In Oklahoma, financial literacy courses highlight the risks of gambling

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

In Oklahoma, financial literacy courses highlight the risks of gambling

Oklahoma has more than 140 casinos, making it second only to Nevada. It’s a rite of passage for kids to visit a casino when they turn 18. Students are required to learn about both the economic impact and the risks of gambling as part of their personal finance education. According to the Oklahoma Association on Problem Gambling and Gaming, more than one in 20 Oklahomans meet the criteria for gambling disorder. The odds of winning at a casino are 50-50, and the odds reset every time you flip a coin, teacher Carrie Hixon tells students in a lesson about gambling. The lesson resonates with 18-year-old Brayden Pierce, who says he got into gambling by playing video games when he was 12 or 13, and now he can’t even go gamble if he had the money to go do it.ers: How much do Americans spend on lottery tickets each year? The students’ estimates ranged from $100 billion to $10 million. It was actually over $113 billion in fiscal year 2024.

Case in point: The state of Oklahoma, where casinos are big business, and students are required to learn about both the economic impact and the risks of gambling as part of their personal finance education.

There are more than 140 casinos in the state, making it second only to Nevada, according to a count by the American Gaming Association. All of them are owned by Native American tribes, and they are a major employer in the state. It’s also part of the culture in Oklahoma, where it’s a rite of passage for kids to visit a casino when they turn 18.

I visited one — the Grand Casino in Shawnee, Oklahoma. When I entered, it felt a little like I was entering a video game. There’s chirping sounds and bright neon lights. I sat down at a game called Silver Dollar Shootout — and promptly lost a few dollars. (No public radio money was spent in the reporting of this story; it was all my own money.)

And no big surprise: these casinos are businesses, and they’re meant to make money. But Chad Mathews, the casino’s marketing director, said they only want that money from people who have it to spend. He said a casino isn’t the place for his 20-year-old son, for example.

“He’s out on his own, and I work at a casino, and I tell him all the time ‘you don’t make enough money to go to the casino,’” said Mathews. “‘You should never step foot in one, because you’re just not in a place where that makes any sense for you.’”

