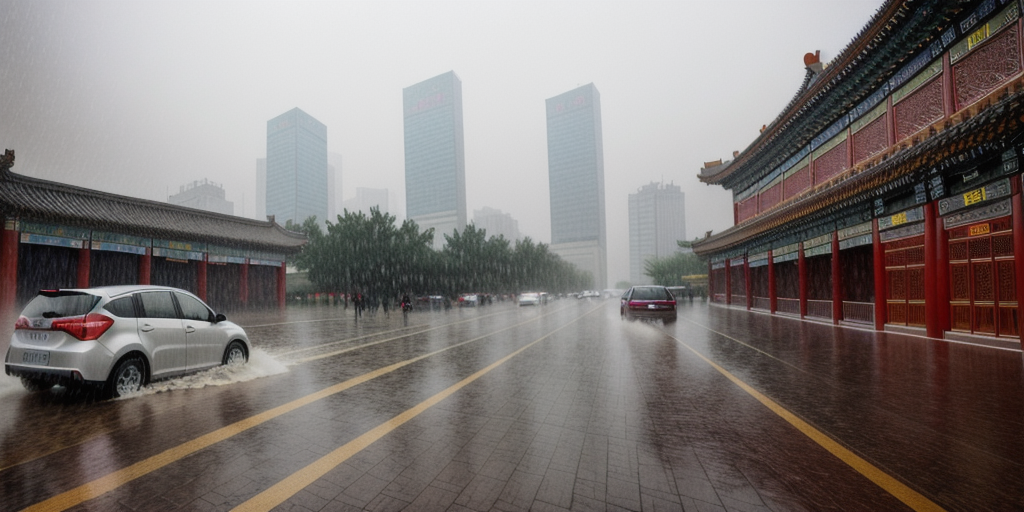

Extreme weather turns Beijing into rain trap, kills at least 30

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Euro struggles after reality check on US-EU trade deal

The euro slid 1.3% in the previous session, its sharpest one-day percentage fall in over two months. The slide in the euro in turn boosted the dollar, which jumped 1% against a basket of currencies overnight. The dollar held on to gains on Tuesday and knocked sterling to a two-month low of $1.3338. The onshore yuan touched a one-week low of 7.1794 per dollar, with investors awaiting the outcome of trade talks between Washington and Beijing.Apart from trade negotiations, investors’ focus this week is also on rate decisions from the Federal Reserve and the Bank of Japan (BOJ) Both central banks are expected to stand pat on rates, but traders will watch subsequent comments to gauge the timing of their next moves. For confidential support call the Samaritans in the UK on 08457 90 90 90, visit a local Samaritans branch or click here for details.

US-EU trade deal criticised by some Eurozone leaders

Dollar buoyant, focus on Fed, BOJ next

SINGAPORE, July 29 (Reuters) – The euro struggled to recoup its steep losses on Tuesday as investors sobered up to the fact that terms of the trade deal between the U.S. and the European Union favoured the former and hardly lifted the economic outlook of the bloc.

France, on Monday, called the framework trade agreement a “dark day” for Europe, saying the bloc had caved in to U.S. President Donald Trump with an unbalanced deal that slapped a headline 15% tariff on EU goods.

Sign up here.

German Chancellor Friedrich Merz said his economy would suffer “significant” damage due to the agreed tariffs

The euro slid 1.3% in the previous session, its sharpest one-day percentage fall in over two months, on worries about growth and as euro-area government bond yields fell.

The common currency failed to recoup its losses and last traded 0.02% lower at $1.1584.

“It hasn’t taken long for markets to conclude that this relatively good news is still, in absolute terms, bad news as far as the near term implications for euro zone growth are concerned,” said Ray Attrill, head of FX research at National Australia Bank.

“The deal has been roundly condemned by France while others – including German Chancellor Merz – are playing up the negative consequences for exporters, and with that, economic growth.”

The slide in the euro in turn boosted the dollar, which jumped 1% against a basket of currencies overnight.

Euro and U.S. dollar banknotes are seen in this illustration taken May 4, 2025. REUTERS/Dado Ruvic/Illustration/File Photo Purchase Licensing Rights , opens new tab

The dollar held on to gains on Tuesday and knocked sterling to a two-month low of $1.3338. The yen edged 0.2% higher to 148.22 per dollar.

The dollar index steadied at 98.66.

