New sports betting taxes tax affect in August, some revenue to go to athletic programs

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

New sports betting tax takes effect in August, some revenue to go to athletic programs

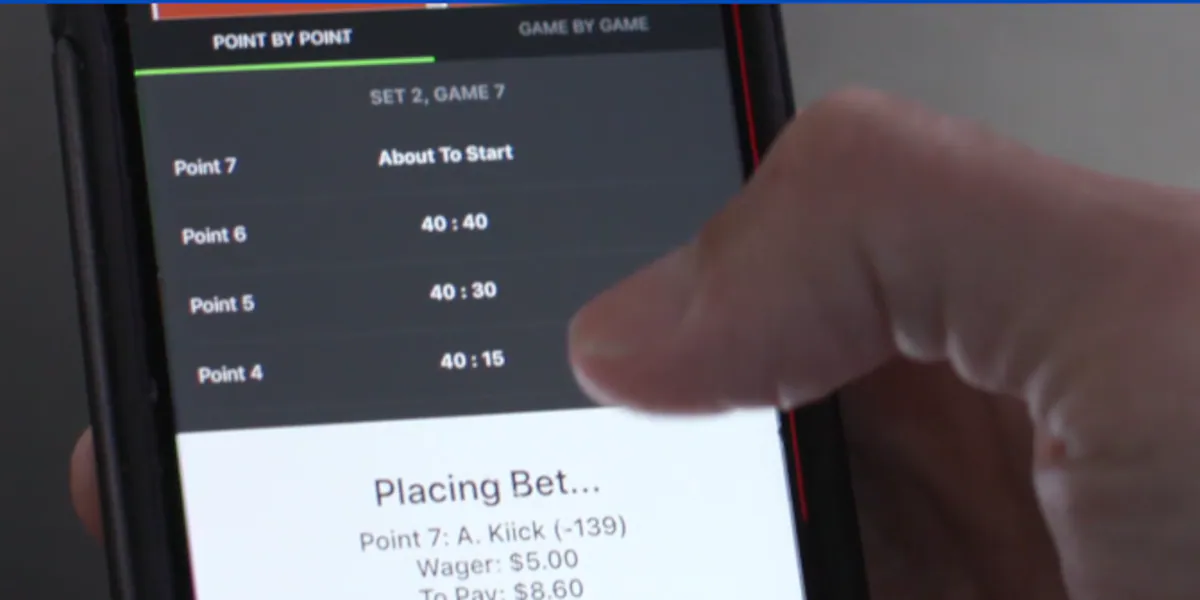

A landmark settlement with the NCAA now allows universities to directly pay their student athletes for their name, image, and likeness (NIL) Starting in July, universities across the country can use up to $20.5 million to pay their athletes. To offset some of those costs for Louisiana’s smaller athletic programs, new taxes on online sports betting are going into effect in August. For smaller universities like Southern, that roughly $2 million is a game changer. The changes aim to even the playing field and curb bidding wars for top athletes.

Starting in July, universities across the country can use up to $20.5 million to pay their athletes NIL. To offset some of those costs for Louisiana’s smaller athletic programs, new taxes on online sports betting are going into effect in August.

“Separate from what we, LSU, can pay our athletes, which is up to that $20.5 million for the upcoming fiscal year, they will also be able to continue to try to get third-party name, image, and likeness opportunities,” Kelli Zinn at LSU Athletics said.

Currently, taxes on online sports betting are at 15%. That will be raised to 21.5%, with a quarter of the revenue going to athletic programs around the state. For smaller universities like Southern, that roughly $2 million is a game changer.

“Most athletic department operate from a deficit because you don’t have enough funds, this also gives us the chance where we can trade some of the scholarship money out and use some of the other state dollars to do something else,” Roman Banks, Southern Athletic Director, said. “Everyone sees that strong athletic programs translate to strong school attendance.”

Addressing concerns about the tax hike, author of the bill Rep. Neil Riser emphasized it would not impact gambling odds.

“They are not going to get taxes 21.5% on their winnings or losses,” Riser said. “That’s in-house by the casino.”

The changes aim to even the playing field and curb bidding wars for top athletes. Zinn said this is crucial for the future of college athletics.

One of those big changes is for third-party NIL deals. Now, according to the House Settlement, these NIL deals will go through a third party to assess the fair-market value, assuring a foundation as athletes shop for their future university.

Universities can begin direct payments in July, with the new tax taking effect in August.

Click here to report a typo. Please include the headline.

Click here to subscribe to our WAFB 9 News daily digest and breaking news alerts delivered straight to your email inbox.

Copyright 2025 WAFB. All rights reserved.