Vermont health insurers reduce requests for 2026 premium increases

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

Vermont health insurers reduce requests for 2026 premium increases

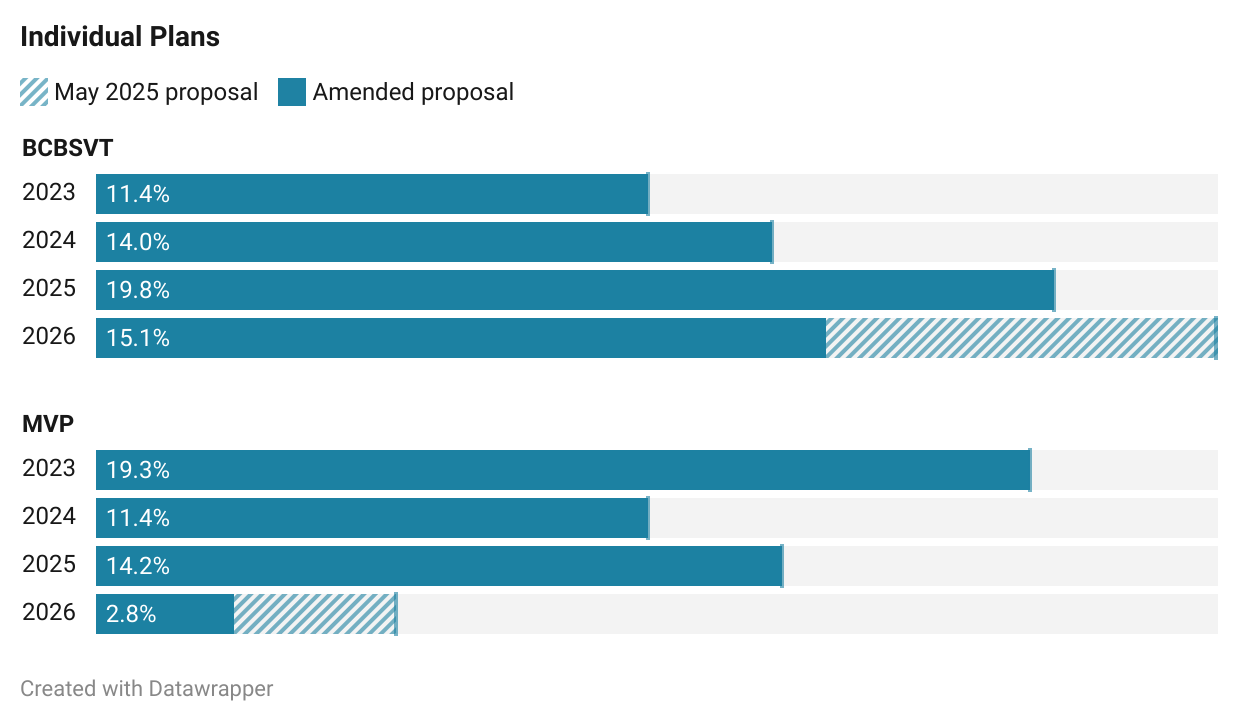

Vermont’s two health insurers have lowered the percentage increases they are seeking for plans sold in 2026. Blue Cross Blue Shield of Vermont lowered its initial request from an average premium rate increase of 23.5% for individual plans down to 15.1%. MVP, which sells the large majority of its plans in New York state where the company is based, asked for a lower increase in May and revised the request even lower.Double-digit premium rate hikes every year are not sustainable for Vermonters, an attorney says. The widening divide between the cost of the plans from the marketplace’s two insurers is concerning, he says.. The expanded tax credits for medium-income households put in place during the Covid-19 pandemic, called Enhanced Premium Tax Credit, are set to expire at the end of 2025 if Congress does not extend them. The increase in MVP rates has a “clear and positive impact,” Vermont’s Chief Health Care Advocate Mike Fisher said during the MVP rate hearing.

