Interested In Bitcoin Backed Lending: Maple Finance CEO

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Wall Street Giant Unlocks Bitcoin Liquidity in New Lending Push

Cantor Fitzgerald has quietly made its entry into the Bitcoin lending space. The Wall Street powerhouse has now issued BTC-backed loans to both FalconX and Maple Finance, marking its first live transactions in the sector. Cantor’s move underscores growing institutional interest in Bitcoin finance. With a legacy dating back to 1945 and a client base across 20 countries, the firm is bringing traditional infrastructure to the digital asset space. CEO Howard Lutnick, a vocal advocate for treating Bitcoin like gold, has also been a prominent figure in policy circles.

The Wall Street powerhouse has now issued BTC-backed loans to both FalconX and Maple Finance, marking its first live transactions in the sector.

FalconX confirmed it secured a lending facility worth over $100 million, while Maple Finance began drawing from a separate agreement. These deals allow firms to borrow against Bitcoin holdings without needing to sell, offering institutional players an alternative route to liquidity. The initiative is part of Cantor’s $2 billion crypto financing venture announced in mid-2024, with Anchorage Digital and Copper managing custody and collateral duties.

While traditional credit markets operate under clear regulations, crypto lending remains a more volatile frontier. This was evident during the sector’s 2022 meltdown, which saw major players like Celsius and BlockFi collapse under poor risk practices and exposure to failing exchanges like FTX.

Despite a 43% drop from its $64.4 billion peak in 2021, the crypto credit market still held $36.5 billion in outstanding loans by the end of 2024, according to Galaxy Research. Notably, onchain lending platforms have seen a significant rebound, with open borrow positions reaching $19.1 billion—up nearly tenfold since late 2022.

Cantor’s move underscores growing institutional interest in Bitcoin finance. With a legacy dating back to 1945 and a client base across 20 countries, the firm is bringing traditional infrastructure to the digital asset space. CEO Howard Lutnick, a vocal advocate for treating Bitcoin like gold, has also been a prominent figure in policy circles, recently joining Donald Trump’s transition team and managing a portion of Tether’s U.S. Treasury reserves following a 5% stake in the company.

Alexander Stefanov With over 8 years of experience in the cryptocurrency and blockchain industry, Alexander is a seasoned content creator and market analyst dedicated to making digital assets more accessible and understandable. He specializes in breaking down complex crypto trends, analyzing market movements, and producing insightful content aimed at educating both newcomers and seasoned investors. Alexander has built a reputation for delivering timely and accurate analysis, while keeping a close eye on regulatory developments, emerging technologies, and macroeconomic trends that shape the future of digital finance. His work is rooted in a passion for innovation and a firm belief that widespread education is key to accelerating global crypto adoption.

Cantor Fitzgerald Launches $2B Bitcoin Lending Facility, Funds FalconX and Maple

Cantor Fitzgerald starts $2B bitcoin-backed lending, funding FalconX and Maple Finance.Crypto lending market rebounds to $36.5B in Q4 2024 after 2022 industry downturns. With its credit facility, the bank plans to support firms that want to profit from their bitcoin holdings. This capital can be used for the company’s trade, operations, or other financial tasks. The firm aims to build a platform that supports bitcoin investors by broadening their access to diverse funding sources. The launch is occurring as there are increasing indications of a recovery in crypto-backed. lending after the disruptions caused by major corporate failures in 2022. The total market size will reach $35.5 billion in Q1 2024, up from a low in Q3 2023 but below the 2021 peak of $64.4 billion.

Crypto lending market rebounds to $36.5B in Q4 2024 after 2022 industry downturns.

Cantor Fitzgerald provides $2B credit facility to enhance liquidity for Bitcoin institutions.

Cantor Fitzgerald, an investment bank on Wall Street has launched a $2 billion bitcoin-based lending program to provide financial support to cryptocurrency firms. The bank made its first financing deals with digital asset prime brokerage FalconX Ltd. and crypto lender Maple Finance. These initial transactions demonstrate Cantor’s commitment to enhancing liquidity and funding options for institutions holding bitcoin.

FalconX confirmed it secured a bitcoin-backed credit facility as part of a broader financing framework with Cantor Fitzgerald, under which it plans to draw more than $100 million. Maple Finance has completed the first tranche of its credit arrangement with Cantor. This launch is occurring as there are increasing indications of a recovery in crypto-backed lending after the disruptions caused by major corporate failures in 2022.

