Xi to Meet EU Chiefs at Downsized Summit Hit by Trade, Ukraine

How did your country report this? Share your view in the comments.

Diverging Reports Breakdown

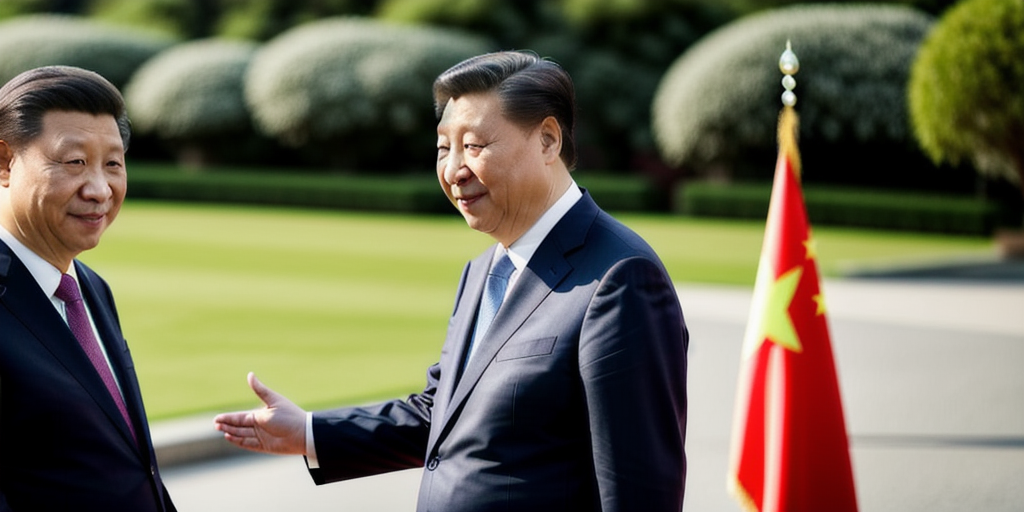

Xi to meet EU chiefs at downsized summit hit by trade and Ukraine

Top representatives from the European Union will meet with Chinese President Xi Jinping and other key leaders. The meeting has been cut short from two days to one at Beijing’s request, with the venue changed from Brussels to the Chinese capital.

Tensions spanning trade to the war in Ukraine are casting a pall over an event that coincides with the 50th anniversary of the establishment of China-EU diplomatic ties. The meeting has been cut short from two days to one at Beijing’s request, it has been reported, with the venue changed from Brussels to the Chinese capital after Xi refused to travel to Europe for the talks.

The Chinese leader as well as Premier Li Qiang will meet throughout the day with European Commission President Ursula von der Leyen and the head of the European Council, Antonio Costa, according to an EU official. The meeting follows the EU’s summit with Japan held in Tokyo on Wednesday.

Xi to Meet EU Chiefs at Downsized Summit Hit by Trade, Ukraine

Top representatives from the European Union will meet with Chinese President Xi Jinping and other key leaders Thursday. It’s their first in-person summit since 2023 that’s exposing a divide between the bloc and Beijing just months after earlier signs of a possible detente. The meeting has been cut short from two days to one at Beijing’s request, with the venue changed from Brussels to the Chinese capital after Xi refused to travel to Europe for the talks. The Chinese leader as well as Premier Li Qiang will meet throughout the day with European Commission President Ursula von der Leyen and the head of the European Council.

Advertisement

Tensions spanning trade to the war in Ukraine are casting a pall over an event that coincides with the 50th anniversary of the establishment of China-EU diplomatic ties. The meeting has been cut short from two days to one at Beijing’s request, Bloomberg News has reported, with the venue changed from Brussels to the Chinese capital after Xi refused to travel to Europe for the talks.

The Chinese leader as well as Premier Li Qiang will meet throughout the day with European Commission President Ursula von der Leyen and the head of the European Council, Antonio Costa, according to an EU official. The meeting follows the EU’s summit with Japan held in Tokyo Wednesday.

