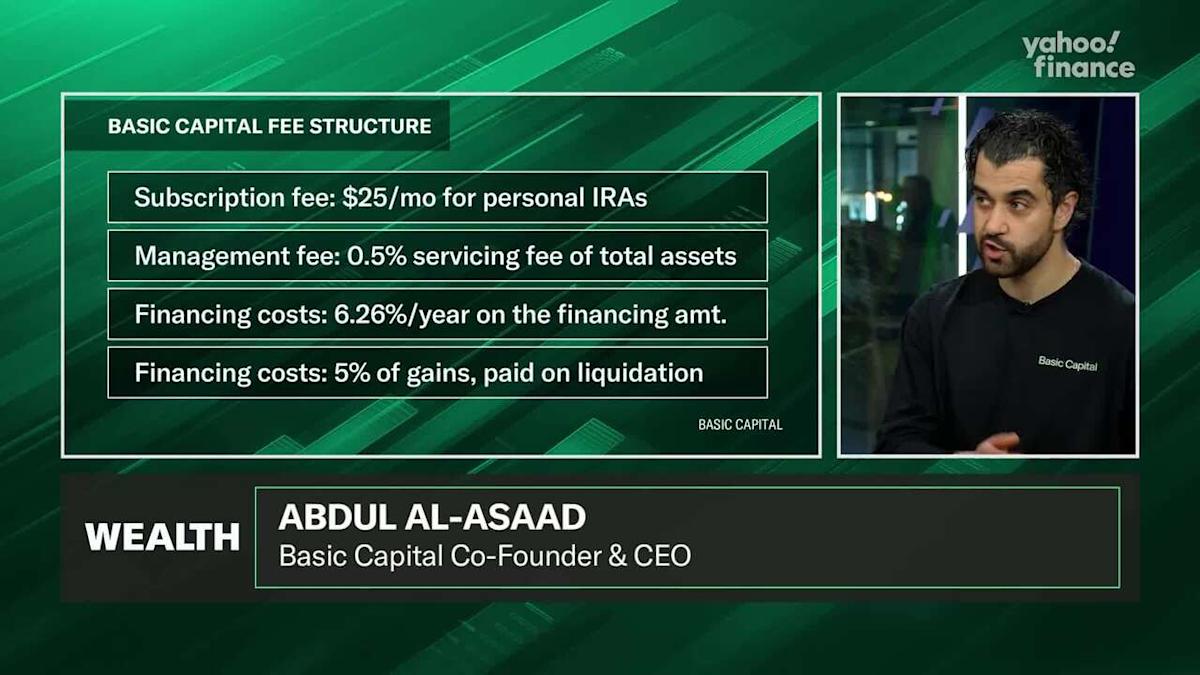

How Basic Capital is helping Americans finance retirement plans

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Advancing Financial Health for Americans

JPMorganChase has supported the mission-driven financial technology sector (fintechs) and nonprofit innovators in developing tools that meet people where they are. Technology isn’t a panacea, approaches that are human-centered have the power to scale financial health solutions and reach underserved populations. Public and workplace benefits are vital to managing daily expenses, covering unexpected needs, and planning for the future. Time and again, we’ve learned that working across public and private sectors is critical to bridging these gaps and creating a more cohesive support network. We’re excited to continue working together to shape the industry’s role in advancing financial health for all in America. The Financial Health Network is a leading nonprofit uniting cross-sector organization to design solutions that equitably advanceFinancial Health for all people. We are continuing to support this work to uncover structural solutions and generate policy recommendations that tackle barriers to economic mobility that hinder families from building savings and accumulating assets—central components of financial security.

Key Lesson #1: Technology Paired with Human-Centered Design Drives Scalable Outcomes

While technology isn’t a panacea, approaches that are human-centered—designed with the needs of people in mind—have the power to scale financial health solutions and reach underserved populations. JPMorganChase has supported the mission-driven financial technology sector (fintechs) and nonprofit innovators in developing tools that meet people where they are, helping them budget, save, build credit, and create wealth with greater ease and dignity.

We have seen technology scale innovative financial health solutions, through initiatives like the Financial Solutions Lab (FSL), an early stage accelerator for mission-driven fintechs in collaboration with the Financial Health Network—a leading nonprofit uniting cross-sector organization to design solutions that equitably advance financial health for all people. The FSL startups have collectively supported over 30 million individuals, helping them build $3 billion in savings, avoid $420 million in fees, and settle $200 million in debt.

“Financial health is not merely a responsibility; it is an opportunity to transform lives, strengthen communities, and propel industries. In our decades-long partnership with JPMorganChase, they have consistently demonstrated what’s possible when business strategy is aligned with philanthropic purpose. Their commitment to both intention and impact has driven meaningful investments, data, and insights that continue to fuel innovation across the sector. We’re excited to continue working together to shape the industry’s role in advancing financial health for all in America.” – Jennifer Tescher, Founder and CEO of The Financial Health Network

With Code for America, we have seen another model for how technology is helping modernize public benefits systems to create efficiencies and expand access. With our initial support, Code for America digitized the tax filing process, reaching over 4 million households and distributing $415 million in benefits to low-income families. The model also informed IRS Direct File, the first-ever free public digital tax filing tool. Thoughtful, user-centered design not only improves short-term financial stability, but drives systemic impact.

Based on these learnings, we provided $3 million in additional support to Code for America to launch a new AI Studio, which is taking a holistic approach to designing and deploying technology-enabled solutions in partnership with state agencies. The goal is to increase access to public benefits and help unlock $80 billion in unclaimed benefits each year.