The state’s health care regulator, the Green Mountain Care Board, reviews the pricing for plans qualified to be sold the following year on Vermont Health Connect, the state’s Affordable Care Act marketplace. The board held hearings on the 2026 rate proposals this week for Blue Cross Blue Shield of Vermont and MVP, the only two insurers that sell health insurance plans there.

Vermonters without access to an affordable health plan through an employer can purchase plans on the individual market for themselves and their families. Businesses with 100 employers or less can buy small group plans. These plans provide health coverage for fewer than 70,000 Vermonters, according to insurer filings with the Green Mountain Care Board. But the trends that lead to price increases for those health insurance plans affect other commercially available plans as well.

Blue Cross Blue Shield of Vermont lowered its initial request from an average premium rate increase of 23.5% for individual plans down to 15.1%. It amended the requested average premium rate increase for small group plans from 13.5% down to 7.4%.

Facing financial headwinds, Blue Cross has been on the brink of insolvency after a yearslong surge in the cost of insurance claims, ending 2024 with a record deficit of $62 million.

Double-digit premium rate hikes every year are not sustainable for Vermonters, said Charles Becker, a staff attorney at the Office of the Health Care Advocate, which represents consumers at the rate hearings. That’s especially true when the hikes are “not even enough to keep Vermont’s sole home state insurer solvent given the extraordinarily high cost of care.”

MVP, which sells the large majority of its plans in New York state where the company is based and only 8% of its plans in Vermont, asked for a lower increase in May and revised the request even lower. The company is now requesting an average premium increase of 2.98% for small group plans, down from 7.5%, and of 2.84% for individual plans, down from 6.24%.

MVP’s financial problems have not fully resolved, but the company trimmed administrative costs and is projected to be in the black for 2025 after years of losses for individual plans in Vermont, while still seeing losses from their small group plans, said the carrier’s top actuary Eric Bachner at the rate review hearing.

The reduction in rates for MVP has a “clear and positive impact,” Vermont’s Chief Health Care Advocate Mike Fisher said during the MVP rate hearing. However, the widening divide between the cost of the plans from the marketplace’s two insurers is concerning.

“A large and growing price variation between the two carriers has a substantial and real negative impact on many Vermonters,” Fisher said at the MVP hearing.

That’s because federal tax credits that subsidize the purchase of individual health insurance plans on the marketplace, to an amount depending on household income, are set based on lower cost plans, Fisher explained in an interview. If the benchmark for the credits is based on the roughly 3% increase of MVP plans, people on Blue Cross’ plans will likely face higher premium costs due to the disparity in rate increases.

Meanwhile, expanded tax credits for medium-income households put in place during the Covid-19 pandemic, called Enhanced Premium Tax Credit, are set to expire at the end of 2025 if Congress does not extend them.

The enhanced subsidy “provided for a really substantial improvement of premium affordability for Vermonters,” Fisher said. He said he is worried about the return of a sharp end to all subsidies above 400% of the federal poverty line — roughly an income of $62,000 for a one-person household — once enhanced tax credits disappear. That may lead some Vermonters just over that line to forgo insurance altogether, he said.

Enhanced subsidies also helped those below the line significantly, making it possible for them to obtain a health plan on the individual market at very low cost.

Alongside the phase-out of the Enhanced Premium Tax Credit, Vermont officials project 45,000 Vermonters will lose access to health insurance — both Medicaid and marketplace plans — under new regulatory requirements included in President Donald Trump’s recently signed “One Big Beautiful” tax bill.

During a public comment period, Grace Powers, 27, said she opted into a Blue Cross insurance plan because the enhanced federal tax credits made it affordable. As a result, Powers said she was able to get surgery necessary to improve her quality of life.

With the expected sunsetting of the federal enhanced subsidies and the requested rate increases for both Blue Cross and MVP, Powers said she will no longer be able to afford any health insurance plan in Vermont. Her only access to health care will be the emergency room if her “health deteriorates enough to be treated there.”

