Japan Flags Big Cut to Long-End Bond Issuance Before Auction

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Japan Flags Big Cut to Long-End Bond Issuance Before Auction

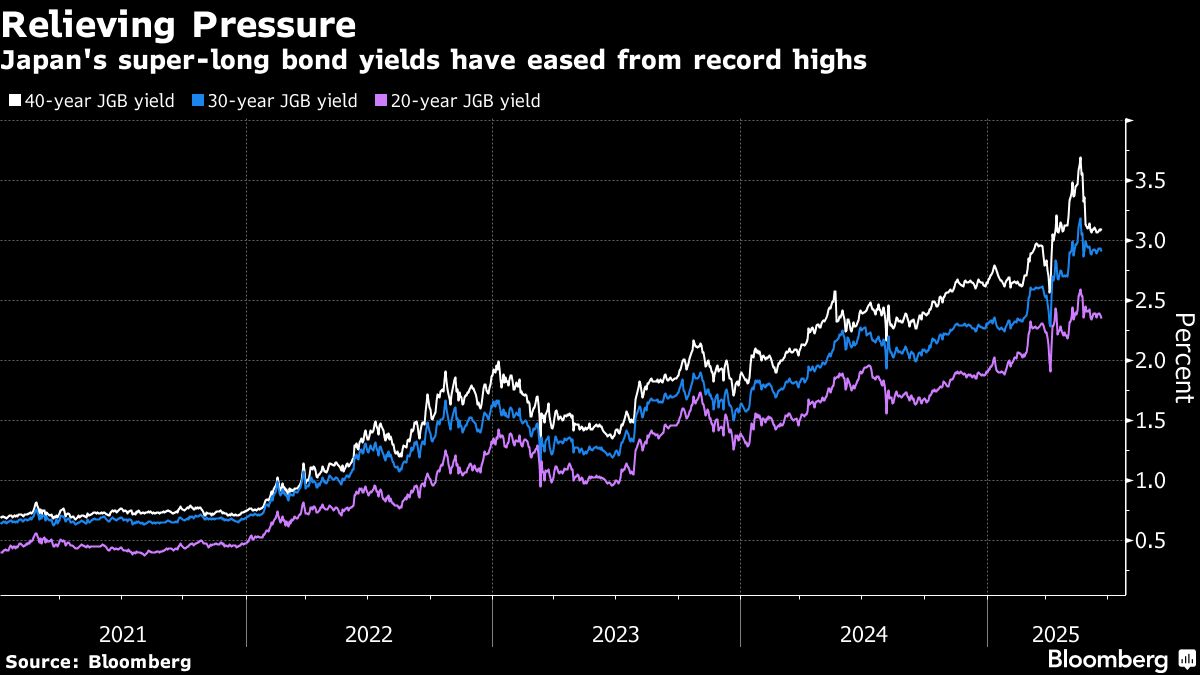

Japan’s larger-than-expected cut to super-long bond issuance has potential to ease some upward pressure on yields. The move by the finance ministry may also prove fortuitous in light of the US attack on Iranian nuclear sites over the weekend. Japanese government bonds dropped on Monday morning in Tokyo, while the 10-year yield was up two basis points to 1.415%.While the conflict in the Middle East will complicate the picture in markets, the plan to reduce sales of 20-, 30- and 40-year bonds was initially judged as a calming factor.

Most Read from Bloomberg

The move by the finance ministry may also prove fortuitous in light of the US attack on Iranian nuclear sites over the weekend. The escalating military action adds to the dangers for super-long yields via higher oil prices and inflation. Japanese government bonds dropped on Monday morning in Tokyo, while the 10-year yield was up two basis points to 1.415%.

While the conflict in the Middle East will complicate the picture in markets, the plan to reduce sales of 20-, 30- and 40-year bonds by a total of ¥3.2 trillion ($22 billion) through March next year was initially judged by rates strategists in Tokyo as a calming factor for trading in this key sector. The changes were presented by officials late Friday during a meeting with primary dealers.

“The bond market is being weighed down by concerns over rising oil prices and the upcoming 20-year bond auction,” said Naoya Hasegawa, chief bond strategist at Okasan Securities. But “the direction of supply and demand for super-long government bonds has become clearer after the revised issuance plan.”

The latest plan includes a reduction in 20-year bond sales that is twice the size suggested in earlier draft documents seen by Bloomberg and other media. A poorly received auction of this maturity debt last month set a fire under super-long yields in Japan and that spread in global markets.

“The ministry publicized its revised plan sooner than anticipated to ward off the risk of a failed 20-year bond auction on June 24 and to avert the market volatility seen in May,” Shoki Omori, chief strategist at Mizuho Securities Co., said immediately after the news. “In light of these announcements, super-long-term auctions are poised to regain a measure of stability.”

The positive impact the ministry may have through adjusting issuance doesn’t overcome the challenge to Japan posed by consumer prices that are rising at the fastest pace in several years, and an election this summer which is likely to encourage more government spending.

The changes presented Friday also risk shifting some of the problem, rather than eliminating it, by increasing issuance of shorter-dated debt.

Source: https://finance.yahoo.com/news/japan-flags-big-cut-long-005213271.html