Dave Ramsey sounds alarm for Americans on Social Security problem

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Dave Ramsey sends blunt message on Social Security growing problem

Radio host and bestselling personal finance author, Dave Ramsey, sounds an alarm about what is needed to ensure the solvency of Social Security trust funds. If lawmakers fail to intervene, Social Security beneficiaries could see a large reduction in payments starting in 2034. “Any money you get from Social Security should be considered icing on the cake,” Ramsey wrote in an email to TheStreet. “Social Security costs began surpassing income in 2021, and the gap has existed between costs and non-interest income even longer, stretching back to 2010,” he said. “The program would be taking in less revenue than it needs to fully cover all scheduled benefits for both current and future recipients,” he wrote. “This shortfall would significantly affect retirees and other beneficiaries unless Congress enacts reforms to restore long-term solvence for Social Security for the long term” “Social security should be a small but helpful part of one’s retirement income that includes investments in 401(k) plans and IRAs,” he added.

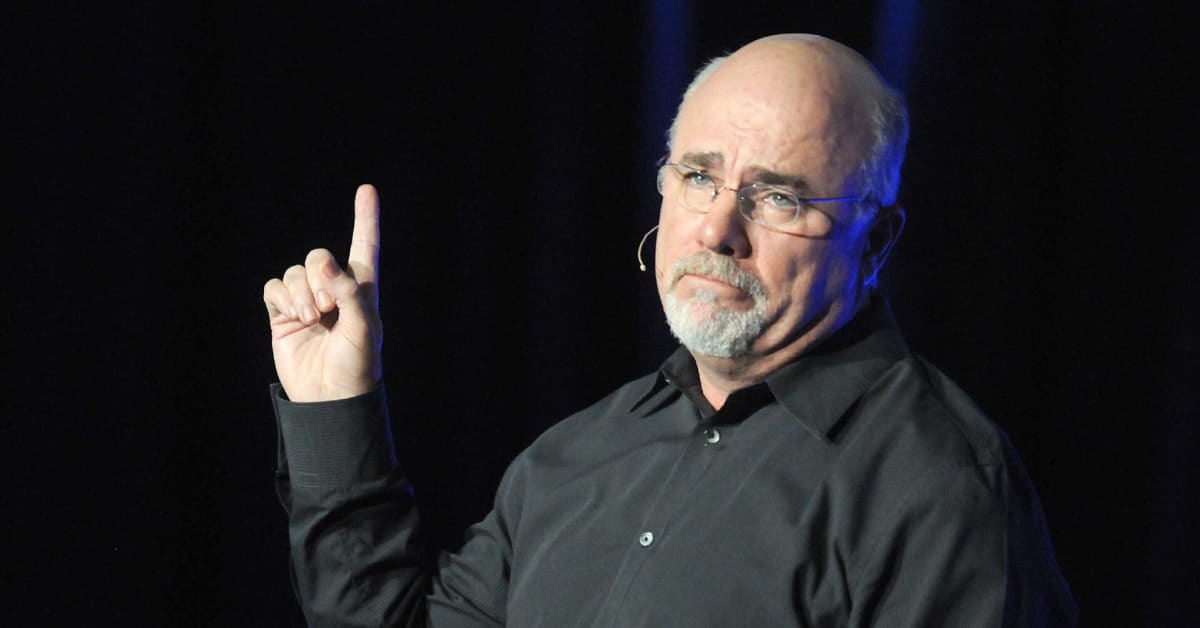

Dave Ramsey, radio host and bestselling personal finance author, sounds an alarm about what is needed to ensure the solvency of Social Security trust funds — and the scenario for which Americans should be planning.

💵💰Don’t miss the move: Subscribe to TheStreet’s free daily newsletter💰💵

According to the 2025 Social Security Trustees’ Report, if lawmakers fail to intervene, Social Security beneficiaries could see a large reduction in payments starting in 2034.

This looming cut stems from the projection that the Social Security trust fund will be exhausted by then. Simply put, the program would be taking in less revenue than it needs to fully cover all scheduled benefits for both current and future recipients.

Historically, Congress has stepped in with last-minute reforms to prevent such scenarios — while often shielding lower-income individuals from the brunt of the changes.

In 1983, for example, legislators passed a set of measures designed to stabilize Social Security in the short term and extend its financial health for what they hoped would be about 75 years.

These measures combined increased revenue — through higher payroll taxes, taxing benefits, and expanding coverage — with modest spending cuts such as adjusting the cost-of-living formula and gradually raising the retirement age.

The latest annual trustees’ report, published on June 18, estimates that the Old-Age and Survivors Insurance (OASI) trust fund may run dry by 2033 — unchanged from last year’s forecast. After that, only about 77% of promised benefits would be payable unless corrective action is taken.

However, one notable update is that the combined trust funds — which include both the OASI and Disability Insurance (DI) programs — are now projected to remain solvent only through 2034, one year earlier than previously expected, unfortunately.

At that point, around 81% of scheduled combined benefits would still be paid out.

Dave Ramsey speaks with TheStreet about personal finance issues. The radio host and author explains how Social Security solvency affects American retirees’ monthly benefits from the federal program. Image source: TheStreet

Dave Ramsey bluntly explains alarm on Social Security

Ramsey uses some basic math to explain why the Social Security system needs adjustment.

“As more and more boomers retire, the number of Americans 65 and older is expected to jump from roughly 61 million today to about 77 million in 2035,” Ramsey wrote. “At the same time, there will be fewer workers supporting more retirees, which puts even more of a strain on the system.”

More on retirement:

Ramsey emphasizes that Americans should not view Social Security as a main source of income during retirement. Rather, it should be a small but helpful part of one’s retirement income that includes investments in tools such as 401(k) plans and IRAs.

“Any money you get from Social Security should be considered icing on the cake,” Ramsey wrote.

The Social Security Board of Trustees highlights adjusted projections

In a statement, the Social Security Board of Trustees made a few key observations.

In 2024, the combined reserves of the OASI and DI trust funds saw a significant decline, dropping by $67 billion and bringing the total down to $2.72 trillion.

This continued erosion of the funds is an indication of the program’s mounting financial strain as benefit payments outpace income from dedicated payroll taxes and other sources.

Looking ahead, the financial outlook remains challenging. Starting in 2025, Social Security’s total annual expenditures are projected to exceed its total annual income for the foreseeable 75-year horizon.

This imbalance isn’t new — Social Security costs began surpassing income in 2021, and the gap has existed between costs and non-interest income even longer, stretching back to 2010. This growing disparity has contributed to the gradual depletion of trust fund reserves.

The statement summarizes the key point for Americans discussed above: Without legislative action, projections show that by 2034, the combined Social Security trust fund reserves could be exhausted.

If that happens, the program would not go bankrupt, but it would only have enough ongoing revenue to cover approximately 81% of scheduled benefits.

This shortfall would significantly affect payments to retirees and other beneficiaries unless Congress enacts reforms to restore long-term solvency for Social Security.

Source: https://www.thestreet.com/retirement/dave-ramsey-sounds-alarm-americans-social-security-problem