“Without insurance, I won’t be able to access primary and preventive care,” Powers said. “I’m urging you to reject these increases because it will make accessing any health care unaffordable for myself, my loved ones and my community.”

‘Bankable savings’

The curtailment of Vermont insurers’ proposed premium rate increases follow a handful of health care bills Gov. Phil Scott signed into law in June.

Act 55 curbs the amount Vermont’s larger hospitals can charge for outpatient prescription drugs, particularly injection or IV-administered drugs for the treatment of cancers or autoimmune diseases. Act 68 sets forth a long-term plan to transform the health care system, including the implementation of reference-base pricing for health care providers. Act 49 designates emergency authority to the Green Mountain Care Board to set hospital prices in case of insurer insolvency.

Blue Cross Blue Shield of Vermont is able to trim its premium increase request because the Act 55 cap on some prescription drugs will result in a “measurable, bankable set of savings” in 2026, Michael Donofrio, a lawyer for the insurer, said during the hearing.

Another Blue Cross attorney, Bridget Asay, warned that if the Green Mountain Care Board rejects the rates the company is requesting, it “will not reduce the cost of health care.”

“What it will do is threaten the company’s solvency and ability to serve Vermonters,” she said.

Part of why Blue Cross needs a larger increase than MVP is the insurer’s need to replenish the reserves it uses to pay claims, said the insurer’s Chief Financial Officer Ruth Greene. The company expects to place 7% of premium earnings back into those reserves, she said, calling it a “critical component” of the insurer’s financial recovery plan.

MVP estimated that just 2% of its premiums would need to be allocated to reserves in 2026 to maintain them.

But for Blue Cross, savings are “dangerously low,” Greene said, noting the insurer took out a $30 million loan at the end of last year from its parent affiliate Blue Cross Blue Shield of Michigan.

Becker, the consumers’ attorney, said that a large percentage contribution to insurer reserves was “once unthinkable.”

Vermonters should not be “forced to hand over 7% in premiums each year for who knows how many more years in order to rebuild Blue Cross’ depleted reserves and to pay back Michigan,” he said.

Vermonters ‘need serious relief’

A Vermonter named Melissa from Westfield said in a written comment that her family is insured through a small business plan, and pays over $1,500 a month with a $14,000 deductible.

When asked by Becker how Melissa’s situation made him feel, Andrew Garland, a Blue Cross vice president, said it was “very upsetting.”

“That’s not what we want for our customers. The cost of care is too high,” Garland said. “We have to find a way to break that cycle and bring it down. It is not affordable.”

In the Blue Cross hearing, Green Mountain Care Board Chair Owen Foster said the state’s health care leaders came together in May for emergency talks about how to address health care affordability concerns, but produced “$0.00 of savings.”

“We have to be accountable to results right now, not just effort,” Foster said. “It’s just not okay to say to Vermonters, ‘We couldn’t come up with anything amongst all these health care leaders. Nothing we could do,’ is not an acceptable answer to Vermont right now.”

The Green Mountain Care Board asked for additional data and analysis from the two insurers as members evaluate the proposed insurance rate increases in the coming weeks.

The requested hikes for small group and individual plans come after the Green Mountain Care Board approved double digit increases to the baseline for insurance premiums for large employers last month.

Former Blue Cross lobbyist Sara Teachout was appointed to the Green Mountain Care Board by Gov. Scott earlier in July, and is set to start her role July 28. Teachout will not be participating in the 2026 Qualified Health Plan rate review as the companies’ filing were submitted in May and the process started internally in the fall of last year, according to the Board’s Communication and Information Officer Kristen LaJeunesse.

At the close of the Blue Cross hearing, Foster said the board will seek to balance the risks the insurer will face without the proposed premium increases with the interests of Vermonters who “need serious relief.”

Source: https://vtdigger.org/2025/07/25/vermont-health-insurers-reduce-requests-for-2026-premium-increases/