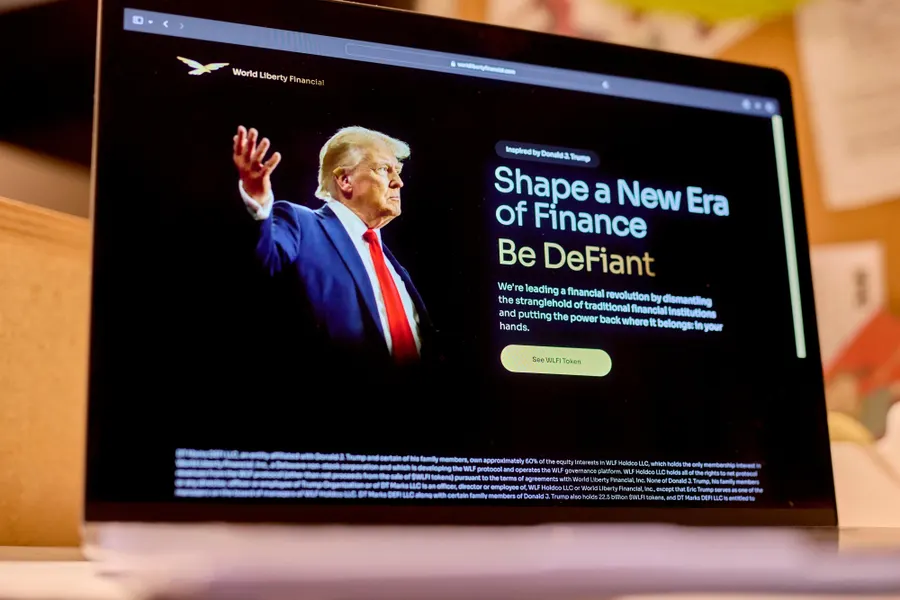

Trump’s Crypto Firm Raised $52 Million—Likely Sending Millions To His Family, New Disclosure Reveals

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Trump’s World Liberty Financial Crypto Venture Raised $50 Million—Likely Sending Millions To His Family, SEC Filing Shows

Trump and his family control about 40% of World Liberty Financial, a decentralized finance platform. If distributed according to current ownership stakes, the July payout could have netted the Trump family around $20 million. Trump can earn income from his businesses while in office through the Donald J. Trump Revocable Trust, the same vehicle he used during his first term. The Trump Organization confirmed in an April regulatory filing in the United Kingdom that Trump retains control over his businesses. The Trumps’ ownership stake in the company was around 75% at the end of December, dropped to roughly 60% by late January and appeared at 40% as of June 8, though it’s unclear exactly when it took that level on the site. The company initially allocated 22.5 billion of its 100 billion $WLFI tokens to Trump and family members. Another 35 billion were offered for sale, while the rest were split among other founders, employees and a reserve for community incentives. It did not reveal how much they paid or who they were.

Key Facts

Trump and his family control about 40% of World Liberty Financial, a decentralized finance platform launched in September 2024 that is building a blockchain-based protocol. On Oct. 15, 2024, World Liberty Financial began selling $WLFI, a crypto token that doesn’t convey ownership in the privately held company but gives holders voting rights on certain matters concerning the protocol, and at launch the tokens were nontransferable. An SEC filing made at the end of that month revealed World Liberty Financial sold $2.7 million worth of tokens to 348 accredited investors, with plans to sell no more than $30 million overall—keeping all proceeds inside the company with none flowing to Trump or other founders. But World Liberty Financial disclosed in an SEC filing last week (first flagged by independent journalist Wendy Siegelman) that it sold another $52.1 million of tokens to 1,966 investors—this time distributing $50.7 million to Trump and other founders, rather than retaining all proceeds within the company as in its initial sale. If distributed according to current ownership stakes, the July payout could have netted the Trump family around $20 million—though the filings don’t break out individual distributions, and Alan Palmiter, a professor at Wake Forest University who specializes in securities regulation, told Forbes he’s not aware of any requirement that payments be proportionate to equity stake. World Liberty Financial declined to comment, and the Trump Organization did not respond to an inquiry.