At the same time, we recognize that digital tools must be paired with “high-touch” interventions—like financial coaching—especially for communities navigating multiple systemic challenges. That’s why JPMorganChase has long supported innovations in financial coaching as a complement to tech-based strategies. For example, we supported a pilot for the MoneySmart Financial Coaching Program which integrates financial coaching into community colleges. With notable early success, we are scaling the program and integrating Chase Community Managers as guest lecturers—reinforcing classroom instruction with real-world financial guidance.

Key Lesson #2: Public + Private Systems Must Work in Tandem to Support Financial Health

For many, both public and workplace benefits are vital to managing daily expenses, covering unexpected needs, and planning for the future. But these systems are often disconnected, forcing individuals to navigate fragmented processes that don’t reflect the full complexity of their financial lives. Time and again, we’ve learned that working across public and private sectors is critical to bridging these gaps and creating a more cohesive support network.

To do this, we supported The Aspen Institute’s Financial Security Program (Aspen FSP) Benefits Transformation Initiative, which brings together leaders from government, nonprofit, and private sectors to build integrated systems that close benefit gaps and modernize access across employers and state agencies. Our initial support aimed to align cross-sector partners on challenges and solutions to realize a more integrated and interoperable benefits system across the public and private sector. Moving forward, we are continuing to support this work to uncover structural solutions and generate policy recommendations that tackle barriers to economic mobility that hinder families from building savings and accumulating assets—central components of financial security.

JPMorganChase recently announced $14.5 million philanthropic commitment to advancing workplace and public benefits for LMI individuals. These initiatives will help increase access to critical benefits such as education savings or retirement plans, enabling more people to manage immediate financial needs, as well as save and build wealth.

Key Lesson #3: Listening to Individuals’ Needs Unlocks Smarter Innovation

Credit and savings are foundational to resilience and wealth building. Yet, for many LMI individuals these tools remain difficult to access and sustain due to real-world barriers like unpredictable income, urgent and unexpected expenses, and administrative complexities.

Our work has shown that listening to individuals and their experience, paired with integrating behavioral design, is key to developing smarter, more accessible products and services designed around the realities of their daily lives.

With these insights in mind, we announced $7 million in philanthropic support to ideas42—a behavioral design nonprofit—to launch the Credit: Expanding Opportunity (C:EO) initiative, bringing nonprofit and mission-driven fintech organizations together across the financial services industry to design and test solutions that improve and protect credit for 2 million individuals. Early insights from the first cohort have shown that fee transparency helps build trust and sustain engagement with individuals, contrary to providers’ concerns, and even simple solutions like text reminders can dramatically improve repayment rates.

Research conducted by SaverLife—a nonprofit fintech serving more than 700,000 low-income users with a digital saving platform—uncovered how everyday stressors, like commuting, caregiving, and rising utility bills, impact financial decisions. By deeply engaging their network of users, they curated the platform to customer needs. For example, they launched a mobile app after recognizing that 90 percent of their users accessed SaverLife via mobile phones, offering personalized savings challenges and incentives to help people reach a savings goal. With these innovations, SaverLife has supported 315,000 members to save an average of $2,500—tripling their savings rate.

We are now working with Saverlife to deepen this impact through a new $3.5 million grant supporting their integration of AI and advanced data analytics to create tailored experiences for LMI individuals that encompasses the totality of an individual’s financial life. Underpinned by behavioral science, these enhancements will provide even more personalized financial health navigation, helping individuals make informed decisions at the right time to improve their financial health.

“Too often, solutions aimed at low- and moderate-income communities don’t reflect the reality of people’s lives—the irregular income, the caregiving responsibilities, the cognitive burden of navigating multiple systems just to make ends meet. JPMorganChase’s support for SaverLife signals something different: a belief that innovation must embrace complexity rather than ignore it. Their support gave us the ability to design tech-driven tools rooted in empathy and reality. They understand that improving financial outcomes for LMI households requires both bold innovation and a deep respect for the contexts in which people live and make decisions.” – Leigh Phillips, President and CEO of SaverLife

On the flipside of the coin, we also know that financial services companies need to remain vigilant in mitigating bias in AI models. JPMorganChase’s Impact Finance & Advisory team invested in FairPlay, a mission-driven fintech helping financial service providers and fintechs evaluate AI-trained underwriting models, as part of their recent $10 million round. FairPlay supports institutions of all sizes in evaluating their models for potential bias, expanding access to responsible credit, and strengthening the broader financial ecosystem through more equitable AI practices.

Key Lesson #4: Financial Health Doesn’t Exist in a Silo—We Must Support Individuals at Every Stage

Wealth building is deeply intertwined with everyday financial realities—employment, housing, entrepreneurship, and systemic risks. Effective financial health strategies must not only acknowledge, but center these complex realities and offer support throughout an individual’s journey—from utilizing benefits and establishing credit, to launching businesses or saving for education.

We know many individuals could significantly improve their financial wellbeing through employer programs. These workplace benefits help provide a vital safety net for workers to navigate their day-to-day challenges and plan for long-term goals like college and retirement. Yet fewer than one-third of workers have access to workplace benefits that could help them manage critical financial need s8 , costing the economy nearly $183 billion per year.9

With a $7 million philanthropic commitment from JPMorganChase, Commonwealth launched “Benefits for the Future”—a national initiative partnering with large employers and benefits providers to pilot and scale workplace benefits programs that improve the financial health of 2.5 million individuals. Benefits for the Future is also going deep in Columbus and Chicago, where they are bringing regional employers to the table to evaluate and develop localized programs.

