Stock market today: Dow, S&P 500, Nasdaq rise as Fed takes front seat from Mideast fears

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Stock market today: Dow, S&P 500, Nasdaq steady as Fed holds rates steady, forecasts 2 cuts in 2025

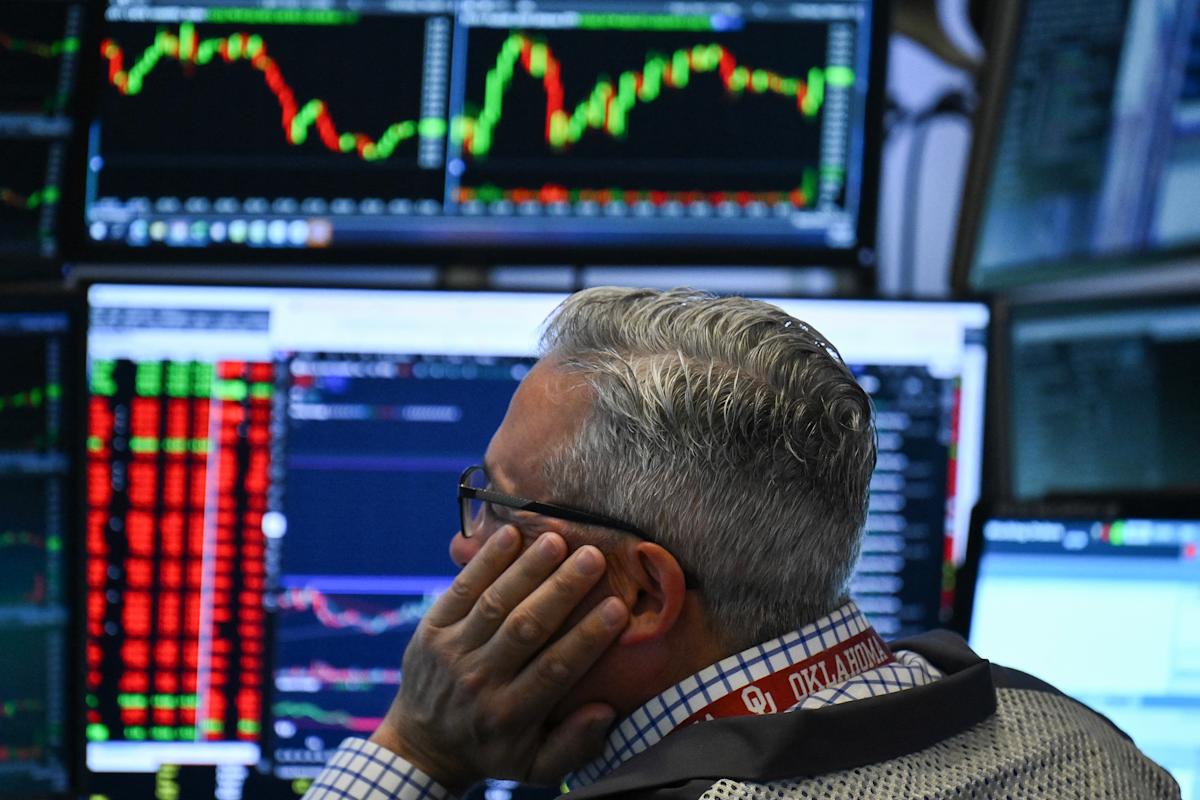

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0. 3%. The Nasdaq Composite (^IXIC) rose about 0.4%.Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week.

The central bank also released its latest Summary of Economic Projections (SEP), including its “dot plot,” which maps out policymakers’ expectations for where interest rates could be headed in the future. The median official’s forecast for the federal funds rate at the end of 2025 was 3.9%, which would likely represent two 25-basis-point cuts this year.

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0.3%. The Nasdaq Composite (^IXIC) rose about 0.4%.

Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week. President Trump demurred Wednesday when asked if he’s moving closer to bombing Iran. “I may do it. I may not do it. I mean, nobody knows what I’m going to do,” he said.

Iran has warned it will respond firmly if the US crosses a red line into involvement and has reportedly readied missiles for strikes on US bases in the region if it does.

Oil prices moved over 1% higher, reversing course after the morning’s decline. Brent futures (BZ=F), the international benchmark, were roughly flat at $76 a barrel while West Texas Intermediate (CL=F) crude traded just below $75.

Read more: The latest on Trump’s tariffs

Meanwhile, weekly jobless claims remained near their highest level in eight months.

LIVE

20 updates

Stock market today: Dow, S&P 500, Nasdaq steady as Fed holds rates steady, forecasts 2 cuts in 2025

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0. 3%. The Nasdaq Composite (^IXIC) rose about 0.4%.Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week.

The central bank also released its latest Summary of Economic Projections (SEP), including its “dot plot,” which maps out policymakers’ expectations for where interest rates could be headed in the future. The median official’s forecast for the federal funds rate at the end of 2025 was 3.9%, which would likely represent two 25-basis-point cuts this year.

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0.3%. The Nasdaq Composite (^IXIC) rose about 0.4%.

Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week. President Trump demurred Wednesday when asked if he’s moving closer to bombing Iran. “I may do it. I may not do it. I mean, nobody knows what I’m going to do,” he said.

Iran has warned it will respond firmly if the US crosses a red line into involvement and has reportedly readied missiles for strikes on US bases in the region if it does.

Oil prices moved over 1% higher, reversing course after the morning’s decline. Brent futures (BZ=F), the international benchmark, were roughly flat at $76 a barrel while West Texas Intermediate (CL=F) crude traded just below $75.

Read more: The latest on Trump’s tariffs

Meanwhile, weekly jobless claims remained near their highest level in eight months.

LIVE

20 updates

Stock market today: Dow, S&P 500, Nasdaq steady as Fed holds rates steady, forecasts 2 cuts in 2025

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0. 3%. The Nasdaq Composite (^IXIC) rose about 0.4%.Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week.

The central bank also released its latest Summary of Economic Projections (SEP), including its “dot plot,” which maps out policymakers’ expectations for where interest rates could be headed in the future. The median official’s forecast for the federal funds rate at the end of 2025 was 3.9%, which would likely represent two 25-basis-point cuts this year.

The Dow Jones Industrial Average (^DJI) rose 0.3%, and the S&P 500 (^GSPC) also gained 0.3%. The Nasdaq Composite (^IXIC) rose about 0.4%.

Markets are also on alert for any sign that the US has joined the Middle East conflict, which has swung stocks around since it broke out last week. President Trump demurred Wednesday when asked if he’s moving closer to bombing Iran. “I may do it. I may not do it. I mean, nobody knows what I’m going to do,” he said.

Iran has warned it will respond firmly if the US crosses a red line into involvement and has reportedly readied missiles for strikes on US bases in the region if it does.

Oil prices moved over 1% higher, reversing course after the morning’s decline. Brent futures (BZ=F), the international benchmark, were roughly flat at $76 a barrel while West Texas Intermediate (CL=F) crude traded just below $75.

Read more: The latest on Trump’s tariffs

Meanwhile, weekly jobless claims remained near their highest level in eight months.

LIVE

20 updates