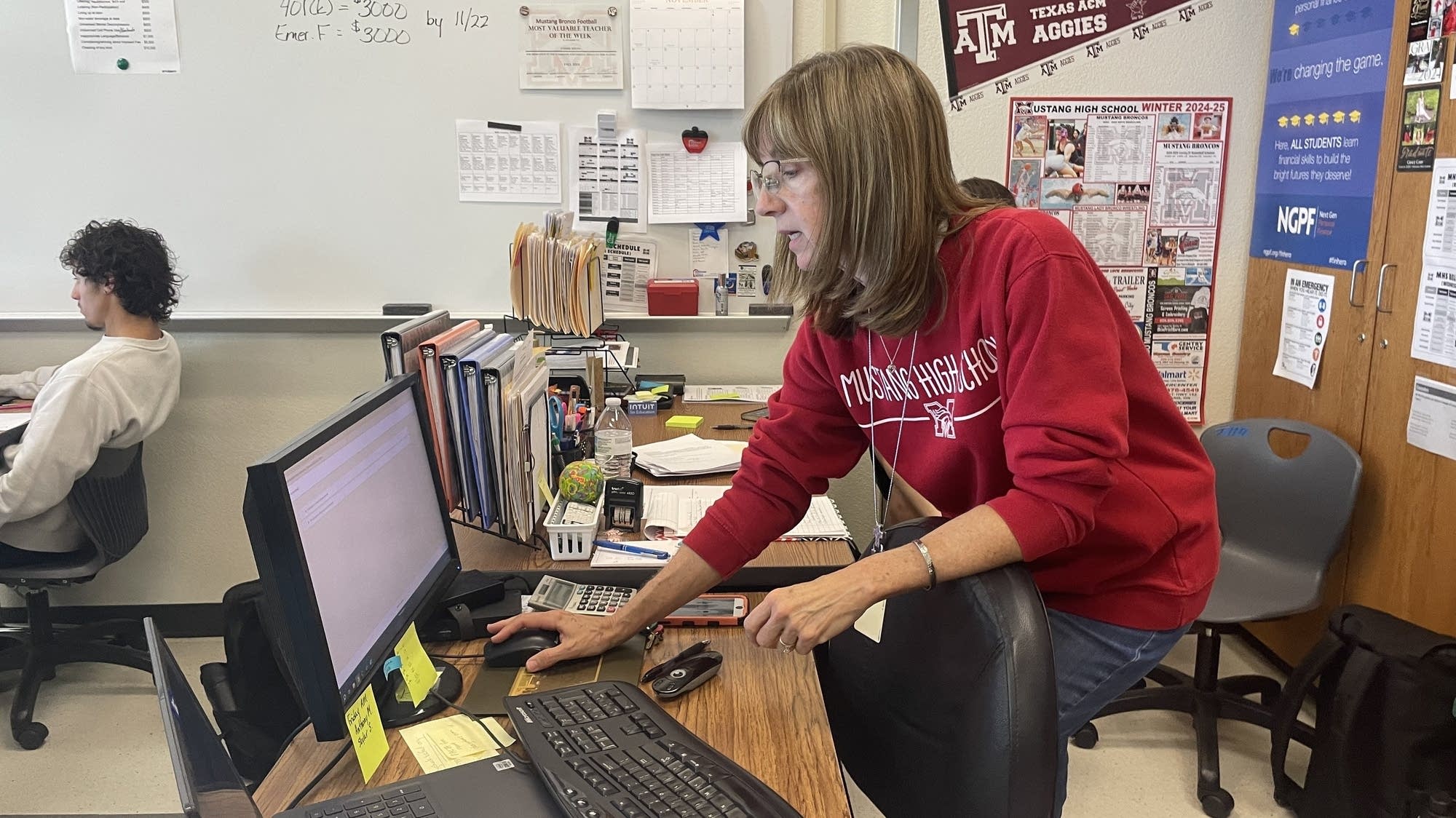

Practical advice is also part of what teacher Carrie Hixon provides her students when teaching about gambling. She teaches personal finance at Mustang High School, in a suburb of Oklahoma City. I visited a lesson earlier this school year, which started with a discussion about the lottery.

“So, your first question up there is: How much do Americans spend on lottery tickets each year?” asked Hixon. The students’ estimates ranged from $100 billion to $10 million.

It was actually over $113 billion in fiscal year 2024.

“We’re spending way more than we’re winning, aren’t we?” said Hixon.

To teach students that in games of chance, no outcome is guaranteed, Hixon passed out coins. “Should be a penny. Big money,” she laughed.

Dice and coins are some of the classroom tools for a personal finance lesson in Mustang, Oklahoma. Stephanie Hughes / Marketplace

Hixon had the students flip the coin as many times as they could in a minute. One student, Brayden Pierce, just kept flipping the same thing. He then thought the chances the next flip would be heads were higher.

“70% heads, 30% tails,” he guessed.

Actually, the chances it’ll be heads are 50-50. You’re not due for tails just because you’ve been flipping heads. Meanwhile, heads isn’t any more likely just because you’ve been getting it a bunch. The odds reset every time you flip.

“I just thought it would land on heads because that’s what it usually landed on, to be honest,” said Pierce.

Another lesson Hixon is trying to get across? Be aware that you can get addicted. According to the Oklahoma Association on Problem Gambling and Gaming, more than one in 20 Oklahomans meet the criteria for gambling disorder. That’s about double what it was less than a decade ago.

“Some of you might have family members that you’re like, ‘Yep, they’ve got a gambling problem,’” said Hixon.

This resonated with 18-year-old Brayden Pierce.

“I think gambling addictions are very real, because personally, I think I have one,” he said. “But I’m broke right now, so I can’t even go gamble. But if I had the money, I’d be at the casino tonight.”

Pierce said he got into gambling by playing video games. Starting when he was 12 or 13, he’d buy loot boxes. These are boxes of items players can purchase without knowing what they’ll get. So buying them is kind of a gamble. He also played a video game that had a casino in it.

Now Pierce can visit an actual casino, and he said there’s one thing that keeps him gambling.

“I think I win a lot. That’s the only reason why, honestly,” he said.

It’s not known if these classes actually keep students from developing gambling disorders. But Hixon said she’s trying to teach her students that if they gamble, do it responsibly.

“I don’t know how much impact it makes on whether they go to the casinos, but I do want them to be aware of — the odds are not in your favor,” she said.

As online betting has taken off, Oklahoma’s Council on Economic Education said they’re getting calls from other states saying ‘Hey, how are you teaching kids about the risks of gambling?’