“While the U.S. dollar’s strength … may reflect the perception that the new U.S.-EU deal is lopsided in favour of the U.S., the U.S. dollar’s strength may also reflect a feeling that the U.S. is re-engaging with the EU and with its major allies,” said Thierry Wizman, global FX and rates strategist at Macquarie Group.

Still, Trump said on Monday most trading partners that do not negotiate separate trade deals would soon face tariffs of 15% to 20% on their exports to the United States, well above the broad 10% tariff he set in April.

Elsewhere, the Australian dollar rose 0.04% to $0.6524, while the New Zealand dollar was little changed at $0.5970.

The onshore yuan touched a one-week low of 7.1794 per dollar, with investors awaiting the outcome of trade talks between Washington and Beijing.

Top U.S. and Chinese economic officials met in Stockholm on Monday for more than five hours of talks aimed at resolving long-standing economic disputes at the centre of a trade war between the world’s top two economies, seeking to extend a truce by three months.

Apart from trade negotiations, investors’ focus this week is also on rate decisions from the Federal Reserve and the Bank of Japan (BOJ).

Both central banks are expected to stand pat on rates, but traders will watch subsequent comments to gauge the timing of their next moves.

Reporting by Rae Wee; Editing by Muralikumar Anantharaman and Kim Coghill

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Trump says he is not seeking summit with Xi, but may visit China

U.S. President Donald Trump said on Tuesday that he was not seeking a summit with Chinese President Xi Jinping. But he added that he may visit China at Xi’s invitation, which Trump said had been extended. A trip would be the first face-to-face encounter between the men since Trump’s second term in office, at a time when trade and security tensions remain elevated.

July 29 (Reuters) – U.S. President Donald Trump said on Tuesday that he was not seeking a summit with Chinese President Xi Jinping, but added that he may visit China at Xi’s invitation, which Trump said had been extended.

“I may go to China, but it would only be at the invitation of President Xi, which has been extended. Otherwise, no interest!,” Trump said on Truth Social.

Sign up here.

Aides to Trump and Xi have discussed a potential meeting between the leaders during a trip by the U.S. president to Asia later this year, sources previously told Reuters.

A trip would be the first face-to-face encounter between the men since Trump’s second term in office, at a time when trade and security tensions between the two superpower rivals remain elevated.

While plans for a meeting have not been finalized, discussions on both sides of the Pacific have included a possible Trump stopover around the time of the Asia-Pacific Economic Cooperation summit in South Korea or talks on the sidelines of the October 30-November 1 event, the people said.

The third round of U.S.-China trade talks taking place in Stockholm this week may lay the groundwork ahead of a leaders’ summit in the autumn, analysts say.

A new flare-up of tariffs and export controls would likely impact any plans for a meeting with Xi.

Reporting by Ismail Shakil in Ottawa; Editing by Jacqueline Wong and Lincoln Feast.

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

UnitedHealth investors may seek roadmap on costs as Hemsley takes center stage

Investors will be looking for confidence that he (Hemsley) has got a handle on things,” said James Harlow, senior vice president at Novare Capital Management. The company’s decision in May to withdraw its 2025 earnings forecast due to soaring medical costs and Medicare-related challenges sent its shares tumbling. Wall Street analysts have lowered expectations throughout this month. Analysts expect a profit of $4.48 per share for the second quarter, according to data compiled by LSEG. The largest U.S. health insurance and services company’s stock has plunged more than 40% this year, dragging down the broader managed care sector with it. It has also grappled with the fallout from a major cyberattack last year that disrupted claims processing across its Change Healthcare unit. The Optum unit, once a growth driver for UnitedHealth, has also emerged as a key area of concern.

Companies UnitedHealth Group Inc Follow

July 28 (Reuters) – UnitedHealth’s (UNH.N) , opens new tab newly returned CEO, Stephen Hemsley, will likely face investor scrutiny over the largest U.S. health insurance and services company’s efforts to rein in the elevated medical costs behind the withdrawal of its annual forecast.

Hemsley returned to the role in May following the abrupt departure of then-CEO Andrew Witty, who stepped down amid rising operational and financial pressures.

Sign up here.

The company’s decision in May to withdraw its 2025 earnings forecast due to soaring medical costs and Medicare-related challenges sent its shares tumbling.

So far this year, UnitedHealth’s stock has plunged more than 40%, dragging down the broader managed care sector with it.

“Investors will be looking for confidence that he (Hemsley) has got a handle on things and that he understands where things may have gone wrong and how they are going to correct it,” said James Harlow, senior vice president at Novare Capital Management, which owns 46,333 shares of the healthcare company.