“JPMorganChase has been a long-standing national leader in financial health and a fantastic partner to Commonwealth. We especially value the creativity and full range of assets JPMorganChase brings to this vital work, beginning with strategic philanthropy but extending to testing new approaches in their business lines, conducting essential research through their Institute, and contributing to critical policy conversations through their PolicyCenter. JPMorganChase also leads by example with their internal Human Resource practices, and uses their respected voice to convene diverse partners and place essential family financial security issues on the agenda nationally and in community. Commonwealth’s work on AI for financial health, inclusive wealth building, and making the workplace an engine of financial security and opportunity would not have been possible without JPMorganChase’s close partnership.” – Timothy Flacke, Co-Founder and CEO of Commonwealth

Homeownership is another proven source of wealth building; however, underserved communities face persistent challenges in obtaining and maintaining their homes. We have learned through our housing affordability initiatives that supporting an individual throughout the entire homeownership journey—from pre-purchase education and affordability support to post-purchase stability—ensures first-time and LMI homeowners have increased access to homeownership and retain equity over time. That’s why we partnered with organizations like Homewise to pilot a new credit builder loan product with matched savings as a model for overcoming key barriers to homeownership.

Entrepreneurship can be another path to wealth, but is often intertwined with personal finances. That’s why we’re supporting the Financial Access Initiative at the NYU Wagner Graduate School of Public Service to launch Small Firm Diaries, a two-year study to understand how entrepreneurs in low-income neighborhoods across the Greater Washington DC Region, Chicago, Atlanta, Oakland, New York City, and St. Louis manage their financial lives—identifying insights to design better support systems for small businesses.

Key Lesson #5: Cross-Sector Collaboration Drives Systemic Change

To build, protect and grow wealth, we must collaborate across the financial ecosystem—designing accessible tools, building new infrastructure, and tackling systemic risks like fraud and scams.

Our support of Aspen FSP and its’ call for a National Financial Inclusion Strategy & Commission reflects our commitment to fostering alignment between financial services, government, and nonprofit leaders on a framework to drive towards a financial system for all. Building on this initial work, Aspen FSP continued to convene the Working Group on Inclusive Finance, including JPMorganChase, to unite and implement a holistic framework—from financial stability, to financial resilience, and ultimately, wealth—to track and accelerate progress on financial inclusion.

“We know that the ability of households to access, use, and benefit from essential financial services is critical to individual prosperity and the broader health of our economy. Our programs actively pursue strategies that expand economic opportunity, strengthen financial resilience, and protect the wealth families build. In partnership with JPMorgan Chase, we are able to advance these efforts and deliver practical solutions that can improve financial well-being for all Americans.” – Dan Porterfield, President & CEO, Aspen Institute

A key topic as part of the broader financial inclusion framework is the growing threat of fraud and scams to Americans’ public safety and financial health, with implications for the economy, U.S. financial system, and national security. Individuals—particularly vulnerable populations such as those living on LMI and the elderly—are increasingly targeted by sophisticated scams. Institutions across sectors—finance, telecommunications, technology and social media, law enforcement, public sector, consumer advocacy groups—are navigating the rapidly evolving fraud and scam ecosystem and are facing an environment of eroding consumer confidence. That’s why JPMorganChase is proud to be a founding member of the Aspen Institute’s National Task Force on Fraud & Scam Prevention, working with leaders across the private, public, and nonprofit sectors to develop a nation-wide strategy aimed at helping prevent fraud and scams and protect Americans. We’re also a founding member of the Global Anti-Scam Alliance North America Chapter—allowing for cross-sector and cross-border information sharing on best practices to tackle fraud and scams.

New Strategy for Strengthening Pathways to Financial Health

Building on these five overarching lessons, JPMorganChase Corporate Responsibility is doubling down on our suite of tools to innovate and scale solutions that improve the financial health of individuals, particularly those living on LMI. Informed by past philanthropic and impact investing capital commitments, partnerships, and business insights, the new strategy will focus on three categories:

Building financial stability;

Supporting financial resilience; and

Creating and protecting wealth.

We view this strategy as three critical phases of the financial wellness journey. By targeting each phase with tailored approaches, we aim to unlock greater innovation, capacity and impact—acting as a force multiplier for the business and communities we serve.

This section outlines our assessment of challenges, particularly for LMI individuals, in each of these phases and articulates details around our strategic approach. Importantly, each section also highlights an area of complementary business growth and investment, recognizing that true scale and impact can only be achieved if our resources are deployed hand-in-hand.

FINANCIAL STABILITY

Many people do not have financial stability, meaning they cannot cover day-to-day or short-term expenses. In 2024, 43 percent of families reported difficulties covering basic daily expenses or short-term financial needs—a notable increase from 38 percent in 2023.10 For LMI individuals in particular, persistent cash flow instability is often driven by volatile income and rising costs. 49 percent of people spent either the same or more than their income, leaving little financial slack.11 Additionally, while public benefits form a critical safety net for low-wage workers, many programs have complexities that inadvertently create barriers to upward mobility. As a result, $80 billion in public benefits go unclaimed each year.12 These gaps leave many Americans without the consistent resources they need to build a foundation of financial stability, heightened by the reality that excess savings from the pandemic have largely depleted based on JPMorganChase Institute research.13

Private Equity for Retirement Savers? Change is Coming to 401(k) Plans

The private fund industry sees individual investor wealth as an untapped pool of capital. Up for grabs are everyday Americans’ retirement savings, estimated to be as high as $14 trillion. Advocates are enlisting help from lawmakers and other government officials to hasten the expansion of private equity into Main Street investors’ tax-deferred, defined-contribution savings plans. It’s far from clear whether PE investment products will be commonplace in 401(k) plans any time soon, or that such offerings will even catch on with mainstream retirement savers, who have little to no experience in the vagaries of the private market. The SEC has various levers it can pull to ease the general public’S access to illiquid asset classes like private equity, private credit, real estate, and infrastructure, an industry expert says. The potential for private assets to produce much upside is limited within a typical employer-sponsored retirement account, which would remain heavily weighted in its exposure to public assets, he says.