We’re pleased to announce our partnership with Cantor, a premier global investment bank. Together, we’ve closed our first Bitcoin-backed financing facility – the first phase of a broader credit framework intended to scale beyond $100M.@JoshBarkhordar, Head of U.S. Sales at… pic.twitter.com/369P2Z9rHO — FalconX (@FalconXGlobal) May 27, 2025

Cantor’s Strategic Role in Crypto Financing and Market Recovery

In July 2024, Cantor Fitzgerald stated that it plans to establish a $2 billion lending program designed to give bitcoin holders leverage. The firm aims to build a platform that supports bitcoin investors by broadening their access to diverse funding sources. Christian Wall, Cantor’s co-CEO and global head of fixed income, emphasized the institution’s goal to assist bitcoin holders in managing liquidity and achieving long-term growth.

The initiative aligns with Cantor’s previous crypto ventures, including an April partnership with stablecoin issuer Tether Holdings and SoftBank Group to launch Twenty One Capital Inc., a bitcoin accumulation fund. The firm also manages U.S. Treasury assets backing Tether’s $142 billion USDT stablecoin.

The crypto lending market has shown signs of revival, with the total market size reaching $36.5 billion in Q4 2024, up from a low in Q3 2023 but still below the 2021 peak of $64.4 billion, according to Galaxy Research.

Source: Centralized crypto lenders (Galaxy)

In addition Blockstream Corp. and Xapo Bank have both secured substantial funding or launched bitcoin-related loan services in 2021.

Impact of Cantor’s Bitcoin Lending on the Institutional Crypto Market

Cantor’s entry into bitcoin-backed lending offers institutions new liquidity options amid increasing demand for crypto financing. With its credit facility, the bank plans to support firms that want to profit from their bitcoin holdings. This capital can be used for the company’s trade, operations, or other financial tasks.

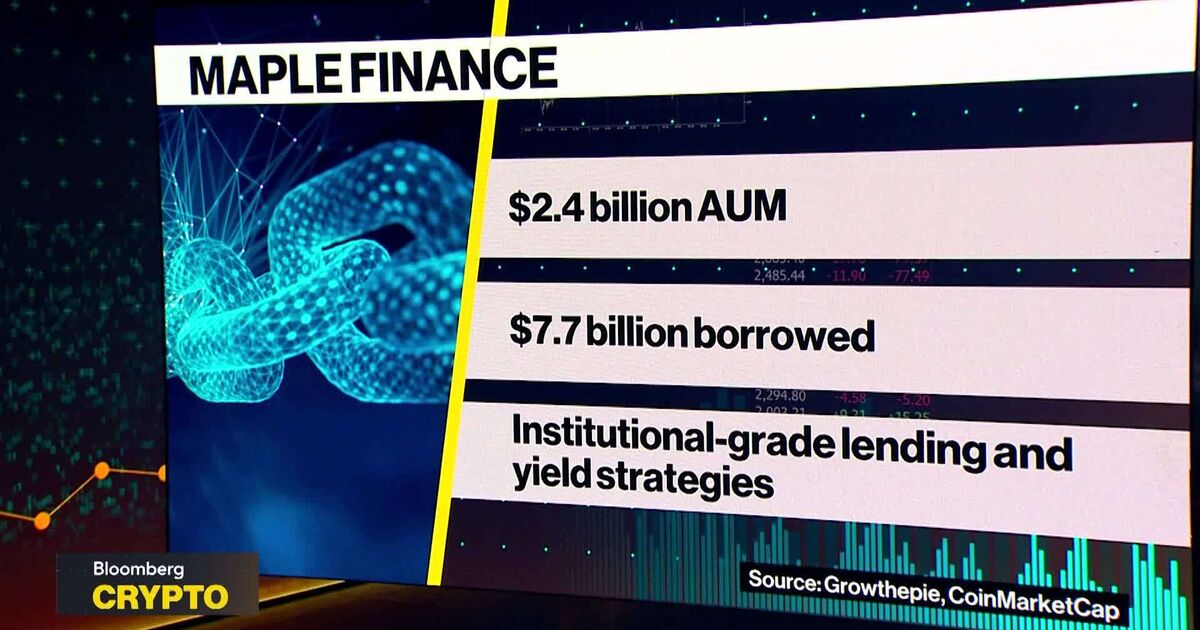

FalconX and Maple Finance, both significant players in crypto lending, stand to benefit from Cantor’s credit access. Maple has a lending platform worth over $1.8 billion, which differentiates it from FalconX, which offers prime brokerage services for digital assets. Cantor’s actions suggest that the financial industry is now more interested in cryptocurrencies. Howard Lutnick, a former CEO of Cantor and the current U.S. Secretary of Commerce, has advocated for the integration of bitcoin and traditional financial markets.