Hemsley, who ran the company from 2006 to 2017, has promised to rebuild trust, telling shareholders last month that regaining their confidence is a top priority.

The pressure is compounded by a federal investigation into UnitedHealth’s Medicare billing practices. The company recently confirmed it was cooperating with both criminal and civil inquiries from the U.S. Department of Justice. These regulatory woes have only added to the uncertainty facing the insurer.

Wall Street analysts have lowered expectations throughout this month. Analysts expect a profit of $4.48 per share for the second quarter, according to data compiled by LSEG. That compares with expectations of $5.70 per share in May, when the company suspended its annual profit forecast.

UnitedHealth plans to establish “a prudent 2025 earnings outlook and offer initial perspectives for 2026,” the company had said in June.

“Ultimately, on Tuesday, what we’d expect is more clarity on the way forward…we would expect a strategy, a roadmap laid out,” said Sahil Bhatia, managing director of life sciences at Manning & Napier.

“I think one of the big issues over the last few months has been just the surprises…so we would expect more consistent execution going forward after laying out that roadmap,” Bhatia said.

At least two investors said they anticipate UnitedHealth will reset its 2025 profit forecast in the range of $18 to $20 per share, far below the company’s previous outlook of $26 to $26.50.

This might be conservative but is an appropriate start for Hemsley’s first call, said Jeff Jonas, portfolio manager at Gabelli Funds.

UnitedHealth has previously built a reputation to guide conservatively and raise its outlook as the year progresses.

But this time, investors warn, withholding guidance altogether would be damaging. “If they continue to not give an EPS outlook for 2025, that will be damaging,” Harlow added.

Apart from financial turbulence, the company has also faced reputational challenges . It has moved to ease prior authorization requirements after a public outcry following the killing of a UnitedHealth executive last December.

The Optum unit, once a growth driver for UnitedHealth, has also emerged as a key area of concern. Last quarter, the company flagged “unanticipated changes” in its Optum business that impacted planned 2025 reimbursements.

“Among all the overhangs, Optum Health remains the biggest concern,” said Deutsche Bank analyst George Hill.

UnitedHealth has also grappled with the fallout from a major cyberattack last year that disrupted claims processing across its Change Healthcare unit.

Reporting by Sriparna Roy in Bengaluru; Editing by Sriraj Kalluvila

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

Share X

Link Purchase Licensing Rights

Extreme weather turns Beijing into rain trap, kills at least 30

Extreme weather killed at least 30 people in Beijing after a year’s worth of rain fell in a matter of days. 28 deaths reported in the district of Miyun and two in Yanqing, Xinhua news agency said on Tuesday. More than 80,000 Beijing residents had been relocated, with roads and communication infrastructure damaged and 136 villages cut off overnight. Rainfall in the city of Xingtai in neighbouring Hebei province exceeded 1,000 mm in two days – double the yearly average of 600 mm.China’s usually arid north has seen record precipitation in recent years, with some scientists linking the rainfall to global warming. In the summer of 2023, heavy rain and flooding killed at at least 33 people in China’s capital, Beijing, with eight still missing, state media reported. The capital experienced rainfall of up to 543.4 mm (21.4 inches) in its northern districts on Monday, with the average annual rainfall in Beijing is around 600mm.

Item 1 of 4 People walk by a damaged bridge after heavy rainfall flooded the area, in Huairou district of Beijing, China July 28, 2025. cnsphoto via REUTERS

Summary Thirty people dead as ‘extreme’ rain hits Beijing

More than 80,000 Beijing residents relocated

Beijing issued highest-level rain, flood alerts

Authorities allocate funds, urge relief efforts

At least four dead, villages flooded on Monday in neighbouring regions

BEIJING, July 29 (Reuters) – Extreme weather killed at least 30 people in Beijing after a year’s worth of rain fell in a matter of days, stretching the Chinese capital’s disaster management capabilities and prompting some experts to call the city a rain trap.

Much of the rain inundated Beijing’s mountainous north near the Great Wall, with 28 deaths reported in the district of Miyun and two in Yanqing, the official Xinhua news agency said on Tuesday. It did not say when or how the deaths occurred.

Sign up here.

Heavy rain started last Wednesday and intensified around Beijing and surrounding provinces on Monday, with the capital experiencing rainfall of up to 543.4 mm (21.4 inches) in its northern districts, Xinhua said. The average annual rainfall in Beijing is around 600 mm.