What We Don’t Know

While World Liberty Financial acknowledged in its latest SEC filing that it sold tokens ”to non-US persons” in a separate sale, it did not reveal how much they paid or who they were, saying such details weren’t required under U.S. securities laws.

What To Watch For

On Wednesday, World Liberty Financial asked tokenholders to approve a plan that would let some tokens become transferable, with voting scheduled to close on July 16. Under the proposal, tokens held by founders, team members and advisors—including Trump—would stay locked at first and “be subject to a longer unlock schedule than early supporters.’

Contra

White House Deputy Press Secretary Anna Kelly responded to questions about the deal by saying, “President Trump is dedicated to making America the crypto capital of the world and revolutionizing our digital financial technology,” adding, “his assets are in a trust managed by his children, and there are no conflicts of interest.” An ethics white paper the Trump Organization released in January noted the Constitution does not bar a president from owning, operating or managing a private business. But to “avoid even the appearance of any conflict,” the company said it hired an outside ethics adviser and Trump would keep his assets in a trust and not manage the company directly. The Trump Organization, however, later fired that adviser at Trump’s instruction.

Key Background

Trump can earn income from his businesses while in office through the Donald J. Trump Revocable Trust, the same vehicle he used during his first term. He is its sole donor and beneficiary, while Donald Trump Jr. serves as the trustee. The Trump Organization confirmed in an April regulatory filing in the United Kingdom that Trump retains control over his businesses. As president, he has pledged to make the United States the “crypto capital of the world,” aligning with his expanding investments in digital assets. World Liberty Financial initially allocated 22.5 billion of its 100 billion $WLFI tokens to Trump and family members. Another 35 billion were offered for sale, while the rest were split among other founders, employees and a reserve for community incentives. The Trumps’ ownership stake in the company was around 75% at the end of December, dropped to roughly 60% by late January and still appeared at that level on World Liberty Financial’s website as of June 8, before being updated to about 40%—though it’s unclear exactly when or why the reductions took place. World Liberty Financial’s other main product is the USD1 stablecoin, a crypto currency pegged to the U.S. dollar and backed by Treasuries and cash equivalents.

Big Number

$57.4 million: Trump’s income from World Liberty Financial, according to a financial disclosure released in June, which appears to cover roughly a 12-month period ending in December 2024.

Surprising Fact

World Liberty Financial’s investor count surged from 348 last fall to nearly 2,000 by mid-2025—an unusually large pool for a private placement that Marcus Walter, a partner at the law firm Caldwell, told Forbes looks “more akin to a mini-IPO,” potentially raising compliance hurdles.

News Peg

In June, the Senate passed the Genius Act, a crypto industry-backed bill that would create new rules for stablecoins like World Liberty Financial’s USD1. The House could vote on it as early as next week, reported Punchbowl News. Meanwhile, in response to Trump’s crypto ventures, Sen. Jeff Merkley, D-Ore., introduced the End Crypto Corruption Act in May, aiming to ban presidents and other top officials from “issuing, endorsing or sponsoring crypto assets.” The bill is pending with 25 co-sponsors (all Democrats plus Independent Bernie Sanders). Last week, Republicans blocked Merkley’s attempt to pass a similar measure as an amendment to another bill.

Chief Critic

“Currently, people who wish to cultivate influence with the president can enrich him personally by buying cryptocurrency he owns or controls,” Merkley said in a statement announcing his bill. “This is a profoundly corrupt scheme. It endangers our national security and erodes public trust in government.”

Tangent

World Liberty Financial co-founder emeritus Steven Witkoff—who serves as Trump’s Special Envoy to the Middle East—is also listed in the SEC filing as a recipient of proceeds from the token sale.

Forbes Valuation

Forbes estimates Donald Trump is worth about $5.2 billion, with crypto making up the bulk of his wealth.

Further Viewing

Further Reading

President Trump’s Crypto Firm Expands Relationship With Embattled Blockchain Billionaire (Forbes)

SEC Drops Binance Lawsuit Days After Crypto Exchange Lists Trump’s Stablecoin (Forbes)

Trump’s New Partner For Crypto Venture Is KuCoin — An Exchange Banned In U.S., Fined $300 Million For Money Laundering (Forbes)

Crypto Now Accounts For Most Of Donald Trump’s Net Worth (Forbes)