Anxious to find alternative sources for fee-generating assets, the private fund industry sees individual investor wealth as an untapped pool of capital worth trillions of dollars. Managers are already making inroads with high-net-worth clients by launching a new generation of fund vehicles that were customized to be accessible to small but affluent investors.

Semi-liquid, wealth-focused evergreen funds now manage some $427 billion, according to PitchBook’s 2029 Private Market Horizons forecast. They’ve aggressively raised capital in large part by promising low minimums, attractive returns, and flexible liquidity options. But the industry’s growth strategy won’t rely on the assets of wealthy people alone. Up for grabs are everyday Americans’ retirement savings—a vast asset pile estimated to be as high as $14 trillion.

A loose coalition of alternative asset firms, broker-dealers, mutual fund platforms, and financial advisers envisions a future in which 401(k) accounts and other employer-sponsored retirement plans offer private-market investment products alongside standard public market mutual funds.

Few such plans exist today in corporate America. That’s why advocates for the public-private retirement savings model are enlisting help from lawmakers and other government officials to hasten the expansion of private equity into Main Street investors’ tax-deferred, defined-contribution savings plans. With fund innovation in high gear and Republicans in control of Washington, many industry advocates sense that the stars have aligned for bolstering their agenda.

The SEC has various levers it can pull to ease the general public’s access to illiquid asset classes like private equity, private credit, real estate, and infrastructure. Mutual funds generally have a 15% cap on illiquid holdings, but many industry groups are itching for regulators to raise that maximum to some degree.

Opening the Floodgates

“If that’s raised, that opens up the private markets to retail, target-date funds—you name it—to all investors,” said Jonathan Epstein, president and founder of the Defined Contribution Alternatives Association, which represents asset managers. “That opens the floodgates.”

It’s far from clear whether PE investment products will be commonplace in 401(k) plans any time soon, or that such offerings will even catch on with mainstream retirement savers, who have little to no experience in the vagaries of the private market.

“Administrators of larger plans want these features and capabilities, and eventually it makes its way down market to the smaller employers,” said researcher Wallace Blankenbaker of Retirement Leadership Forum, an independent group that works with asset managers and plan advisory firms.

Investment firms that manage savings plans for employers have long been reluctant to package PE into retirement products, citing the complexity of managing liquidity risk in alternative investments and the potential of lawsuits stemming from underperformance or excessive fees.

Now some industry groups, such as the Institute for Portfolio Alternatives, are actively pushing Congress and the Trump administration to explicitly endorse portfolio diversification with private assets. Getting some kind of “safe harbor” provision is seen as a way to lessen litigation risk by making it harder to sue employers or plan administrators. Meanwhile, the potential for private assets to produce much upside is limited within a typical employer-sponsored retirement account, which would remain heavily weighted in its exposure to public assets.

Expanding PE options in retirement plans seems most likely to occur within the context of so-called target date mutual funds, which are preset, diversified portfolios built to match a saver’s time horizon for retirement. According to Morningstar data, investors today have roughly $4 trillion parked in target date funds. A big reason for the growth of these assets is that since 2007, the Department of Labor has allowed plan administrators to use them as default investments for workers who don’t pick a specific option in their defined contribution offerings.

“Target date funds are the right chassis to incorporate private markets, not just because a lot of client sponsors offer them and a lot of participants use them, but also given their multi-asset design,” said Brendan Curran, who heads State Street‘s retirement and defined contribution strategy. Target date funds account for over 80% of defined contribution plans, according to State Street.

These funds limit how much upside of alternatives they can capture. A mutual fund containing some private market exposure can only deliver so much risk-adjusted return after factoring in the dilution created by the public market assets held in the same vehicle.

A newly launched target date fund from State Street, featuring a blend of 90% public and 10% private-index-based holdings managed by Apollo Global Management, targets the defined contribution market.

Pension Plans

Some industry leaders have cast the issue of private market access as a question of fairness in diversifying investments. According to this argument, pension plans have had decades of experience investing on behalf of unionized workers and public employees in the private markets, and there’s therefore more impetus to open the asset class to the rest of Americans as the profile of the private markets rises.

“We started down this path two-plus years ago because we felt the direction of travel in capital markets—in terms of assets increasingly existing outside the domain of public markets—was going to persist,” says Curran. “And we need to start bringing solutions to the market that address that and provide the breadth that investors expect, frankly.”

Administrators of 401(k) plans are generally permitted to include private market investment products, subject to some limits, under the Employee Retirement Income Security Act (the landmark 1974 law that set standards for the nation’s retirement and health benefit programs). Not all employer-sponsored plans are in favor of adding private market alternatives to their offerings, citing longstanding concerns about volatility risk and the relative lack of sophistication among everyday investors.

Plan administrators, also concerned about litigation exposure, are again looking to the Labor Department for guidance on adding PE components to defined contribution plans. During President Donald Trump’s first term, Labor officials signalled broad support for a PE option in professionally managed plans. But under President Joe Biden, the department took a more cautious view, and in December 2021, it urged careful evaluation by professional fiduciaries in any retirement plan. Labor officials also warned that the previous guidance could be misrepresented to promote the PE industry’s marketing efforts.

Another way regulators could change the equation for who gets access to riskier, more sophisticated investment opportunities would be expanding the criteria to meet “accredited investor” eligibility. The SEC has been reevaluating wealth minimums, like a net worth of $1 million or having professional financial competency, according to people now in talks with regulators.