“The cumulative amount of precipitation has been extremely high – reaching 80–90% of the annual total in just a few days in some areas,” said Xuebin Zhang of the University of Victoria in Canada and CEO of the Pacific Climate Impacts Consortium (PCIC).

“Very few systems are designed to handle such an intense volume of rainfall over such a short period,” Zhang said.

The local topography – mountains to the west and north – “trapped” the moist air and forced it to rise, enhancing the extraordinary amount of precipitation, he said.

China’s usually arid north has seen record precipitation in recent years, with some scientists linking the rainfall to global warming.

In the summer of 2023, heavy rain and flooding killed at least 33 people in Beijing. Rainfall in the city of Xingtai in neighbouring Hebei province exceeded 1,000 mm in two days – double the yearly average.

Late on Monday, President Xi Jinping said there had been “heavy casualties and property losses” in Beijing and the provinces of Hebei, Jilin and Shandong, and ordered “all-out” search and rescue efforts.

More than 80,000 Beijing residents had been relocated, Xinhua reported, with roads and communication infrastructure damaged and power to 136 villages cut off overnight.

The most intense rain occurred on Saturday in Beijing’s hilly Huairou, which saw 95.3 mm of rain in one hour.

In Miyun on Monday, some people were trapped at an elderly care centre as water levels rose close to the roof. Emergency rescue services swam into the building and used ropes to pull out 48 people.

On Tuesday, parks, libraries and museums including the Palace Museum at the Forbidden City were closed. Train and bus services in the suburbs and along waterways were suspended. Hundreds of flights were cancelled or delayed at Beijing’s two airports, state media reported.

‘FLOOD STILL COMING’

Heavy rain also pounded the province of Hebei and the city of Tianjin neighbouring Beijing, which are all part of the vast Hai river basin.

Four people were killed in a landslide in Hebei on Monday, with eight still missing, as six months’ worth of rain fell over the weekend.

In two villages in Tianjin on Monday, major roads were flooded, bridges damaged, with only the roofs of single-storey houses visible, China Central Television (CCTV) reported.

Heavy rain is expected to persist in parts of Beijing, Hebei and Tianjin on Tuesday, the emergency management ministry said Monday night, adding that “the disaster relief situation is complex and severe.”

Some residents in the region posted on social media platform Weibo calling on authorities to expedite rescue efforts.

“The flood is still coming, and there is still no power or signal, and I still can’t get in touch with my family!” a post on Tuesday morning said.

Reporting by Xiuhao Chen and Liz Lee in Beijing and Farah Master in Hong Kong; Editing by Stephen Coates and Saad Sayeed

Our Standards: The Thomson Reuters Trust Principles. , opens new tab

US, China hold new talks on tariff truce, easing path for Trump-Xi meeting

Top U.S. and Chinese economic officials met in Stockholm on Monday for more than five hours of talks aimed at resolving longstanding economic disputes. Talks seek to extend a truce by three months. Talks follow Trump’s biggest trade deal yet with the European Union on Sunday for a 15% tariff on most EU goods exports to the United States. Trade analysts said another 90-day extension of a tariff and export control truce struck in mid-May was likely. An extension would facilitate planning for a potential meeting between Trump and Chinese President Xi Jinping in late October or early November, they said. China is facing an August 12 deadline to reach a durable tariff agreement with President Donald Trump ‘s administration, after Beijing and Washington reached preliminary deals in May and June to end weeks of escalating tit-for-tat tariffs and a cut-off of rare earth minerals. China claims Taiwan as its own territory, a position Taiwan rejects, and denounces any show of support for Taipei from Washington from Washington. Taiwan President Lai Ching-te is set to delay an August trip his team had floated to the Trump administration.

Companies Stockholm talks aim to extend tariff truce by 90 days

Talks expected to resume on Tuesday

Trump-Xi meeting could ease trade tensions, analysts say

China seeks reduction of US tariffs and tech export controls

STOCKHOLM, July 28 (Reuters) – Top U.S. and Chinese economic officials met in Stockholm on Monday for more than five hours of talks aimed at resolving longstanding economic disputes at the centre of a trade war between the world’s top two economies, seeking to extend a truce by three months.

U.S. Treasury Chief Scott Bessent was part of a U.S. negotiating team that arrived at Rosenbad, the Swedish prime minister’s office in central Stockholm, in the early afternoon. China’s Vice Premier He Lifeng was also seen at the venue on video footage.

Sign up here.

