Economist’s jumbo $128 RBA interest rate prediction in weeks: ‘No need to wait’

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Economist’s jumbo $128 RBA interest rate prediction in weeks: ‘No need to wait’

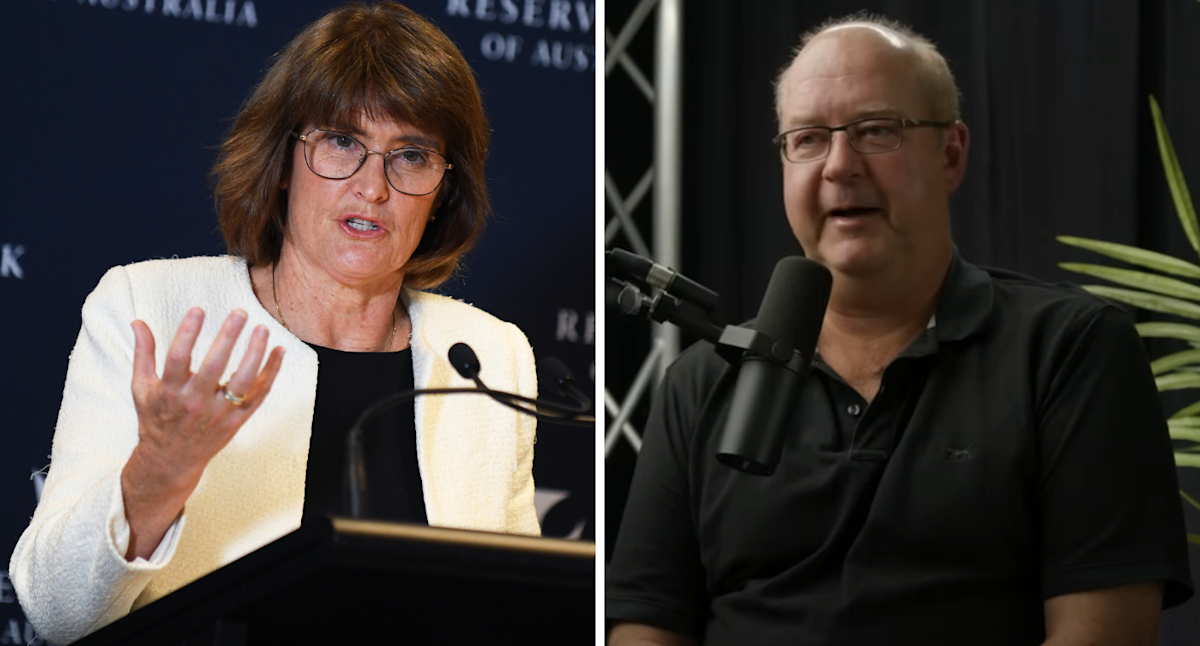

Economist Warren Hogan said the RBA should cut interest rates by 35 basis points in July. A 35 basis point cut would lower repayments on the average $600,000 home loan with 25 years remaining by $128 per month. That would be a saving of an extra $37 a month, compared to a standard 25 basis points cut. The longer it takes to get the cash rate to a neutral level, the “worse the economy will be”, says Yahoo Finance contributor Stephen Koukoulas. The RBA seems to think a neutral cash rate is about 3.5 per cent, he says.

A top economist has called on the Reserve Bank of Australia (RBA) to deliver a jumbo cash rate cut in July. Economic growth has been weak, and Australian consumers are continuing to be “cautious” with their spending, leading to an “agonisingly gradual recovery” in the private sector economy.

EQ managing director Warren Hogan has called on the central bank to “act decisively” at its next meeting and make an “uncharacteristic” 35 basis point rate cut. This is bigger than the standard 25 basis point cut mortgage holders received in February and May.

“At this stage, the RBA seems to think a neutral cash rate is about 3.5 per cent. There is no reason to wait,” Hogan, who has previously been a cautious voice about rate relief, wrote in an opinion piece for the Australian Financial Review.

RELATED

A 35 basis point cut would lower repayments on the average $600,000 home loan with 25 years remaining by $128 per month. That would be a saving of an extra $37 a month, compared to a standard 25 basis point cut.

Economist and Yahoo Finance contributor Stephen Koukoulas has also called for a supersized interest rate cut at the RBA’s next meeting. He said the RBA needs to “aggressively” move the cash rate to a neutral, or accommodative, position.

“We do need to see the RBA cutting 50 [basis points] at the July meeting, playing a bit of catch up for its errors previously, getting the cash rate down to 3.35 per cent and giving the economy a chance to get a breather, to grow a bit,” he said.

A neutral rate is one that is neither stimulatory nor contractionary. There is no set definition for what it is, but it is thought to be in the low 3 per cent region.

The longer cash rate cuts take, the ‘worse economy will be’

The Australian economy grew just 0.2 per cent in the March quarter and 1.3 per cent in annual terms.

Koukoulas warned that the longer it takes to get the cash rate to a neutral level, the “worse the economy will be”.

“It needs to get there sooner rather than later, otherwise 2026 is going to be a really tough year for the economy,” he said.

Hogan said that despite a boost to real disposable incomes, Australian consumers were “unwilling to loosen the purse strings in a meaningful way”, preferring to save rather than spend their extra income.

“The household saving ratio jumped above 5 per cent, back to what was normal prior to the pandemic. It could go higher, particularly as the government seeks to tax superannuation incomes at a higher rate in the future,” he said.