What Is Secure 2.0? How It Impacts Your Retirement

The Secure 2.0 Act is a federal measure passed in late 2022 to encourage Americans to save for retirement. The law pushed back the required minimum distribution age for individual retirement accounts (IRAs) The measure also increases catch-up contribution limits for people ages 60 to 63. Many parts of the legislation are already in effect, but others will continue to be phased in and implemented over the coming years, with a number of new changes on the horizon. The Act covers several retirement issues, such as hardship withdrawals and emergency savings, that weren’t part of the original Secure Act of 2019, which changed the way Americans saved and withdrew money from their retirement accounts. It’s a continuation of the first Secure Act, which was passed in 1998. It was intended to help Americans save for their retirement while balancing current expenses. It also aims to help more people prepare for retirement by making government incentive programs more forgiving to people who need help catching up on their savings. It will also help people with student loans to take advantage of a new incentive to balance saving and repaying student loans.

While many parts of the legislation are already in effect, certain provisions will continue to be phased in and implemented over the coming years, with a number of new changes on the horizon.

Here are the details about Secure 2.0 and an overview of the ways it might affect you.

What is the Secure 2.0 Act?

The Secure 2.0 Act is a federal measure passed in late 2022 to encourage Americans to save for retirement. Among the many changes it makes to retirement policy, the law pushed back the required minimum distribution age for individual retirement accounts (IRAs). The measure also increases catch-up contribution limits for people ages 60 to 63.

Why “2.0”? It’s a continuation of the original Secure Act of 2019, which changed the way Americans saved and withdrew money from their retirement accounts. Secure 2.0 covers several retirement issues, such as hardship withdrawals and emergency savings, that weren’t part of the original Secure Act. These changes may help Americans save for retirement while balancing current expenses.

Advertisement 1 Answer a few simple questions 2 Get a recommended match 3 Start achieving your money goals What’s your financial priority? Financial Planning Retirement Planning Investment Management Tax Strategy Other Match with a financial advisor for free

Secure 2.0 provisions that are already in effect

A new 401(k) employer contribution option

In the past, employees with a Roth 401(k) typically had their employer contributions made into a separate, pretax account such as a traditional 401(k). With Section 604 of Secure 2.0, employees can now choose to have their employer contributions be made into the Roth account, if offered by their employer. This does mean that the money will count as earned income and incur taxes now, but qualified distributions in retirement will be tax-free, similar to how they are treated with a Roth IRA.

Automatic 401(k) enrollment

If your employer offers a retirement plan, such as a 401(k) or 403(b) plan, you typically have to opt in to participate. As of Jan. 1, 2025, this is no longer be the case.

Instead, once new employees are eligible, employers will automatically enroll them in a retirement savings plan, and existing employees will be auto-enrolled in a plan if they are not currently participating. Most employers must abide by these new regulations, but there are some exceptions in cases of church plans, government plans and small businesses with 10 or fewer employees.

The initial contribution must be at least 3% of pretax earnings but not more than 10%. Following the initial year, the employee’s contribution will increase by 1% annually until it hits 10% to 15%. Employees will have to opt out if they don’t want to participate in their company’s retirement plan.

Catch-up contributions

Catch-up contributions allow people age 50 and older to contribute additional money to retirement plans. With new provisions in the Secure 2.0 Act, people in this age group have a few more options to reach their retirement goals.

As of 2025, catch-up contribution limits to retirement plans such as 401(k)s for those on the cusp of retirement — ages 60 to 63 — will increase from $7,500 per year to $11,250. After 2025, this new limit will be indexed for inflation annually.

For SIMPLE IRAs, the catch-up contribution limit is $3,500 in 2024 and 2025 (though people with certain plans may be able to contribute up to $3,850). The newly introduced catch-up contribution for those ages 60 to 63 will be $5,250.

Education savings and loan debt

As of 2024, parents saving for their children’s college funds gained some new flexibility with their 529 plans. After 15 years, funds from the 529 plan can be rolled into a Roth IRA for the beneficiary. The amount rolled over each year can’t exceed the annual IRA contribution limit, up to a lifetime limit of $35,000.

People with student loans may be able to take advantage of a new incentive under the Secure 2.0 Act to balance saving for retirement and repaying student loans instead of choosing one or the other. As of 2024, when you make a qualified student loan repayment, your employer can opt to “match” that amount into your 401(k) plan, 403(b) plan or SIMPLE IRA. The catch here is that employers can choose whether or not to offer this option.

» Learn more: See the IRA contribution limits

Emergency withdrawals

One drawback of saving for retirement is that you typically can’t touch the funds until retirement age without incurring hefty penalties and a 10% early distribution tax. As of January 2024, however, account holders are able to withdraw from their 401(k) plans or IRAs for certain emergency expenses without these consequences.

Only one distribution of up to $1,000 per year is allowed, and you have the option to repay the funds within three years. If you don’t repay the distribution, no other emergency distributions are allowed during the three-year repayment period.

Emergency savings

Building an emergency fund is crucial to ensuring you can cover any surprise expenses, but between daily living expenses and the added responsibility of saving for retirement, it can be hard to get started.

As of 2024, employers that provide a defined contribution retirement plan may also offer a pension-linked emergency savings account for employees who are not highly compensated, with employees automatically opted in at up to 3% of their salary.

The balance of the account is capped at $2,500 (or less, depending on employer guidelines), and contributions can stop or be directed to a Roth-defined contribution plan, if available, until the balance drops below the cap. The first four withdrawals from this account aren’t subject to fees or charges, and after employees leave the company, they can choose to take the funds in cash or roll them into a Roth-defined contribution plan or Roth IRA.

Expansion of Roth accounts

Before 2023, SIMPLE IRA plans, which are retirement savings plans for small businesses and self-employed people, did not permit Roth contributions. This meant that the contributions to a SIMPLE IRA were tax-deductible, but withdrawals would be taxed. Secure 2.0 amended this provision to allow for Roth contributions, where taxes are paid upfront on contributions, and qualified withdrawals later on are tax-free.

