Fiscal policies prove highly effective in mitigating the environmental impact of food

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Fiscal policies prove highly effective in mitigating the environmental impact of food

Researchers from the University of the Basque Country looked at how different fiscal policies contributed to reducing the carbon emissions, water use and food waste generated by food consumption. They concluded that a generalized increase in taxes on all products is not as effective as differential taxing or subsidizing of each food category. They also stated the importance of designing different policies according to the objectives to be achieved. The research is published in the journal Ecological Economics (2025) and is available to legislators so that they can design tax policies that are better adapted to their objectives, says María José Gutiérrez, professor of economic analysis at the EHU. The study has shown that there are no combinations of taxes and subsidies that achieve a significant reduction in environmental impacts in all three types of formulas. However, some states have found that some combinations were able to mitigate the three environmental impacts: legumes and oilseeds, cereals and seafood by 20% taxing and subsidizing, fruit and vegetables, eggs, dairy and other food categories.

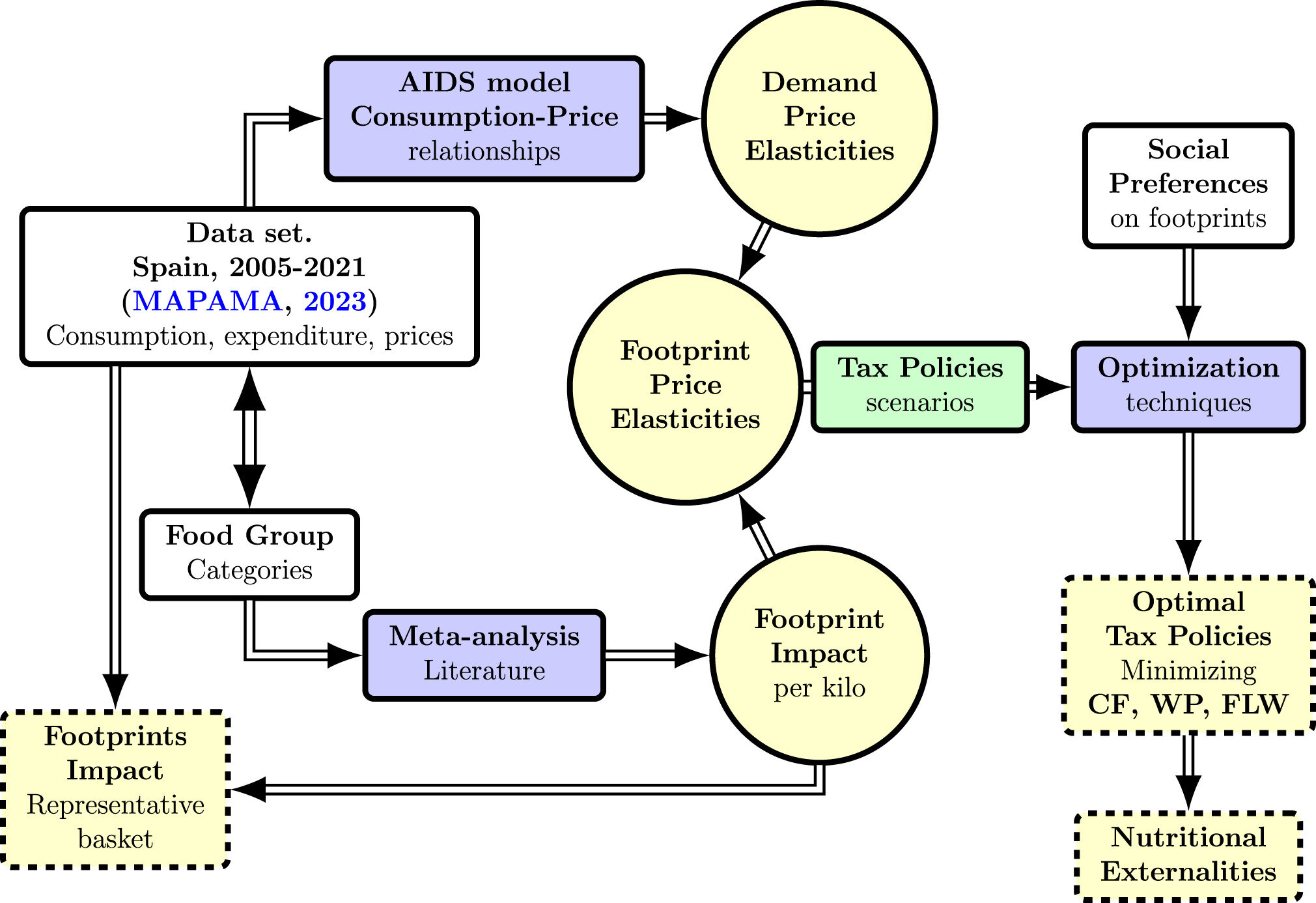

The logic behind the methodological strategy. Credit: Ecological Economics (2025). DOI: 10.1016/j.ecolecon.2025.108596

A study by the University of the Basque Country (EHU) has identified the optimal combinations of taxes and subsidies for reducing the environmental footprint of food consumption. Researchers from the BIRTE research group looked at how different fiscal policies contributed to reducing the carbon emissions, water use and food waste generated by food consumption.

