Trump’s “big, beautiful bill:” What’s in, what’s out

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Elon Musk’s ‘wake-up call’ for America echoes what brother Kimbal Musk said on Donald Trump’s ‘One Big Beautiful Bill’

Elon Musk warns that China’s solar power is on a trajectory to surpass the entire electricity output of the US within the next three to four years. His claim comes days after his brother, Kimbal Musk, criticised President Donald Trump’s proposed ‘Big, Beautiful Bill,’ warning that the legislation would cripple the US’s renewable energy sector. The concerns of the Musk brothers centre on the future of solar and wind power in the US, which they argue would be decimated by the new bill.

solar power

generation is on a trajectory to surpass the entire electricity output of the US within the next three to four years.

Tired of too many ads? go ad free now

His claim comes days after his brother,

Kimbal Musk

, criticised President Donald Trump’s proposed ‘Big, Beautiful Bill,’ warning that the legislation would cripple the US

renewable energy

sector and jeopardize American

energy independence

.

“Solar power in China will exceed ALL sources of electricity combined in the USA in 3 to 4 years. Wake up call,” Musk said in a post which showed data from Ember, a global energy think tank.

Ember’s data chart suggests China’s solar output hit 100 TWh in May 2025 and is doubling every two years, outpacing the US’s 400 TWh monthly total.

Musk DITCHES Trump | ‘Snake’ Allegation & Security Clearance SHOCKER Rock White House Ties

Elon Musk brothers raise concerns on ‘Big, Beautiful Bill’s’ impact on power generation

The concerns of the Musk brothers centre on the future of solar and wind power in the US, which they argue would be decimated by the new bill. Kimbal Musk, an entrepreneur and board member of Tesla and SpaceX, criticised the bill last week with a stark warning about the legislation’s impact.

“American Energy Independence is critical to our national security. The new bill will drive solar and wind energy growth to zero. Zero,” Musk stated publicly.

He argued that the halt in renewable expansion would force the US into a desperate scramble for traditional energy sources, directly undermining its ability to compete globally, particularly with China.

“We will need 25 new natural gas plants built per year to replace our amazingly successful solar and wind energy growth that this bill will kill,” he projected.

Tired of too many ads? go ad free now

Highlighting the urgency, he added, “Do the math. It takes 5-7 years to build a natural gas plant. The AI race will be won or lost in the next few years. Our energy grids are already collapsing.”

He shared a post on X (formerly Twitter) from Jesse Peltan, co-founder of HODL Ranch, to which Musk replied, “They don’t understand.”

What to know as the Senate tries to pass Trump’s agenda bill next week

Aides and members say that if everything goes according to plan, the 20-hour clock to debate the bill could start as soon as Wednesday. The Byrd Bath is a critical process led by the Senate parliamentarian that ensures all the provisions of the bill comply with special Senate rules. Some of these negotiations will be substantial, others will be a way to give members an off-ramp to vote “yes” because members really do want to back the president here. The Senate Finance Committee is expected to undertake this process Sunday evening, a critical step in moving forward because so many of the tax and health care provisions that are the heart of this bill are in Finance’s purview. State and local tax deductions may be the biggest hurdle right now. Unlike in the House, where a number of members hail from high-tax states, there is absolutely no interest in the Senate in investing billions of dollars to raise the cap on how much in state and local taxes in New York, California, New Jersey and Illinois can deduct.

It’s go time in the Senate for President Donald Trump’s “big, beautiful bill.”