Secure 2.0 also made some changes to the simplified employee pension (SEP) plan to allow participants to allocate either their or their employer’s contributions on a Roth basis rather than pretax.

Improvements for long-term, part-time workers

Employers who provide a 401(k) plan to full-time employees must now also allow part-time employees to participate, provided certain requirements are met. Employees must complete either 1 year of service with the 1,000-hour rule or 2 years (reduced from 3 years) with at least 500 hours of service to be eligible. Years worked prior to 2021 are not included for vesting purposes, and employees under collectively bargained plans are also excluded.

Required minimum distributions (effective 2023, 2024 and 2033)

Under the Secure 2.0 Act, the rules and penalties around required minimum distributions (RMDs) have also changed.

The age for RMDs was raised from 72 to 73 in 2023, and it will rise again to 75 in 2033.

As of 2023, the penalty for not taking required distributions decreased from 50% to 25%. If the error is corrected in time, the penalty drops to 10%.

As of 2024, required pre-death distributions will be eliminated altogether from non-IRA Roth accounts, including Roth 401(k) plans.

These changes mean people will now have even more time to grow their retirement funds. However, pushing back your retirement payouts can come with a caveat. For example, taking distributions later could mean you’ll have to withdraw more funds in a shorter period of time, a decision that could be more expensive depending on your tax rate at the time.

Secure 2.0 provisions effective 2026 or later

Roth catch-up contributions for high-earners (effective 2026)

Secure 2.0 laid out some new rules affecting 401(k) contributions for high earners — people who make over $145,000 — who are age 50 and older. It would require catch-up contributions on a Roth basis rather than pretax. However, to give participants and plan sponsors more time to prepare for this change, the IRS has pushed this requirement to begin in 2026.

Saver’s tax credit (effective 2027)

The Secure 2.0 Act includes changes to the saver’s tax credit, intended to give lower-income earners an extra boost toward their retirement savings.

Beginning in 2027, the tax credit will be replaced with the “saver’s match” program. Instead of getting a tax credit for contributions to an eligible retirement plan, lower-income workers will get a direct match of up to $2,000 from the federal government. While this means you won’t receive the tax break, it could also potentially result in more retirement savings.

Nationwide and Annexus Break New Ground with First Actively Managed Mutual Fund within a RILA

Nationwide Defined Protection Annuity 2.0 will include strategies indexing to an actively managed mutual fund. The fund is the American Funds Growth Fund of America Class F-3. This will be the first registered index-linked annuity (RILA) in the industry to include strategiesIndexing to the mutual fund will allow investors to pursue growth and protect against downside risk. DPA 2. 0 features daily protection and floor levels, numerous index strategies and free withdrawals. It comes with a customizable selection of protection levels: 90%, 95% and 100%. The 90% and 95% options offer the potential for greater performance, while the 100% option provides complete principal protection from market losses. The product’s combination of features make it uniquely positioned to succeed with financial professionals and their clients in today’s environment.

“Nationwide has a history of innovation in the annuity industry, launching the first variable annuity using unaffiliated mutual funds in 1980, which was a game changing product development that was quickly imitated by the industry at large,” said Craig Hawley, president of Nationwide Annuity. “We’re excited to build on our partnership with Capital Group to take that innovation one step further, offering strategies that will index to their highly respected American Funds Growth Fund of America mutual fund in our DPA 2.0 annuity. DPA’s unique features, built in partnership with Annexus, combined with Capital Group’s investment strength, will allow investors to pursue growth and protect against downside risk.”

American Funds Growth Fund of America is an actively managed mutual fund that offers a flexible approach to growth investing. The fund seeks opportunities in traditional growth stocks as well as cyclical companies and turnaround situations with significant potential for growth of capital to help investors pursue their long-term goals. Growth Fund of America distinguishes itself through Capital Group’s distinct multi-manager system, with a team of 12 portfolio managers averaging 27 years of experience.

“In our 11th year of partnership with Nationwide, I am excited about another first-to-market innovation that includes an actively managed American Funds mutual fund from Capital Group to a RILA,” said Ron Shurts, CEO of Annexus. “Defined Protection Annuity 2.0 will now offer strategies that provide upside potential based on the total return of American Funds Growth Fund of America with access to three protection levels to help limit losses.”

Created in collaboration with Annexus, DPA 2.0 features daily protection and floor levels, numerous index strategies and free withdrawals. It comes with a customizable selection of protection levels: 90%, 95% and 100%. The 90% and 95% options offer the potential for greater performance, while the 100% option provides complete principal protection from market losses. The product’s combination of features make it uniquely positioned to succeed with financial professionals and their clients in today’s environment.

“We are thrilled to partner with Nationwide and Annexus to offer American Funds Growth Fund of America in this innovative RILA solution,” said Melissa Buccilli, head of Insurance Strategy and Product at Capital Group. “We continue to look to expand access to our investment capabilities in innovative new ways within the annuity marketplace to help even more investors pursue their long-term investment goals.”

Financial professionals interested in Nationwide DPA 2.0 should contact their Nationwide wholesaler or call the National Sales Desk at 1-800-321-6064. Individual investors interested in learning more about the benefits of DPA 2.0 should contact their financial professional or visit www.definedprotection.com.

1 American Funds Growth Fund of America – Class F-3 is not a market index. It is a mutual fund, and its index value reflects the mutual fund’s total return. If a mutual fund-linked index strategy is selected for investment, you will not be investing in the linked mutual fund. You will not be a shareholder or beneficial owner of the fund and you will have no rights with respect to the fund.

