Jackson County property tax hike forces West Bottoms business owner to sell historic building

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Jackson County property tax hike forces West Bottoms business owner to sell historic building

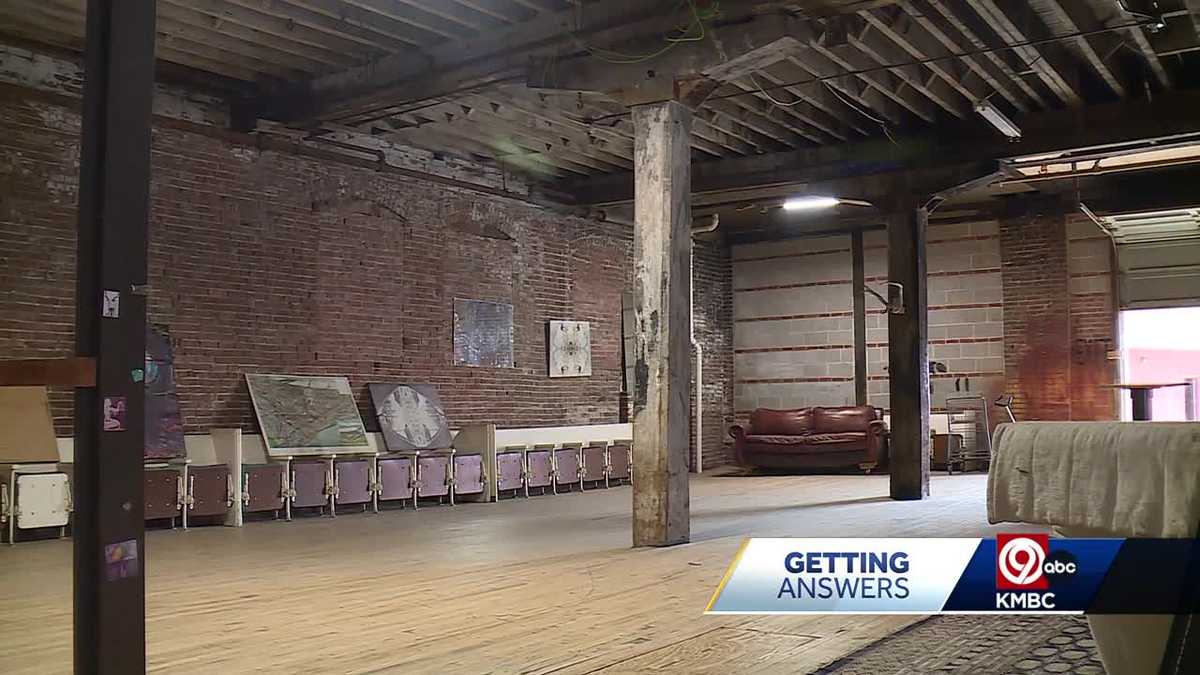

Jackson County recently assessed the property at nearly $2 million, resulting in an annual bill of roughly $17,000. Conrad McAnany, owner of the six-story, 36,000-square-foot building at 1428 Saint Louis Ave., said the tax increase has created too much financial stress and uncertainty for him to stay. The building, built in 1886 and formerly home to the Trumble, Allen and Reynolds Seed Company, will host one final event this July before it goes up for sale. “It’s a lot of physical stress not knowing in two years if they could do another 600%,” McAnan said. He said he personally renovated the floors and has spent years to restore the building, which has no electricity or water access yet. He says the Fourth of July views are a highlight from its basement to rooftop, where he says the building is worth about $1 million. He cited a lack of transparency, lack of inspection, and limited TRANSPARENCY.

Advertisement Jackson County property tax hike forces West Bottoms business owner to sell historic building Editorial Standards ⓘ

A West Bottoms business owner is closing up shop after a steep rise in Jackson County property taxes, saying he can no longer afford to hold onto his historic building.Conrad McAnany, owner of the six-story, 36,000-square-foot building at 1428 Saint Louis Ave., said the tax increase has created too much financial stress and uncertainty for him to stay.“It’s a lot of physical stress not knowing in two years if they could do another 600%,” McAnany said.The building, built in 1886 and formerly home to the Trumble, Allen and Reynolds Seed Company, will host one final event this July before it goes up for sale.“I feel like I’ve been fighting upstream for a long time,” McAnany said. “People still want this kind of stuff.”He said he personally renovated the floors and has spent years working to restore the building, which has no electricity or water access yet. He even walks visitors through the site’s history, from its basement to rooftop, where he says the Fourth of July views are a highlight.Jackson County recently assessed the property at nearly $2 million, resulting in an annual tax bill increase of roughly $17,000.“It might not be a popular statement amongst other building owners, but I think these properties are worth what the county has assessed them at,” he said.Still, McAnany is frustrated with the process.“They send you back and forth from office to office to office. They ping pong you,” he said.He cited a lack of inspection, limited transparency and a short payment window as reasons he’s choosing to leave.Despite the challenges, McAnany said he wants to stay focused on his family’s future.“I don’t want to sit here and complain about how they spend their money,” he said. “I’d rather focus on what I can do right, and that’s build a sustainable future for my family.”He worries redevelopment by outside investors may erase the neighborhood’s history, and that longtime local property owners are being left behind when it comes to tax breaks or economic incentives.“I think we should emphasize sustainability and think about the future,” he said.

Source: https://www.kmbc.com/article/jackson-county-property-tax-business-owner-west-bottoms-sale/65095113