While there are no plans to issue a joint communique, the EU intends to release a statement listing the main messages it delivered, according to people familiar with the matter, who spoke on condition of anonymity.

Advertisement

The tensions on display this week contrast with hope at the height of the trade war unleashed by Donald Trump for China to repair ties with the EU. Back then, Beijing appeared to be positioning itself as a more reliable partner as Trump alienated the bloc. Now, deep disagreements are once again marring the relationship.

Tensions flared in April with Beijing’s decision to impose export controls on rare earth magnets, which shook European car companies and other sectors.

Brussels also takes issue with what it considers as Beijing’s support for Moscow. The EU on Friday sanctioned two Chinese banks and five China-based companies as part of its latest measures against Russia.

Trade ties are another source of frustration. The Asian nation’s goods trade surplus reached almost $143 billion in the first half of this year, a record for any six-month period, according to data released last week.

Advertisement

The EU inflamed trade tensions when it imposed tariffs on Chinese electric vehicles last year in a bid to ward off a flood of cheap imports. In response, China launched anti-dumping probes into European brandy, dairy and pork.

With assistance from Iain Rogers and Jorge Valero.

©2025 Bloomberg L.P.

RIL Q1 preview: Profits have slowed, hype is building—can Reliance deliver this time?

Reliance Industries Ltd is scheduled to announce its June quarter results on 18 July. According to a Bloomberg analyst consensus, the oil-to-telecom conglomerate is expected to report consolidated revenue of ₹2.42 trillion for the first quarter of FY26. In Q1FY25, revenue had grown by almost 12% year-on-year. Reliance is betting on its new energy business, which spans solar module and clean power manufacturing, hydrogen generation, and clean energy manufacturing. The telecom and retail businesses, which have been the drivers of Reliance’s growth over the past decade, have matured and are expected to see steady growth in Q1 Q1 FY26, analysts say. But they too face headwinds: cost control remains a challenge in retail, while telecom continues to grapple with revenue growth. The retail business, though a relatively smaller contributor to the consolidated earnings, trades at expensive multiples. The company has guided for continued floor space expansion starting this year, and investors will look for material progress on that front.

After a prolonged slump in its core oil-to-chemicals (O2C) business, and as investor expectations rise, the Mukesh Ambani-owned conglomerate will not only have to deliver stronger earnings but also offer concrete progress on its much-touted new energy ventures.

While the O2C business has seen a sharp erosion in profitability, the retail and telecom arms have provided crucial support to overall earnings—though not without facing their own operational challenges.

Reliance Industries is scheduled to announce its June quarter results on 18 July. According to a Bloomberg analyst consensus, the oil-to-telecom conglomerate is expected to report consolidated revenue of ₹2.42 trillion for the first quarter of FY26, up nearly 5% from ₹2.32 trillion a year earlier. In Q1FY25, revenue had grown by almost 12% year-on-year.

Net profit is estimated at ₹20,059 crore, compared to ₹17,445 crore in the same quarter last year, when profit had declined 5% year-on-year.

O2C drag persists

Weak commodity prices have routed the margins in its mainstay O2C business over the past couple of years. The Ebitda from the O2C business has shrunk by over a tenth in the last two years.

In response, retail and telecom—the conglomerate’s other two key growth engines—have been doing the heavy lifting. But they too face headwinds: cost control remains a challenge in retail, while telecom continues to grapple with revenue growth. Together, these two segments have just about offset the drag from O2C.

The result: consolidated profit grew by a modest 4% between FY23 and FY25, compared to about 67% over the previous four financial years, according to JP Morgan. This tested investor confidence, with the stock hovering close to its 52-week low of ₹1,115.55 between December and April.

Recently, however, investors have warmed up to the stock again, with shares gaining nearly a quarter since April and approaching their 52-week high of ₹1,593.30 apiece seen in July 2024. Investors are taking comfort in analysts’ guidance that there was little downside to the O2C business from the lows of FY25, when its profit declined by 12%.