2 Annuity Genius Research, 3/13/2025

Tips for Successful Retirement Investing

Retirement might feel far away depending on where you are in life, but successfully investing for it starts now. Without a clear long-term strategy, you might sacrifice some potential investment gains to fees, taxes, and market volatility. There are only two types of retirement accounts for most Americans, broadly speaking, and each offers distinct benefits. Starting early and staying invested can dramatically increase your retirement nest egg thanks to compound interest. The difference between these and tax-advantaged accounts is that money from a retirement account usually triggers a 10% top-up penalty on top of any taxes owed before age 59. If you have a traditional IRA or 401(k), you not only owe taxes on your withdrawals, you’re also typically required to take withdrawals, which are known as required minimum distributions (RMDs), starting at age 73. It’s crucial to build a resilient investment plan that can weather both time and turbulence through your working years and beyond. A qualified financial advisor can help tailor your plan and prevent costly mistakes.

It’s crucial to build a resilient investment plan that can weather both time and turbulence through your working years and beyond.

Key Takeaways Starting early and staying invested can dramatically increase your retirement nest egg thanks to compound interest.

Diversifying across asset classes and rebalancing regularly are critical to managing risk.

Failing to plan for taxes and ignoring investment fees erode long-term gains.

Beware of emotional decision making during market downturns, which can sabotage a sound retirement strategy.

If you’re not sure where to start or have questions, a qualified financial advisor can help tailor your plan and prevent costly mistakes.

Understanding Retirement Accounts

The are only two types of retirement accounts for most Americans, broadly speaking, and each offers distinct benefits.

Tax-Advantaged Accounts

Tax-advantaged accounts are the backbone of retirement savings. If you work for a company, then you may have access to a company-sponsored 401(k) plan or 403(b). Anyone with earned income can invest in an individual retirement account (IRA), too.

There are two types of 401(k) plans and IRAs, each with distinct tax implications: the traditional and the Roth. Many employers also offer matching contributions to your 401(k), which is essentially free money added to your retirement savings. Employers may match each dollar you contribute to your 401(k) up to a certain limit, or they may use partial matching, in which they match a percentage of your contributions up to a certain limit. It’s important to contribute at least enough to receive the match, as the match is essentially free money.

Traditional vs. Roth

The various types of retirement accounts—401(k)s, traditional IRAs, and Roth IRAs—and they all offer tax benefits:

Traditional 401(k)s and IRAs : You contribute pretax dollars to these accounts. The amount you contribute is deducted from your gross income for the year, giving you an immediate tax break for the year. You’ll pay taxes when you take distributions.

: You contribute pretax dollars to these accounts. The amount you contribute is deducted from your gross income for the year, giving you an immediate tax break for the year. You’ll pay taxes when you take distributions. Roth IRAs and 401(k)s: You contribute post-tax dollars to a Roth account. You won’t get a tax break that year, but your distributions will be tax-free after age 59½

Roth accounts are a favorite of financial planners because distributions from these accounts are tax-free. (Note that only some employers offer a Roth 401(k) option, so it’s worth checking your plan.) However, if you have a traditional IRA or 401(k), you not only owe taxes on your withdrawals, you’re also typically required to take withdrawals, which are known as required minimum distributions (RMDs), starting at age 73.

“In my experience working with retirees, many overlook tax planning opportunities early on,” says Avanti Shetye, certified financial planner (CFP) and founder of Maryland-based Wealthwyzr. “While they focus on building wealth, they often underestimate the impact of RMDs in later years.”

Roth IRAs, however, do not have RMDs, which means that money can grow tax-free over the account owner’s lifetime.

Shetye notes that large RMDs can push retirees into higher tax brackets—potentially increasing their tax burden “significantly.” She recommends strategic Roth conversions in early retirement to minimize lifetime taxes.

Taxable Accounts

Taxable accounts—such as brokerage investment accounts—don’t come with tax deferral perks, but they do offer a great deal more flexibility.

You can invest in stocks, bonds, mutual funds, and exchange-traded funds (ETFs) of your choice. The proceeds are taxable at the (usually lower) capital gains tax rate rather than your income tax rate as long as you hold the assets for a year or more.

A key difference between these accounts and tax-advantaged accounts is that withdrawing money from a retirement account before age 59½ usually triggers a 10% early withdrawal penalty on top of any taxes owed. Taxable brokerage accounts are not subject to these withdrawal penalties.

Investment Options for Retirement

Stocks and Bonds

In general, equities provide growth while bonds offer stability. Striking the right balance between the two depends on your timeline and risk tolerance.

Advisor Eric Maldonado, the founder of Aquila Wealth Advisors, says that one of the most common mistakes people make when investing for retirement is not giving themselves a chance to keep up with inflation. “If you have years to invest before retirement, positioning yourself too conservatively with too many fixed-income investments, bonds, or money market funds might not be enough to keep up with rising costs throughout retirement,” he said.

The traditional portfolio allocation has long been thought of as 60% to equities and 40% to bonds. Yet some have argued that this allocation may not be right for everyone. As a result, many advisors suggest adjusting the balance based on market conditions, risk tolerance, and individual goals rather than following a fixed rule.

Ultimately, Maldonado stresses the importance of knowing your overall risk appetite and working with an advisor to help manage emotions and investments, particularly during times of market distress.

Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) are popular tools for retirement investors because they offer instant diversification, professional management, and a way to invest in broad market segments without picking individual stocks or bonds.

While both pool money from multiple investors to purchase a range of securities, they operate a bit differently.

Mutual funds are typically bought and sold at the end of the trading day at the fund’s net asset value (NAV). They’re often used in 401(k)s and other retirement plans, especially target-date funds, which automatically adjusts your asset allocation over time—by making your portfolio more conservative as you get older—based on your expected retirement year.

