Brain surgeon’s clash with United Healthcare shows its hardball tactics

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Taking on Goliath: Brain surgeon’s clash with UnitedHealthcare shows insurer’s hardball tactics

Doctors say they were never reimbursed for many claims because the disruption meant they couldn’t submit them within insurers’ required time periods. Doctors also said their costs increased after the hack because they had to pay staff members to chase reimbursements. UnitedHealth Group announced earnings of $9 billion from operations in the first quarter of 2025, a 15% jump from the same period last year. The company said it is reaching out to those “that have not been responsive to previous calls or email requests for more information.’“I really believed that Optum, who was orchestrating these loans, would give physicians and physician groups a reasonable amount of time to repay the loans with the understanding that this financial crisis almost bankrupted us,” Mazzola said. The main reason doctors like Parikh and Mazzolas are in this crucible is that UnitedHealth group operates so many cogs in the nation’s health care machinery.

The central question surrounding UnitedHealth Group’s reimbursement actions is “whether they abused their use of this remedy by insisting on repayment before it was appropriate for them to do so given the damages that they caused,” Daniel Schwarcz, a professor at the University of Minnesota law school, said in an email.

Amid its clashes with doctors, UnitedHealth Group announced earnings of $9 billion from operations in the first quarter of 2025, a 15% jump from the same period last year. Revenue for the three months was $110 billion.

Even after Change Healthcare restarted claims processing, doctors who spoke with NBC News said they were never reimbursed for many claims because the disruption meant they couldn’t submit them within insurers’ required time periods. The doctors also said their costs increased after the hack because they had to pay staff members to chase reimbursements.

Mazzola, who estimates that her practice lost $1 million because of the hack, has asked Optum to reimburse her for costs her practice incurred as a result of the breach. But the terms Optum offered would have barred her from being able to sue it because of the hack. So she declined to accept it.

“I really believed that Optum, who was orchestrating these loans, would give physicians and physician groups a reasonable amount of time to repay the loans with the understanding that this financial crisis almost bankrupted us,” Mazzola said. “I mean literally, you’re talking about $0 in your bank account, and you have 70 employees to pay.”

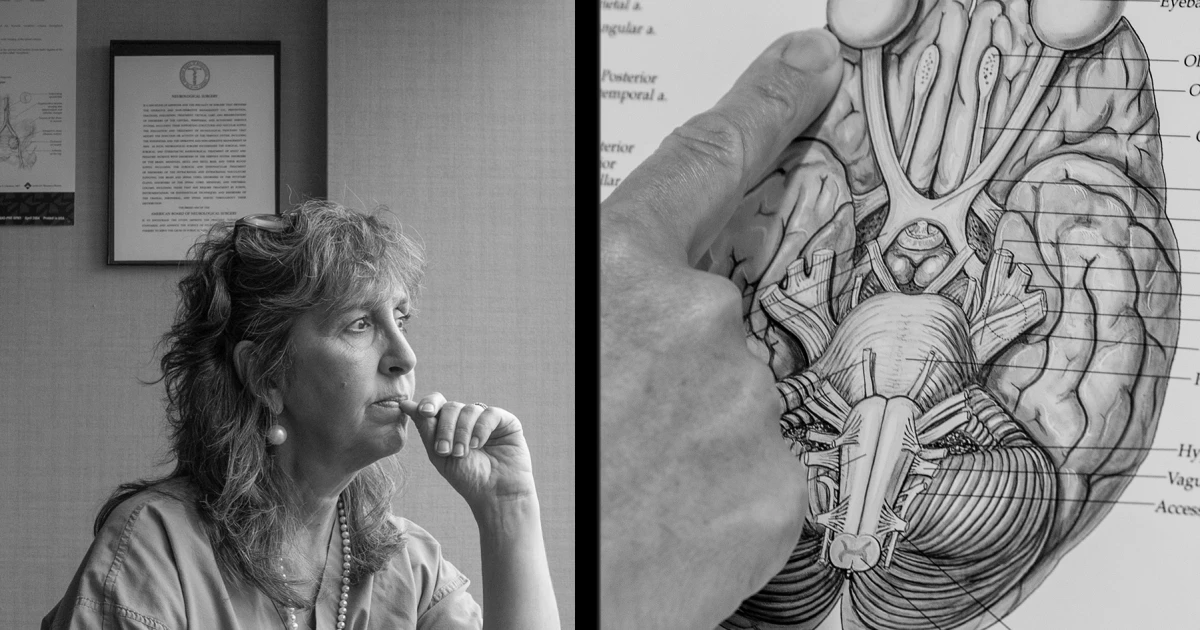

Dr. Catherine Mazzola. Zach Gross for NBC News

Delays of patient careDoctors say they weren’t the only ones hurt by the hack. Patients, too, were harmed when providers didn’t have the reimbursement revenue needed to buy medicine, for example.

“There were a lot of delays of patient care as a result of it,” said Dr. Pruvi Parikh, an allergist and immunologist in New York City who is medical director of a practice with six locations in New York and 15 in New Jersey.

Parikh’s group borrowed $400,000 from Optum to survive the hack. By the end of 2024, it had repaid all but $102,000 of it, documents show.

On Jan. 7, Optum threatened to withhold reimbursements to Parikh’s practice if the rest of the loan wasn’t repaid in days, an email shows.

“Coming up with that amount of money in five business days is not possible for the majority of private practices,” Parikh said in an interview. “Not only did they not give us time to get back on our feet, they were like, ‘Pay it now.’”

While the practice met Optum’s demand, she estimated it is out $2 million because of the hack.

In a statement, Change Healthcare said it started clawing back funding it had provided “more than one year post the event and with services restored.” The company said it is reaching out to those “that have not been responsive to previous calls or email requests for more information.”

The main reason doctors like Parikh and Mazzola are in this crucible, antitrust experts and physicians say, is that UnitedHealth Group operates so many cogs in the nation’s health care machinery. By acquiring an array of health care operations in recent years—including physician practices and pharmacy benefits management, technology, claims processing and financial services — UnitedHealth Group can exert market muscle over weaker participants like doctors and patients.