“Both refining and petchem (which comprise the O2C business) margins have fallen materially, and should have little sustained downside over FY25 levels,” JP Morgan analysts noted on 6 June. O2C also accounts for only a third of RIL’s consolidated Ebitda now, down from 44% in FY23, implying that the drag on the consolidated numbers from any margin weakness in this business should be relatively lower, they said.

At 0238pm (India time), shares of Reliance traded at ₹1475.10 apiece on the BSE, down 0.72% from previous close.

Retail and telecom in focus

Meanwhile, retail and telecom—the conglomerate’s other two key growth engines—have been doing the heavy lifting.

The retail business, though a relatively smaller contributor to the consolidated earnings, trades at expensive multiples and is expected to report better growth. The store count shrank over the past year as Reliance rationalized its retail network and workforce. Management has guided for continued floor space expansion starting this year, and investors will look for material progress on that front.

In the January-March quarter, the company also saw an increase in sales within the existing stores, a trend which investors would expect to continue.

JP Morgan values the retail business at 32.5x FY27 Ebitda compared to 7.5x for O2C and 13x for telecom.

The telecom business under the Jio brand is projected to see revenue and Ebitda growth of 18-21% CAGR over FY25–27 due to an improving pricing environment and the expansion of its home broadband business, analysts at Jefferies said in a note dated 5 June.

Cash flows are expected to jump tenfold over this period as capital expenditure requirements are also moderating in conjunction with better income forecasts, they said.

The next growth engine

The telecom and retail businesses, which have been the drivers of the Reliance stock over the past decade, have matured.

Also Read | Reliance Jio may see steady growth in Q1 on user adds, IPL push

A new growth engine is needed—and the company is betting on its new energy business, which spans solar module manufacturing, clean power generation, green hydrogen, and data centres.

Reliance is going back to its roots in Jamnagar, where its refinery is located, to set up its new energy and artificial intelligence (AI) infrastructure. The company sees its new energy business being “more ambitious, far more transformational, and far more global in scope than anything it’s ever done before,” analysts at Morgan Stanley noted on 3 July, citing company presentations.

However, beyond the hype, the company will have to give material updates on the progress it is making on this front as investor enthusiasm on renewable energy has started running out of steam even as interest in AI remains high.

Conclusion

Investors have already reposed their faith in the stock. The numbers tell the story.

Reliance contributed 457 points, or about a tenth to the benchmark index Nifty’s 4,534-point (17.25%) correction from a record high of 26,277.35 on 27 September 2024 to a 13-month low of 21,743.65 on 7 April 2025, making it the biggest drag on the index, as per wealth advisory firm Equentis.

Also Read | Jio BlackRock has made a solid start. The real test lies ahead

Since then, the company has contributed another tenth to the index’s 18% recovery when it hit a high of 25,654.2 points on 27 June.

Now, Reliance has to deliver on its guidance.

Stocks to buy today: Trade Brains Portal recommends two stocks for 17 July

The railway finance sector plays a crucial role in India’s economy, as it raises money so that railroads can upgrade and grow their networks. Sona BLW Precision Forgings Ltd (Sona Comstar) is one of the top mobility technology firms in the world. The company designs, manufactures, supplies systems and supplies systems in both electrified and non-electrified powertrain segments. We also analyze the market’s performance on Wednesday to understand what may lie ahead for the stock indices in the coming days. The stocks to trade today, recommended by Trade Brains Portal for 17 July: Indian Railway Finance Corp. Ltd (IRFC) and Sona Blw Precision forgings (BLW) India, the US, China, North America, and Mexico are among the five nations where it is present, followed by India (29%), Europe (29%) and the rest of the world (3%). The company reported revenue from operations of ₹3,546 crore, an 11% increase from the previous year.

We also analyze the market’s performance on Wednesday to understand what may lie ahead for the stock indices in the coming days.

