Goldman, Citi See Europe’s Economic Edge Extending Stock Rally

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Goldman and Citi See Europe’s Economy Powering Stock Rally

The Stoxx Europe 600 Index is expected to end the year around 557 points, according to the average of 19 strategists polled by Bloomberg. That implies a further 3% advance from Wednesday’s close, handing investors annual returns of about 10%. European stocks have posted moderate moves since mid-May, following a V-shaped recovery that erased all the losses triggered by the US tariff announcements of early April. Most strategists have had to chase the rally in Europe as the outlook brightened.

Most Read from Bloomberg

The Stoxx Europe 600 Index is expected to end the year around 557 points, according to the average of 19 strategists polled by Bloomberg. That implies a further 3% advance from Wednesday’s close, handing investors annual returns of about 10%.

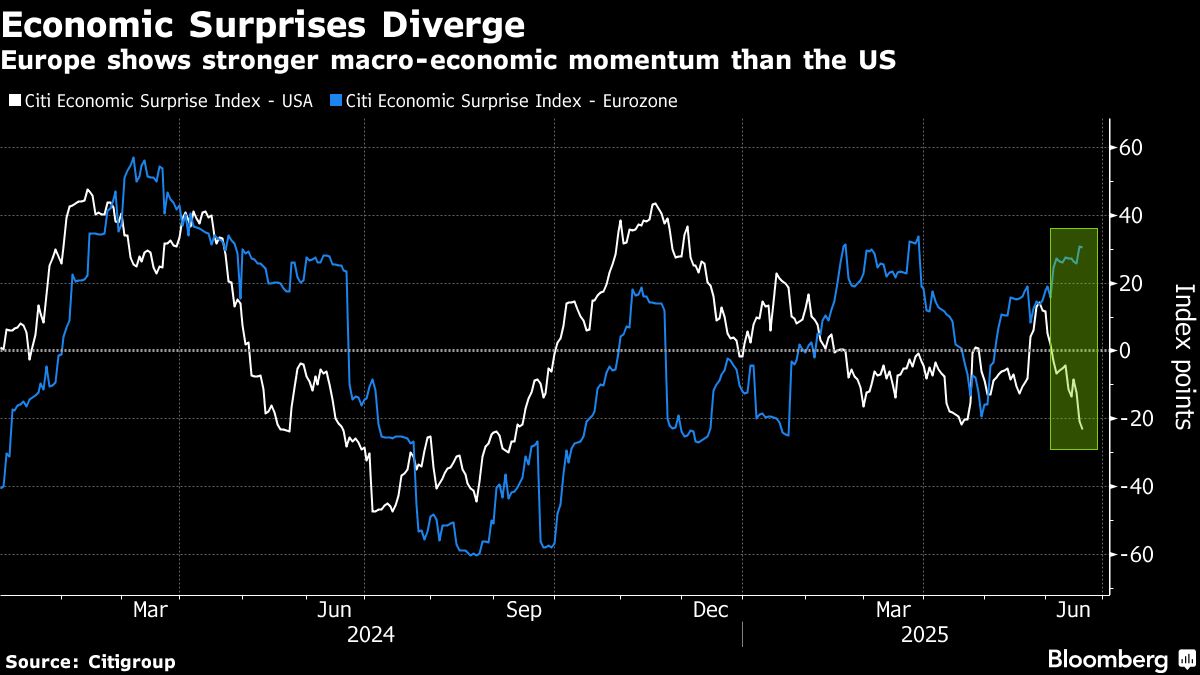

Europe’s loosening monetary policy and increased government spending are forecast to give the region’s stocks the impetus they need to overcome risks from tariffs and rising international tensions.

“Equity markets have been remarkably resilient, despite many risks,” said Citigroup Inc. strategist Beata Manthey. She noted that global equity market valuations reflected relatively average levels of geo-economic risk in the lead up to the Israel-Iran conflict. “This could be worrisome from a short-term perspective, but over the longer term we see many structural tailwinds to support European equities.”

European stocks have posted moderate moves since mid-May, following a V-shaped recovery that erased all the losses triggered by the US tariff announcements of early April. Recent weeks have proved more volatile, as Middle East tensions intensified and pushed oil prices higher. The Stoxx Europe 600 is down 1.5% this month, with energy shares and utilities the only sectors in the green.

“Many investors we are speaking with are awaiting the end of the truce on US tariffs on July 9 to gain better visibility,” said Societe Generale SA strategist Roland Kaloyan. “Looking ahead, we anticipate that the European equity market will remain within a trading range.”

Most strategists have had to chase the rally in Europe as the outlook brightened, updating the cautious price targets they drew up in January. Challenges to so-called US exceptionalism in stocks, Europe’s improving economic prospects, as well as a wide interest-rate differential have fueled bets on the region.

This is also evident in other asset classes. The euro is gaining prominence in the global currency options market as traders avoid the dollar due to unpredictable US policy and global trade war risks. Trading volumes show 15% to 30% of contracts tied to the dollar versus major currencies being switched to the euro which is increasingly being used as a haven and for bets on big moves.

Source: https://finance.yahoo.com/news/goldman-citi-see-europe-economic-070000643.html