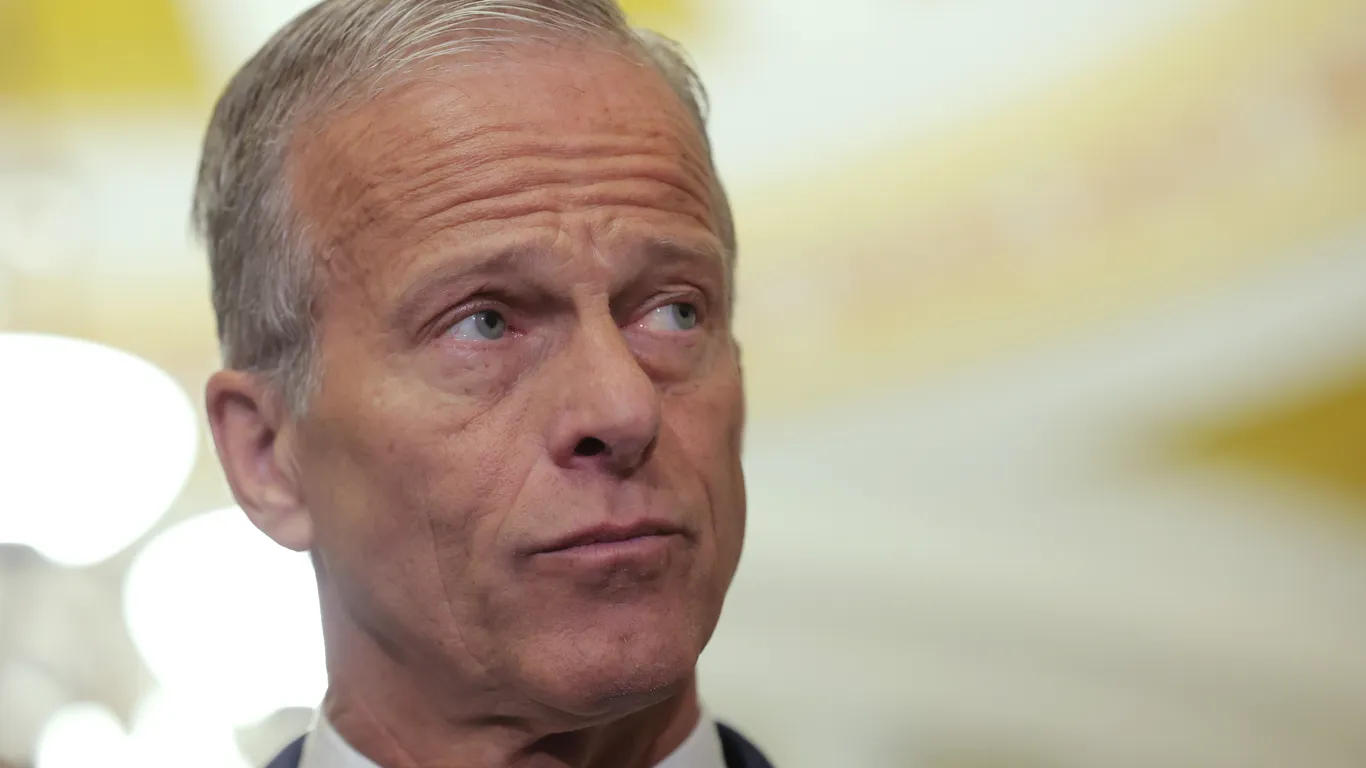

After months of negotiations, Senate Republicans are gearing up for a potential vote next week on Trump’s sweeping domestic policy bill. It will be a major test for Republican Leader John Thune and Trump’s own hold on the upper chamber that aides say will be cast as a binary choice for the rank-and-file: you either are with the president or you aren’t.

Thune has predicted the Senate could begin consideration on the bill as early as the middle of next week. That would mean a massive sprint starting this weekend to draft final text, whip votes and iron out a series of major sticking points that will satisfy holdouts – without pushing the bill in such a different direction that it stalls out in the House of Representatives where it passed by a single vote.

The bottom line is next week is crunch time and all the hard decisions that have been punted will need to be made in the next several days.

The timeline

Aides and members say that if everything goes according to plan (and that’s far from certain), the 20-hour clock to debate the bill could start as soon as Wednesday.

Republicans would yield a big part of their time back and vote-a-rama – an hours-long voting marathon – could begin Thursday evening into Friday. That could always get pushed into Friday evening, but right now the goal is to have this finished by the end of next week.

So, what happens now?

Over the next several days, a myriad of technical work and hard-fought negotiations have to unfold in order to get the bill to a place where it is even ready for the floor. Some of these negotiations will be substantial, others will be a way to give members an off-ramp to vote “yes” because members really do want to back the president here.

One of those tasks is already underway and will continue this weekend: the Byrd Bath.

What is the Byrd Bath?

Simply put, the Byrd bath is a critical process led by the Senate parliamentarian that ensures all the provisions of the bill comply with special Senate rules that allow Republicans to move this bill with a simple majority rather than being subject to the normal 60-vote threshold.

Those rules are specific and nuanced, but the Budget Control Act set parameters that required provisions within a bill that is going to pass with a simple majority to have more than just an “incidental” budget impact. The parliamentarian traditionally makes a call on whether a provision qualifies.

It’s named after the late Democratic Sen. Robert Byrd of West Virginia, who came up with the rule to stop either side from abusing the reconciliation process and trying to use it to just pass legislation that bypassed a filibuster.