ETFs trade throughout the day like individual stocks, offering more flexibility and lower fees than most actively managed mutual funds.

“Low-cost target-date funds may be a better choice for many investors for their retirement portfolios,” says Shetye. These funds can serve as a one-stop shop for retirement investing as they rebalance automatically, effectively reducing the need for hands-on management.

Annuities and Other Income-Producing Investments

For retirees seeking guaranteed income, annuities can be a useful retirement tool. They’re worth considering in the distribution phase of retirement alongside dividend-paying stocks and bonds.

Note that annuities, which are purchased through insurance companies, often have higher fees than other investments. It’s essential to read the fine print on the contract.

Strategies for Successful Retirement Investing

Start Early and Leverage Compounding

Even small contributions snowball if given enough time. “One of the biggest mistakes people make is they think they will work forever,” says Shetye. “Be prepared for retirement by investing early in your career.” As the chart below shows, time can make a really big and potentially life-changing difference in overall returns.

Diversification and Risk Management

A well-diversified portfolio can reduce risk without sacrificing return. Kristy Jiayi Xu, the founder of Global Wealth Harbor, recommends a time asset pool strategy (also known as the bucket strategy): allocating assets based on when distributions will be needed, with more volatile assets reserved for the long term and safer ones set aside for near-term needs.

Regular Portfolio Rebalancing

Market fluctuations can throw your asset allocation out of whack, so it’s important to reassess your portfolio periodically.

Rebalancing your portfolio at least every six to 12 months or after major market moves can help you maintain your intended risk level, says Xu.

Managing Emotions and Behavioral Biases

Avoiding Emotional Investing

To help clients stay calm and avoid emotional decisions during market downturns, Xu recommends formula investing, which follows a structured investment plan to avoid emotional investing. “Because there is a quantitative rule of how much the investor is investing in each period of time, this helps prevent investors from taking spontaneous reactive actions,” she says.

Noah Damsky, the founder of Los Angeles-based Marina Wealth Advisors, is similarly cautious. “If you have a strategy in place that is ready for the inevitable downturn, then throw away the keys (your online login) and ignore your account balances,” he says. “Checking your account balances during volatility is like going on an epic vacation and opening your work email—it doesn’t do you any good.”

Staying the Course During Market Volatility

Market corrections are inevitable, but panic selling locks in losses, which can be especially harmful for your portfolio at the beginning of retirement.

“You have to have handrails in place before the next big world calamity happens,” says Maldonado. “Know your numbers and have a buffer of cash-equivalent holdings so you’re not forced to sell growth investments during a downturn.”

He suggests asking yourself questions like:

How much can you cut back on in monthly spending if there is a recession?

Do you have a buffer of cash-equivalent holdings to draw from in a down market so you don’t have to sell your ETFs or mutual funds at the bottom?

How many months’ or years’ worth of expenses do you have in liquid, stable holdings to help keep your growth-focused assets invested while you wait for markets to recover?

Minimizing Fees and Expenses

Understanding Investment Fees

One of the most overlooked yet critical components of successful retirement investing is managing investment fees. The reality is that higher fees don’t necessarily translate into better performance.

There is a critical difference between managed mutual funds and index funds. Managed mutual funds set a goal of exceeding the performance of a benchmark index such as the S&P 500. Index funds are designed to duplicate the performance of the index.

Managed mutual funds usually have higher fees than index funds (whether they are index mutual funds or ETFs) because managed funds are staffed by active managers who buy and sell stocks to maximize fund performance. Those costs are passed on to fund investors.

Maldonado cautions that fees can make a big difference.

Fees for funds are usually expressed by an expense ratio, which represents the percentage of your investment that goes toward fund operating costs each year. For example, a fund with a 0.50% expense ratio will charge $5 annually for every $1,000 you invest.

Even small differences in expense ratios can add up to big differences in long-term returns.

Shetye stresses just how pronounced the differences can be. “Investing in a low-cost fund versus a fund with an expense ratio of 1% could mean a difference of 12% in your portfolio value over 20 years,” she says. “Over 30 years, this differential could increase to 18%, and over 40 years, it could mean almost one-fourth of your total portfolio [is] lost to fees.”

As a result, Shetye says low-cost target-date funds may be a better choice for many investors’ retirement portfolios.

Choosing Low-Cost Investment Options

Pay close attention to fund fees when selecting mutual funds or ETFs. Look beyond the ticker and assess the fund’s expense ratio, trading costs (if any), and whether you’re being charged front-end loads, back-end loads, or annual account maintenance fees.

“Be ready to pay for good service,” says Damsky, “but don’t settle for subpar value.”

When to Consult a Financial Advisor

If you’re unsure about which options are best for you or have questions about taxes, financial strategies, or managing fees efficiently, it’s good to consult a professional.

“Tax planning can be complicated for people who don’t do it on a regular basis,” Shetye says. “For example, Roth conversions are taxable events…”

A good financial advisor can help you align your investment, tax, and income strategies and avoid costly mistakes.

“Don’t cut off your nose to spite your face,” Damsky says. “Be realistic and seek help unless you’re going to do all of the work yourself.”

Shetye offers some advice for choosing a financial planner, including interviewing several people before making your decision and asking them about their experience working with people in similar financial or life circumstances.

She also recommends looking for qualifications such as the chartered financial analyst (CFA) and CFP designations.

The Bottom Line

A successful retirement doesn’t happen by accident. It requires early planning, ongoing discipline, and smart strategies. That means choosing the right accounts, diversifying your portfolio, keeping fees in check, managing your emotions, and staying the course through market cycles.

Whether you’re decades from retirement or nearing the finish line, the best time to start planning—or refining your plan—is now.

Source: https://finance.yahoo.com/video/basic-capital-helping-americans-finance-150045087.html