EulerSwap: Uniswap V4-Powered DEX Joins Crypto Lending Race with Cantor, Strike

Cantor Fitzgerald, Strike, Nexo are few of the names that have entered or expanded their crypto lending business in just a single month of 2025. EularSwap aims to lend against more diverse crypto assets and Stablecoins including Ripple’s (RUSD). EulerSwap is launched on Uniswap V4 consisting of lending vaults. According to its blog announcement, users can simultaneously swap tokens, earn lending yield, and collateralize positions for on-demand borrowing. The company is also making fierce Bitcoin purchases with the formation of its new treasury-focused vehicle, 21 Capital. Its launch was already mark by over 42,000 BTC on its balance sheet.

Cantor Fitzgerald has launched its Bitcoin‐backed lending arm. Strike has started offering Bitcoin-backed loans, allowing U.S. customers to borrow fiat with no credit check. Nexo has made a comeback in United States with its crypto‐lending business.

This race aligns with the market trend that is witnessing a rebound in crypto lending market with its volume reaching as high as at $36.5 billion – up 157% from the last year.

Now, in a latest instance to this, another crypto lending entity has made its foray into the sector. Announced on Thursday by Eular Finance, EularSwap has launched to offer the combination of lending and trading together.

It is noteworthy that while Cantor and Stripe are offering Bitcoin-backed loans, EularSwap aims to lend against more diverse crypto assets and Stablecoins including Ripple’s (RUSD).

EularSwap – New Player in the Crypto Lending Market

EulerSwap is launched on Uniswap V4 consisting of lending vaults. It implies that Euler plugs into existing DEX routing routes while extending functionality with lending-backed boosts.

According to the project, traditional AMMs grapple with fragmented liquidity and idle capital. To solve this, EulerSwap fuses an automated market maker with Euler’s modular lending vaults and Uniswap V4 hooks.

Liquidity providers will be depositing assets into Euler vaults. According to its blog announcement, interesting part is that users can simultaneously swap tokens, earn lending yield, and collateralize positions for on-demand borrowing.

1/ Introducing EulerSwap A smarter DEX with lending-boosted yield, deeper just-in-time liquidity, and native support for LP positions as collateral. Supercharged by Euler lending infra. pic.twitter.com/3yvHre6kUM — Euler Labs (@eulerfinance) May 28, 2025

Fierce Race in the Market

The sector has been witnessing an unprecedented scale of entries not only from new projects but also from leading financial institutions.

Strike’s Jack Mallers is trying to beat up the competition by offering Bitcoin-backed loans at “single digit interest rate.”

Cantor Fitzgerald under its $2 billion Bitcoin-backed financing arm has executed its first loans to FalconX and Maple Finance. It is calling Bitcoin as a means of bringing “scale, structure, and sophistication to the digital asset industry”.

The company is also making fierce Bitcoin purchases with the formation of its new treasury-focused vehicle, 21 Capital. Its launch was already mark by over 42,000 BTC on its balance sheet.

Thus, as the sector continues to witness claims and competitive offers, the entry of another new player is bound to make it witness more growth and significance.

Also Read: OpenSea’s New Platform

Disclaimer: The content may include the personal opinion of the author and is subject to market conditions. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Forward Guidance Podcast: DeFi Lending Will Eat Wall Street By 2030

Maple Finance CEO Sid Powell unpacks the rise, fall, and rebuild of crypto lending. He discusses navigating the 2022 crypto credit collapse, the trade-offs between fixed and variable lending, and how composability, transparency, and tokenized credit products are reshaping global finance. Sid also shares Maple’s shift toward overcollateralized lending, BTC-based yield products, and the future of structured on-chain credit. Ledger, the world leader in digital asset security for consumers and enterprises, proudly sponsors Forward Guidance. Buy a LEDGER™ device today and protect your assets with top-tier security technology.