The way it works is Democrats and Republican staffers of each committee with jurisdiction in the bill privately meet with the parliamentarian and make their arguments for whether provisions meet the confines of the process. The Senate Finance Committee is expected to undertake this process Sunday evening, a critical step in moving forward because so many of the tax and health care provisions that are the heart of this bill are in Finance’s purview.

Several other committees have already begun, including the Senate Banking Committee, which Democrats say led to some of the provisions in that committee’s jurisdiction from being ruled out of compliance with reconciliation.

“The Parliamentarian agreed that the funding cap for the Consumer Financial Protection Bureau (CFPB), elimination of the Public Company Accounting Oversight Board (PCAOB), gutting of the Office of Financial Research and Financial Stability Oversight Council, and slashing Federal Reserve staff salaries violate the Senate’s Byrd Rule,” Sen. Elizabeth Warren’s office announced in a statement.

WASHINGTON, DC – MAY 22: A sign is attached to a podium before a press conference celebrating the passage of the One Big Beautiful Bill Act on Thursday May 22, 2025 in Washington, DC. Matt McClain/The Washington Post/Getty Images

The outstanding issues

State and local tax deductions: This may be the biggest hurdle right now. Unlike in the House, where a number of swing district members hail from high-tax states, there is absolutely no interest in the Senate in investing hundreds of billions of dollars to raise the cap on how much constituents in New York, California, New Jersey and Illinois can deduct in state and local taxes on their federal taxes. The Senate bill currently keeps the cap frozen at $10,000, a placeholder that Senate leaders have indicated they may be willing to negotiate on. But the coalition of House Republicans who raised the cap to $40,000 for certain income thresholds under $500,000 aren’t interested in renegotiating the hard-fought deal they cemented in the House.

Sen. Markwayne Mullin, a Republican from Oklahoma and former House member, has been leading the talks over the issue, but so far there is no deal. There is some discussion, two sources say, over dialing back the income threshold for who qualifies for the $40,000 deduction but so far that’s been a nonstarter for the group of House Republicans who got this concession in the House bill a few weeks ago.

To say there is palpable frustration in the Senate with a handful of House members dictating the future of a provision in the Senate bill that no one in that chamber cares much about is putting it mildly.

Medicaid: A number of Senate Republicans have made clear they could vote against the Senate bill if there aren’t protections to ensure rural hospitals are protected from some of the changes to Medicaid in the bill, like the slash to how much hospitals can be held harmless when it comes to the provider tax. Led by Sen. Susan Collins of Maine, a group of these Republicans are pushing leadership to create a kind of stabilization fund that states could use. Aides close to the process say that it could go a long way to win over some skeptical Republicans, including people like Sen. Jim Justice of West Virginia and Missouri Republican Sen. Josh Hawley. The particulars of how the fund would be structured and how much it would cost are still being considered and it’s important to note that the fund helps hospital but wouldn’t do much for others who could lose coverage because of other changes to Medicaid, including new work requirements.

Green energy tax credits: While the Senate bill takes a slower approach to phasing out some of the clean energy tax credits that were a key part of the Biden administration’s environmental legacy, there are still some Republicans who have warned that some of the phaseouts may happen too quickly. Other conservatives have warned that they need to be eradicated more expeditiously, setting up a massive clash and one that could rear its head again if the Senate passes a bill that ultimately doesn’t go as far as the House did. A last-minute negotiation is ultimately what got House conservatives to vote for the bill so any changes to the timeline could be an issue when the bill goes back to the House.

Then what? Back to the House

Once the Senate passes its version of Trump’s bill, it will go over to the House. There, Speaker Mike Johnson and his GOP conference will have to decide whether to back the new bill – or begin the drawn-out process of trying to negotiate. Do they swallow the Senate’s big changes and allow the bill to move quickly to Trump’s desk for a huge policy win? Or do they fight for their own version and begin the rigorous, and time-consuming, process of a conference committee, where both chambers will formally iron out their differences? Johnson and Trump are both hoping to avoid the latter option – but will the fractious House GOP conference agree?

What the business world has to like (and not) in the Senate version of Trump’s ‘big, beautiful bill’

The Senate version of the tax reform bill is expected to be passed by the end of the week. The bill does not include the so-called revenge tax, which was introduced in the House version. The Senate version also raises the debt ceiling by $5 trillion, compared with $4 trillion in the Senate version. However, the bill does cut the annual deduction for individual state and local taxes (SALT) from $40,000 to $10,000. The House version does not cut the SALT deduction, but does cut it by $1.5 billion. The final version is not expected to come out until after the July 4 holiday.