They concluded that a generalized increase in taxes on all products is not as effective as differential taxing or subsidizing of each food category. They also stated the importance of designing different policies according to the objectives to be achieved. The research is published in the journal Ecological Economics.

Food has a major impact on the environment, given that the production, processing, transport, preparation and final consumption of food require a lot of water, produce high carbon emissions and generate food waste. However, it should be noted that not all products have the same environmental impact.

For example, cereal production requires many liters of water, while meat production contributes significantly to greenhouse gas emissions. Therefore, what we eat plays an important role in our own health and that of the planet. By changing our diet, we also change our environmental footprint.

In this context, from among the various reasons for changes in our diet, a research study by the University of the Basque Country (EHU) focused on the economic factors. Specifically on the potential of fiscal policies to mitigate the environmental footprint of food.

“When food prices increase and decrease, the composition of the shopping basket changes and, therefore, also the impact on the environment. And considering that taxes and subsidies are, after all, a way of modifying prices, we analyzed the specific way in which taxing and subsidizing certain foods influences people’s buying habits,” explained María José Gutiérrez, professor of economic analysis at the EHU.

To perform the calculations, the database of the Spanish Ministry of Agriculture, Fisheries and Food was used, which offered detailed information about the monthly composition of the shopping basket of an average household over a period of 20 years.

“Using statistical tools, we are able to estimate how the population would respond to different combinations of taxes and subsidies; that is, what they would no longer eat and what they would buy in greater quantity. At the same time, using the results of other studies, we were able to calculate the environmental impact of each shopping basket.

“From these results, we concluded that fiscal policies are, in fact, effective tools for reducing the environmental footprint of food,” said Gutiérrez.

María José Gutiérrez, professor of economic analysis at the EHU. Credit: University of the Basque Country

Taxes and subsidies by food category and adapted to the objectives

One of the main conclusions drawn from the research was that general policies are not very effective. For example, the study showed that a 20% VAT increase on all food products would reduce the carbon footprint by just 3% and the water footprint and food waste footprint by less than 1%.

“With this increase in prices, we would consume much less food and the environmental impact would, therefore, be reduced; though we have verified that this reduction would be very limited. However, the conclusions from the study show that differential policies, those that tax some foods and subsidize others, obtain better results. In some cases the carbon footprint was reduced by 18% and water use by 11%,” Gutiérrez explained.

Regarding the differential policies, the study by the University of the Basque Country (EHU) went one step further and identified the optimal combinations of taxes and subsidies for mitigating the environmental impact of food. “We did not decide on any specific combination, but instead made the information available to legislators so that they can design tax policies that are better adapted to their objectives,” stated Gutiérrez.

The researchers emphasized that it is particularly important to establish priorities and to decide which footprint they are most interested in mitigating, since the study has shown that there are no combinations of taxes and subsidies that can achieve a significant reduction in all three types of environmental impacts. In fact, they have verified that most of the formulas studied inevitably caused one of the footprints to increase.

However, Gutiérrez states that some combinations were found to mitigate the three environmental impacts: “For example, subsidizing legumes and oilseeds, cereals and seafood by 20% and taxing, by the same amount, meat, fruit and vegetables, eggs, dairy and other food categories would reduce the water footprint by 11%, the carbon footprint by 9% and the food waste footprint by 4%. All impacts were reduced, but if the priority of regulators is to reduce carbon emissions, this reduction may not be enough.”

The importance of large price increases and decreases

The research highlights that, for the fiscal policies to have a significant impact, the price increases and decreases must be large. Gutiérrez explains that this is because “the demand for food is what we economists call ‘inelastic.'” For example, if the price of cereals increases by 1%, their consumption drops by 0.53%. As this is not proportional, we would need to apply larger price increases or decreases to see a significant change. Which is why we made the estimations using taxes and subsidies of up to 20%.

Finally, the EHU’s study states that we need to consider the collateral effects of fiscal policies applied to food, such as potential social and nutritional consequences. “Given that, in some cases, in order to reduce the environmental footprint, taxes might be increased on foods that form the basic diet the most vulnerable populations. Or it could happen that, as a result of taxing fruit and vegetables with the aim of reducing water consumption, the consumption of these foods reduces but so too does the intake of essential vitamins,” said Gutiérrez. She added that in future work they plan to research the nutritional impacts.

Source: https://phys.org/news/2025-06-fiscal-policies-highly-effective-mitigating.html