__

Follow Sidney: https://x.com/syrupsid

Follow Felix: https://x.com/fejau_inc

Follow Forward Guidance: https://twitter.com/ForwardGuidance

Follow Blockworks: https://twitter.com/Blockworks_

Forward Guidance Telegram: https://t.me/+CAoZQpC-i6BjYTEx

Forward Guidance Newsletter: https://blockworks.co/newsletter/forwardguidance

__

Ledger, the world leader in digital asset security for consumers and enterprises, proudly sponsors Forward Guidance, where traditional finance meets crypto. As Ledger celebrates a decade of securing 20% of the world’s crypto assets, it offers a secure gateway for those entering digital finance. Buy a LEDGER™ device today and protect your assets with top-tier security technology. Buy now on https://Ledger.com.

—

Timestamps:

( 00:00 ) Introduction

( 00:52 ) Sid Powell’s Journey into Crypto

( 02:11 ) The Birth of Maple Finance

( 02:51 ) Challenges and Evolution in Crypto Lending

( 07:12 ) Ledger Ad

( 07:12 ) Challenges and Evolution in Crypto Lending

( 08:45 ) Navigating the 2022 Crypto Crisis

( 14:33 ) Current State of Crypto Lending

( 17:21 ) Biggest Crypto Innovations

( 18:32 ) Ledger Ad

( 19:32 ) Defi Integration and Secondary Markets

( 21:01 ) Creating Counterparty Transparency

( 22:52 ) Transparency and Financial Product Costs

( 24:40 ) Fixed Rate vs Variable Rate Lending in Crypto

( 28:21 ) Future of Crypto Lending and Institutional Interest

( 31:16 ) Structured Products and Treasury Companies

( 35:51 ) Navigating Crypto Market Cycles

( 38:25 ) Final Thoughts

__

Disclaimer: Nothing said on Forward Guidance is a recommendation to buy or sell securities or tokens. This podcast is for informational purposes only, and any views expressed by anyone on the show are opinions, not financial advice. Hosts and guests may hold positions in the companies, funds, or projects discussed.

#Macro #Investing #Markets #ForwardGuidance

Bitcoin advocate TFTC launches browser extension for real-time BTC pricing

Truth for the Commoner (TFTC), a media company that advocates for Bitcoin and sound money principles, launched the “Opportunity Cost’ browser extension on Wednesday. The extension allows users to view online prices in Bitcoin (BTC) or sats to weigh purchasing decisions. It is the latest in a series of tools, products, and services designed to spur Bitcoin adoption and normalize a Bitcoin standard where all prices and financial calculations are expressed in Bitcoin terms. The software is open-source and has no revenue model.

TFTC founder and contributor Marty Bent outlined three main goals of the extension, including promoting low time preference behavior — a reference to a willingness to defer present consumption to meet future needs — increasing Bitcoin adoption and providing a tool for business owners to calculate revenue denominated in BTC. Bent told Cointelegraph:

“The concept of opportunity cost has been completely corrupted in the late stage fiat era wrought with interest rate manipulation and money printing. The interest rate and pricing signals that humanity has depended on for millennia to make economic decisions are no longer reliable.

“Bitcoin reintroduces a proper hurdle rate that enables individuals to truly weigh the opportunity cost of their spending decisions,” the TFTC founder said. The software is open-source and has no revenue model. A hurdle rate is the lowest rate of return an investor will accept.

An example of the Opportunity Cost browser extension at work, displaying residential home prices in Bitcoin alongside the US dollar prices. Source: Opportunity Cost

The browser extension is the latest in a series of tools, products, and services designed to spur Bitcoin adoption and normalize a Bitcoin standard where all prices and financial calculations are expressed in Bitcoin terms.

Related: Maple Finance, FalconX secure Bitcoin-backed loans from Cantor Fitzgerald — Report

The world adopts the Bitcoin standard bit by bit

A growing list of companies and financial institutions are adopting a Bitcoin treasury strategy by converting all or a portion of their cash reserves to BTC as a long-term savings account that accrues value with time, rather than depreciating like traditional fiat cash reserves.

Companies such as Ledn, a BTC lending company, have created Bitcoin-backed loan products, giving BTC holders the option to use the asset as collateral to secure debt financing.

These loans allow individuals and businesses to finance real estate purchases, automobiles, operational expenses, capital investment, and even acquire more Bitcoin without selling any of the supply-capped asset, which might appreciate over time.

These financial services and functions are the necessary infrastructure to create a Bitcoin standard where all economic calculations, including opportunity costs, savings, and lending markets, are denominated in BTC.

Magazine: Financial nihilism in crypto is over — It’s time to dream big again