The Senate’s Finance Committee’s 549-page blueprint contains significant changes, especially on taxes, Medicaid funding, and clean energy.

One proposal was quickly embraced by the business community: a Senate-side push to make corporate tax deductions permanent around things like interest payments and new capital investments.

But a less popular idea is the survival of the so-called revenge tax that would allow the government to levy new duties on foreign nations and their businesses.

That idea was introduced in the House version and sparked fears of reduced foreign investment. The version released last Monday pares back the tax but doesn’t eliminate it entirely, as corporate lobbyists had asked.

Specific industries also have plenty at stake from Senate changes if they make it into law.

Businesses that work in clean energy will have more time to adjust to the phase-out of Biden-era credits. Restaurants and gig economy companies have more limited tax breaks for tips and overtime. Healthcare providers will also have to adjust to even steeper cuts to Medicaid’s provider tax structure — perhaps the most surprising and significant overall change in the Senate version.

President Trump speaks to reporters while traveling back to Washington, D.C., from Canada on June 16 after leaving a G7 summit in Canada a day early. (Brendan Smialowski/AFP via Getty Images) · BRENDAN SMIALOWSKI via Getty Images

What the Senate version of the bill doesn’t appear to have — as Elon Musk and others had pushed for — is a significant change in the final price tag. Both versions are expected to add trillions of dollars to the debt.

The Senate version also raises the debt ceiling by $5 trillion, compared with $4 trillion in the House version.

The bill does have one clear cost-saving measure: slashing the annual deduction for individual state and local taxes (SALT) from $40,000 to $10,000.

But that provision is described even in the bill’s official summary as “the subject of continuing negotiations,” with defenders of the deduction pledging to restore the full credit forthwith.

The Senate version earned a quick flurry of Republican pledges — from fiscal hawks to defenders of those SALT deductions to those who object to the Medicaid cuts — to vote no if the final version isn’t changed to their liking.

“We’re not seriously addressing our long-term deficit and debt,” Sen. Ron Johnson of Wisconsin told reporters soon after the unveiling, reiterating that he remains a no.

The back and forth comes just weeks ahead of Republicans’ self-imposed deadline to get the bill to the president’s desk by July 4. Senate Majority Leader John Thune has said sticking to that timeline means Senate passage by the end of this coming week.

Hoosiers could be kicked off Medicaid under Trump’s ‘big beautiful bill.’ What to know

Some Hoosiers could be kicked off Medicaid if President Donald Trump’s “One Big Beautiful Bill Act” passes in its current form.Language added to the federal legislation on June 16 caps the Medicaid provider tax — which is used to cover 90% of the state’s portion of the costs for the Healthy Indiana Plan — at 3.5%. Indiana utilizes a 6% provider tax, meaning the change would decrease funding from the fee by nearly half. Opponents of the provider tax view it as a loophole used by states to qualify for matching dollars from the federal government without having to dedicate much of their own funds. With a slim Republican majority, it’s possible the part of the bill that imposes the 3-5% tax cap could be removed.

Language added to the federal legislation on June 16 caps the Medicaid provider tax — which is used to cover 90% of the state’s portion of the costs for the Healthy Indiana Plan — at 3.5%. Indiana utilizes a 6% provider tax, meaning the change would decrease funding from the fee by nearly half. Opponents of the provider tax view it as a loophole used by states to qualify for matching dollars from the federal government, which pays for 90% of the costs of the program, without having to dedicate much of their own funds.

If passed as is, Indiana would not be able to afford the current costs of the Healthy Indiana Plan, the state’s insurance program for low-income people, Indiana Family and Social Services Administration Secretary Mitch Roob said at a state budget committee meeting June 18.

But neither Roob nor Gov. Mike Braun are asking Congress to keep the full 6%. Instead, Roob said at the meeting that he wants Congress to add language that would give states the flexibility to adapt.

Those changes would allow the state to enroll fewer Hoosiers in HIP, according to Roob.

“Please give us the needed flexibility to roll back our eligibility if they change the fuel mix for our program,” he said at the meeting.

Even without the added impact of the federal legislation, the state is making it more challenging to qualify for Medicaid. The latest version of HIP already includes more restrictions, such as work requirements for able-bodied recipients that passed the legislature this year. The new law includes a list of exceptions, though not all would be covered under the work requirement language proposed in the federal bill.

