Intel to report Q2 earnings as Wall Street looks for signs of turnaround

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Intel to report Q2 earnings as Wall Street looks for signs of turnaround

Intel is expected to report adjusted earnings per share (EPS) of $0.01 on revenue of $11.8 billion. Shares of Intel are off 29% over the last 12 months, though up 16% year to date. New CEO Lip-Bu Tan has already undertaken or is exploring a number of cost-cutting measures at Intel. There’s also little chance that the company will be able to compete in the AI chip space, which Nvidia continues to dominate with a market cap of more than $4 trillion. The company is shuttering its automotive business, outsourcing marketing jobs, and laying off factory workers.

Shares of Intel are off 29% over the last 12 months, though up 16% year to date. Intel’s market capitalization as of Monday was $101 billion. Rival AMD’s (AMD) market cap tops out at $257 billion. AI leader Nvidia (NVDA) dwarfs both companies with a market cap of more than $4 trillion.

For the quarter, Intel is expected to report adjusted earnings per share (EPS) of $0.01 on revenue of $11.8 billion, based on Bloomberg’s analyst consensus data. That’s down from adjusted EPS of $0.02 and $12.8 billion in revenue the company reported in the same period last year.

Read more: Live coverage of corporate earnings

Intel’s Products business, which includes sales of its laptop and desktop CPUs and data center and AI chips, is expected to generate $10.9 billion, down 8% year over year.

According to KeyBanc Capital Markets analyst John Vinh, Intel could benefit from a pull forward in PC and data center chip sales as customers seek to purchase devices ahead of any future tariffs on semiconductors.

Intel also has to contend with new competition from Qualcomm (QCOM), which is pushing further into the PC chip space with its Snapdragon X Plus and X Elite chips. There’s also little chance that the company will be able to compete in the AI chip space, which Nvidia continues to dominate.

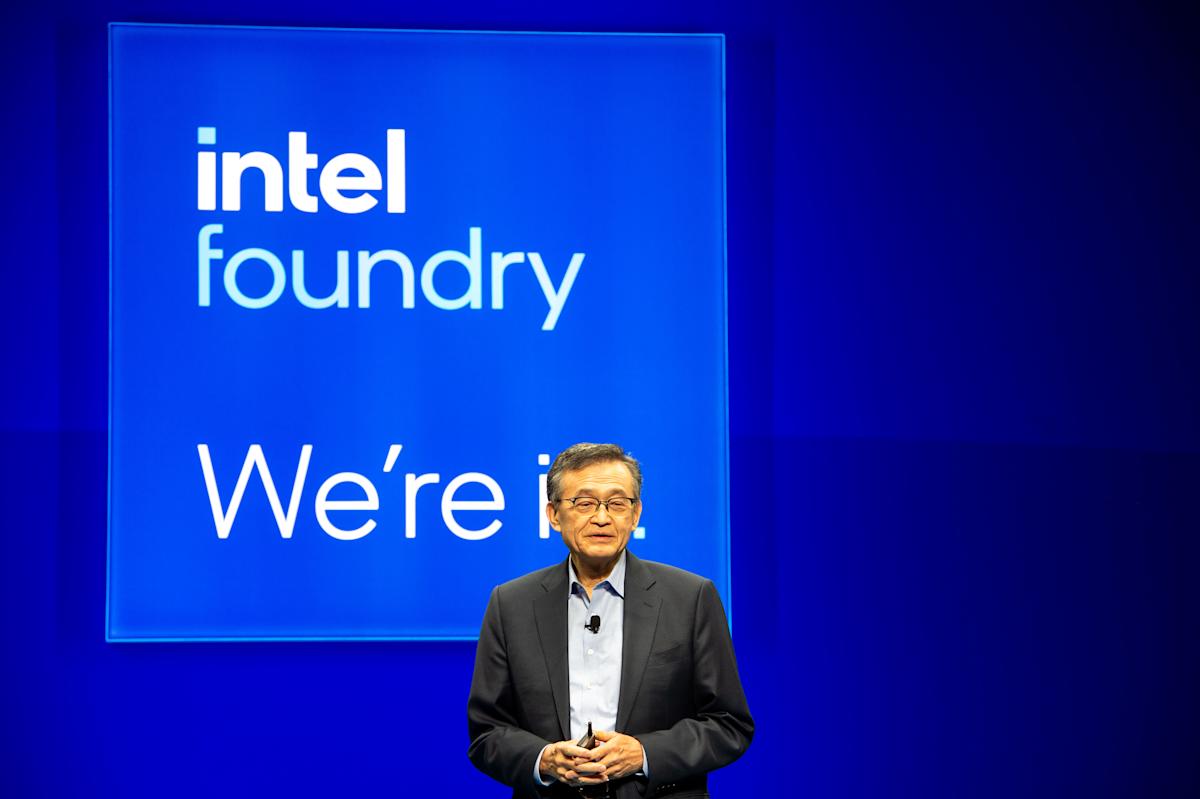

Intel’s still-nascent Foundry business is expected to pull in $4.3 billion, up 2%. But the division, which is meant to produce chips for third-party customers using Intel’s processor technology, is still struggling to make meaningful headway.

Intel previously announced it reached agreements to build chips for Microsoft and Amazon using its 18A technology, which former CEO Pat Gelsinger championed to help grow the company’s manufacturing segment.

The symbol for Intel appears on a screen at the Nasdaq MarketSite, in New York, Tuesday Oct. 1, 2019. (AP Photo/Richard Drew) · ASSOCIATED PRESS

But according to Reuters, Tan is considering promoting its next-generation 14A technology to customers. That could mean Intel would face a massive write-down on 18A.

However, Intel would still continue to use 18A for its own internal products, including CPUs for consumer and enterprise devices. And an Intel spokesperson said the company had no comment on the matter.

Tan has already undertaken or is exploring a number of cost-cutting measures at Intel. According to The Oregonian, the company is shuttering its automotive business, outsourcing marketing jobs, and laying off factory workers.

Given Intel’s broader issues, Bernstein analyst Stacy Rasgon questioned whether the company’s numbers will actually matter to investors.