China is facing an August 12 deadline to reach a durable tariff agreement with President Donald Trump ‘s administration, after Beijing and Washington reached preliminary deals in May and June to end weeks of escalating tit-for-tat tariffs and a cut-off of rare earth minerals.

Negotiators from the two sides were seen exiting the office around 8 p.m. (1800 GMT) and did not stop to speak with reporters. The discussions are expected to resume on Tuesday.

Trump touched on the talks during a wide-ranging press conference with British Prime Minister Keir Starmer in Scotland.

“I’d love to see China open up their country,” Trump said.

Without an agreement, global supply chains could face renewed turmoil from U.S. duties snapping back to triple-digit levels that would amount to a bilateral trade embargo.

U.S. Trade Representative Jamieson Greer said he did not expect “some kind of enormous breakthrough today” at the talks in Stockholm that he was attending.

“What I expect is continued monitoring and checking in on the implementation of our agreement thus far, making sure that key critical minerals are flowing between the parties and setting the groundwork for enhanced trade and balanced trade going forward,” he told CNBC.

The Stockholm talks follow Trump’s biggest trade deal yet with the European Union on Sunday for a 15% tariff on most EU goods exports to the United States.

XI-TRUMP MEETING?

Item 1 of 5 Swedish Prime Minister Ulf Kristersson greets Chinese Vice Premier He Lifeng at Rosenbad before trade talks between the U.S. and China in Stockholm, Sweden July 28, 2025. TT News Agency/Fredrik Sandberg via REUTERS [1/5] Swedish Prime Minister Ulf Kristersson greets Chinese Vice Premier He Lifeng at Rosenbad before trade talks between the U.S. and China in Stockholm, Sweden July 28, 2025. TT News Agency/Fredrik Sandberg via REUTERS Purchase Licensing Rights , opens new tab

Trade analysts said another 90-day extension of a tariff and export control truce struck in mid-May between China and the United States was likely.

An extension would facilitate planning for a potential meeting between Trump and Chinese President Xi Jinping in late October or early November.

The Financial Times reported on Monday that the U.S. had paused curbs on tech exports to China to avoid disrupting trade talks with Beijing and support Trump’s efforts to secure a meeting with Xi this year.

Meanwhile, in Washington, U.S. senators from both major parties plan to introduce bills this week targeting China over its treatment of minority groups, dissidents, and Taiwan, emphasizing security and human rights, which could complicate talks in Stockholm.

Taiwan President Lai Ching-te is set to delay an August trip his team had floated to the Trump administration that would have included stops in the United States, sources familiar with the matter told Reuters on Monday.

The potential visit would have infuriated Beijing, possibly derailing the trade talks. China claims Taiwan as its own territory, a position Taiwan rejects, and denounces any show of support for Taipei from Washington.

Previous U.S.-China trade talks in Geneva and London in May and June focused on bringing U.S. and Chinese retaliatory tariffs down from triple-digit levels and restoring the flow of rare earth minerals halted by China and Nvidia’s (NVDA.O) , opens new tab H20 AI chips, and other goods halted by the United States.

So far, the talks have not delved into broader economic issues. They include U.S. complaints that China’s state-led, export-driven model is flooding world markets with cheap goods, and Beijing’s complaints that U.S. national security export controls on tech goods seek to stunt Chinese growth.

“Geneva and London were really just about trying to get the relationship back on track so that they could, at some point, actually negotiate about the issues which animate the disagreement between the countries in the first place,” said Scott Kennedy, a China economics expert at the Center for Strategic and International Studies in Washington.

Bessent has already flagged a deadline extension and has said he wants China to rebalance its economy away from exports to more domestic consumption — a decades-long goal for U.S. policymakers.

Analysts say the U.S.-China negotiations are far more complex than those with other Asian countries and will require more time. China’s grip on the global market for rare earth minerals and magnets, used in everything from military hardware to car windshield wiper motors, has proved to be an effective leverage point on U.S. industries.

Reporting by David Lawder, Greta Rosen Fondahn, Marie Mannes, Janis Laizans and Maria Martinez in Stockholm; additional reporting by Liz Lee and Yukun Zhang in Beijing, Terje Solsvik and Gwladys Fouche in Oslo and Bhargav Acharya in Toronto; writing by David Lawder and Keith Weir; Editing by Diane Craft, Stephen Coates, Emelia Sithole-Matarise, Rod Nickel and Chizu Nomiyama

Our Standards: The Thomson Reuters Trust Principles. , opens new tab