In a statement June 18, Braun said the efforts to reduce federal spending were overdue.

“However, flexibility in managing Indiana’s HIP program will be essential for the state moving forward, especially if we are required to take on more of the financial obligation,” he said in the statement. “This will require a hands-on approach to updating and maintaining Indiana’s Medicaid system that only Hoosiers can provide.”

Braun said he would work to “stretch the dollar” for people with chronic diseases and those who “really can’t afford health care” when speaking to reporters at the Indiana Statehouse on June 19.

“That’s what I’d like to have it there for, not what it’s expanded into with very lax supervision, pushed by the feds and now with a bunch of begrudging state partners because it’s been busting the budget,” he said.

The provision has already faced some GOP opposition in the U.S. House of Representatives, which must approve this version of the bill before it can move on. With a slim Republican majority, it’s possible the part of the bill that imposes the 3.5% tax cap could be removed.

The version that already passed the House only capped future increases in provider fees.

Contact Marissa Meador at mmeador@gannett.com or find her on X at @marissa_meador.

Senate’s Byrd Rule Upends Trump’s ‘Big Beautiful Bill’

Elizabeth MacDonough, the Senate parliamentarian, may have had more influence over Donald Trump’s legislative agenda than anyone else in Washington. After meeting with Republicans and Democrats behind closed doors, she has significantly shrunk the size of the President’s sweeping tax-and-spending package. She has struck several measures that violated an arcane, decades-old Senate rule known as the Byrd Rule, which prohibits provisions considered “extraneous” to the federal budget. The rulings will force Republicans to either strip those provisions from the bill or secure a 60-vote supermajority to keep them in, a nearly impossible hurdle given that Senate Republicans only hold 53 seats. They illustrate the often-overlooked power of Senate procedure—and the person tasked with interpreting it. The first woman to ever serve as Senate parliamentary, she was appointed in 2012 and has struck prohibited measures from reconciliation bills several times under both Democrats and Republicans. She could issue additional guidance this week. The spate of rulings has significantly complicated the prospects of passing the tax and spending bill by the July 4 deadline.

Advertisement Advertisement

One of the main GOP provisions the parliamentarian said did not satisfy the Byrd Rule was a measure to push some of the costs of federal food aid onto states, sending Republicans back to the drawing board to find the billions in savings that provision would have yielded. MacDonough also rejected measures to bar non-citizens from receiving SNAP benefits and one that would have made it more difficult to enforce contempt findings against the Trump Administration. MacDonough could issue additional guidance this week. The spate of rulings from the Senate parliamentarian, an official appointed by the chamber’s leaders to enforce its rules and precedents, has significantly complicated the prospects of passing Trump’s tax and spending bill by the July 4 deadline he imposed on Congress. Republicans have been scrambling for months to secure enough votes for Trump’s megabill, which centers on extending his 2017 tax cuts and delivering on several of his campaign promises, such as boosting border security spending and eliminating taxes on tips. Support for the package has softened this month as more Republicans warn that it would add trillions of dollars to the deficit without further spending cuts.

Advertisement

But the parliamentarian’s latest rulings will force Republicans to either strip those provisions from the bill or secure a 60-vote supermajority to keep them in, a nearly impossible hurdle given that Senate Republicans only hold 53 seats. MacDonough ruled that some of the provisions have little business in a budget reconciliation bill, which can make big changes to how the federal government spends money but, under Senate rules, isn’t allowed to substantively change policy. MacDonough’s rulings came about after days of behind-the-scenes meetings between her office and Senate staff. They illustrate the often-overlooked power of Senate procedure—and the person tasked with interpreting it. MacDonough, a former Justice Department trial attorney and the first woman to ever serve as Senate parliamentarian, is Washington’s ultimate rules enforcer. She was appointed in 2012 and has struck prohibited measures from reconciliation bills several times under both Republicans and Democrats.

