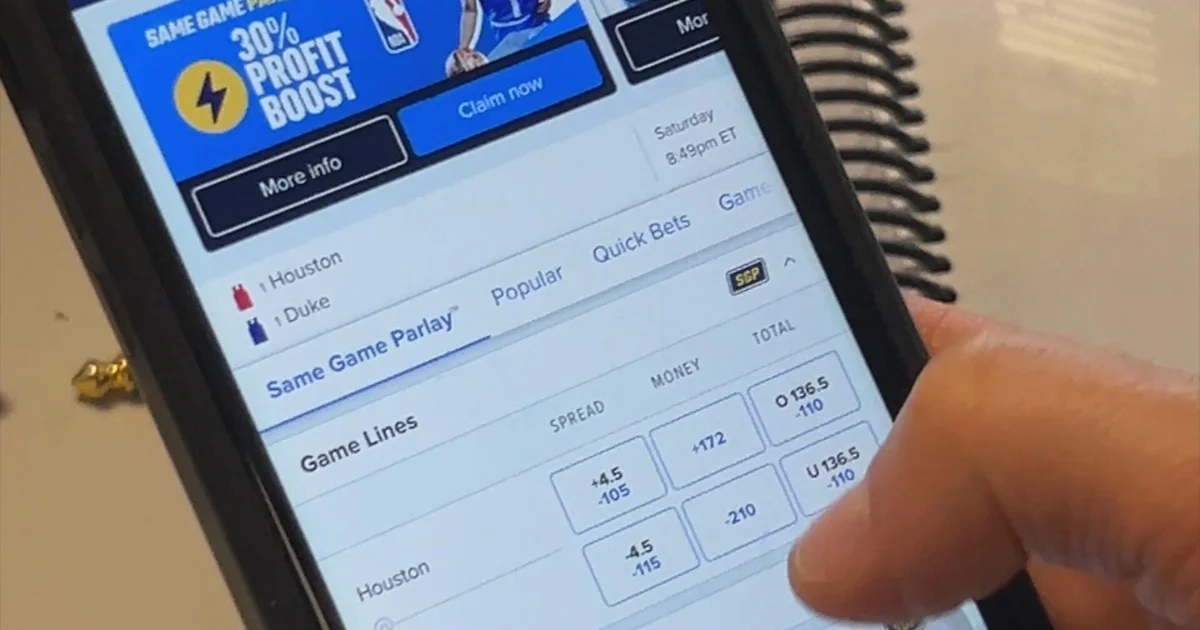

Maryland sports wagering revenue jumps 47% as tax rate increases

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Maryland sports wagering revenue jumps 47% as tax rate increases

Maryland Lottery and Gaming says sports wagering brought in $9.2 million in June. The mobile and retail sports betting market grew 47.4% year-over-year. Mobile operators’ contribution increased from 15% to 20% of taxable proceeds under legislation passed during the 2025 General Assembly session. Gov. Wes Moore is working to close a $3.3 billion deficit.

$9.1 million was collected from mobile operators, and $140,405 from retail facilities in June.

FY2025 marks the second full fiscal year that both mobile and retail sports wagering have been available in the state.

The mobile and retail sports wagering market grew 47.4% year-over-year, per the report.

In June, sports bettors wagered $403,841,872 and won back $346,732,134 in prizes.

Increased tax on sports wagering

The growth comes as mobile sports wagering operators now pay a higher tax rate to the state. Beginning June 1, mobile operators’ contribution increased from 15% to 20% of taxable proceeds under legislation passed during the 2025 General Assembly session.

For June, the entire 20% contribution from mobile operators went to the Blueprint fund. Starting in July, mobile operators will pay 15% to the Blueprint fund and 5% to the state’s General Fund.

Retail sports wagering facilities continue to contribute 15% of their taxable proceeds to the Blueprint fund.

Maryland’s share of sports wagering proceeds is directed to the Blueprint for Maryland’s Future Fund, which supports public education programs.

Maryland launched its sports wagering program in December 2021. Since then, the program has contributed $177.4 million to the Blueprint for Maryland’s Future Fund.

Maryland faces budget deficit

Maryland is facing a $3.3 billion deficit, which Gov. Wes Moore is working to close.

That effort began by passing a state budget that has tax increases and cutting state spending.

Moore last week announced a hiring freeze on state jobs, voluntary employee buyouts, and the elimination of vacant positions.

Source: https://www.cbsnews.com/baltimore/news/maryland-sports-wagering-revenue-tax-rate/