Advertisement

Now, the parliamentarian’s rulings may force Republicans back to the drawing board just as they were hoping to finalize their legislative centerpiece. Here’s what to know about the rejected measures. What is the Byrd Rule? The Byrd Rule, adopted in 1985, is a procedural constraint named after the late Senator Robert C. Byrd of West Virginia to prohibit “extraneous” provisions from being tacked onto reconciliation bills, which are fast-tracked budget packages that allow legislation to pass with a simple majority, bypassing the 60-vote filibuster threshold. The rule makes it so that every line of a reconciliation package must have a direct and substantive impact on federal spending or revenues. Provisions that serve primarily policy goals—rather than budgetary ones—are subject to elimination by a parliamentary maneuver known as a point of order. Whether a point of order is sustained is ultimately made by the parliamentarian, who is essentially the Senate’s umpire tasked with providing nonpartisan advice and ensuring that lawmakers are complying with the Senate’s rules.

Advertisement

Parliamentarians often face backlash during the budget reconciliation process, when they determine whether policy proposals comply with the constraints of the Byrd Rule. What’s been cut so far? MacDonough’s rulings have invalidated a number of headline-grabbing GOP provisions, including a plan requiring states to pay a portion of food benefits—the largest spending cut for SNAP in the bill. The SNAP measure, which the parliamentarian said violated the Byrd Rule, would have required all states to pay a percentage of SNAP benefit costs, with their share increasing if they reported a higher rate of errors in underpaying or overpaying recipients. Some lawmakers warned their states would not be able to make up the difference on food aid, which has long been provided by the federal government, and could force many to lose access to SNAP benefits. Republican Sen. John Boozman of Arkansas, the chairman of the Agriculture Committee, said in a statement that he’s looking for other ways to cut food assistance without violating Senate rules.

Advertisement

Another rejected provision would have zeroed out $6.4 billion in funding of the Consumer Financial Protection Bureau, effectively shuttering the agency. The bureau was created by Democrats as part of the 2010 Dodd-Frank Act in the aftermath of the financial crisis as a way to protect Americans from financial fraud. Republicans have long decried the CFPB as an example of government over-regulation and overreach. “Democrats fought back, and we will keep fighting back against this ugly bill,” said Senator Elizabeth Warren of Massachusetts, who said the GOP plan would have left Americans vulnerable to predatory lenders and corporate fraud. The Senate parliamentarian also blocked a GOP provision intended to limit courts’ ability to hold Trump officials in contempt by requiring plaintiffs to post potentially enormous bonds when asking courts to issue preliminary injunctions or imposing temporary restraining orders against the federal government.

Advertisement

Democrats hailed that decision by the parliamentarian, noting that it would have severely undermined the judiciary’s ability to check executive overreach. Senate Democrats “successfully fought for rule of law and struck out this reckless and downright un-American provision,” Senate Minority Leader Chuck Schumer said in a statement. MacDonough also nixed provisions to reduce pay for certain Federal Reserve staff, slash $293 million from the Treasury Department’s Office of Financial Research, and dissolve the Public Company Accounting Oversight Board, which is tasked with overseeing audits of publicly traded companies. Each of these proposals, she ruled, either lacked sufficient budgetary impact or were primarily aimed at changing policy, not federal revenues or outlays. MacDonough also rejected language in the bill drafted by the Senate Environment and Public Works Committee that would have exempted certain infrastructure projects from judicial review under the National Environmental Policy Act. The rejected proposal would have allowed companies to pay a fee in exchange for expedited permitting, a move Republicans argued would streamline bureaucratic delays.

Advertisement

Also disqualified was a measure to repeal the Biden Administration’s tailpipe emissions rule for cars and trucks manufactured after 2027. MacDonough ruled that the environmental provisions were either insufficiently tied to federal spending or failed to meet the Byrd Rule’s strict thresholds for inclusion. Are the parliamentarian’s rulings final, or could they be overturned? The parliamentarian’s decisions could, in theory, be overturned. Senate Majority Leader John Thune of South Dakota has the authority to ignore her ruling by calling for a floor vote to establish a new precedent—essentially overruling the Senate’s referee. Parliamentarians have been ignored in the past, though it is quite rare. In 1975, Vice President Nelson Rockefeller ignored the parliamentarian’s advice as the Senate debated filibuster rules. MacDonough has been overruled twice before: in 2013, when Democrats eliminated filibusters to approve presidential nominees, and in 2017, when Republicans expanded the filibuster ban to include Supreme Court nominations.

Advertisement

But Thune has signaled he has no intention of going down that path this time. “We’re not going there,” the Senate Majority Leader said on June 2 when asked by reporters about overruling MacDonough.

Thune could also fire the Senate Parliamentarian and replace her with one willing to interpret the rules more in line with how Senate Republicans view them.

Source: https://www.axios.com/2025/06/23/senate-byrd-bath-parliamentarian-status-provisions