Stocks to trade today, recommended by Trade Brains Portal for 17 July:

Indian Railway Finance Corp. Ltd

Current price: ₹135

Target price: ₹175 in 16-24 months

Stop loss: ₹110

Why it’s recommended: The ministry of railways has administrative authority for IRFC, a navratna public sector enterprise that was founded in 1986. Its primary responsibility is to raise money from the financial markets in order to finance the development or purchase of assets, which are then leased to Indian Railways. A number of other organizations in the industry, such as Rail Vikas Nigam Ltd (RVNL), RailTel, Konkan Railway Corp. Ltd (KRCL), and Pipavav Railway Corp. Ltd (PRCL), have received financial support from IRFC in addition to the railways. The company’s assets under management (AUM) were valued at ₹4.6 trillion as of 31 March 2025.

IRFC’s net interest income increased by 2.2% from ₹6,429 crore in 2023-24 to ₹6,569 crore in 2024-25. Additionally, its net interest margin improved somewhat, going from 1.38% to 1.42% over the prior year. IRFC approved ₹5,700 crore in loans for the fiscal year, including ₹700 crore for NTPC and ₹5,000 crore for NTPC Renewable Energy Ltd. Additionally, the company became the first bidder for ₹3,167 crore in funding for the construction of the Banhardih Coal Block in Jharkhand’s Latehar district, and it signed a rupee term loan arrangement for ₹5,000 crore with NTPC REL.

The department of public enterprises granted the firm navratna status in 2024-25, and it hopes to soon obtain maharatna status. Additionally, under Indian Railways’ General Purpose Waggon Investment Scheme (GPWIS), the IRFC board authorized funding to NTPC for 20 BOBR rakes on a finance lease basis up to ₹700 crore. In January 2025, a leasing agreement was also struck with NTPC Ltd for eight BOBR rakes, which were valued at over ₹250 crore. Additionally, IRFC and REMCL have signed a memorandum of understanding to jointly investigate financing alternatives for Indian Railways’ renewable energy projects, including possible financing in the nuclear, thermal, and renewable energy domains.

Risk factor: The ministry of railways and its affiliates account for the entirety of IRFC’s loan book. As of 31 March 2025, 37% consisted of advances for leased railway assets, 62% consisted of lease receivables from the ministry, and 1% consisted of loans to organizations such as NTPC and RVNL. The company is susceptible to changes in finance or policy because its expansion is directly linked to the ministry’s investment plans for Indian Railways. Furthermore, IRFC is vulnerable to interest rate swings and shifts in investor sentiment due to its reliance on market borrowings.

Sona Blw Precision Forgings Ltd

Current price: ₹456

Target price: ₹550 in 16-24 months

Stop loss: ₹405

Why it’s recommended: One of the top mobility technology firms in the world, Sona BLW Precision Forgings Ltd (Sona Comstar) was founded in 1995. It designs, manufactures, and supplies systems and components for global mobility OEMs in both electrified and non-electrified powertrain segments. The company has three engineering competency centres, five R&D centres, and twelve manufacturing units.

India, the US, China, Serbia, and Mexico are among the five nations where it is present. North America accounts for 41% of the company’s revenue, followed by India (29%), Europe (24%), Asia (6%), and the rest of the world (0.3%). Globally, Sona BLW holds an 8% market share in differential gears and a 5% market share in starter motors.

In 2024-25, the company reported revenue from operations of ₹3,546 crore, an increase of 11.3% from ₹3,185 crore in the previous year. Ebitda stood at ₹975 crore with a 27.5% Ebitda margin. Profit after tax increased by 16% to ₹600 crore from ₹518 crore in the previous year. Segment-wise revenue share from BEV rose from 29% to 36% in 2024-25. In 2024-25, the firm increased its global market share for starter motors from 4.2% to 4.4% and differential gears from 8.1% in CY2023 to 8.8% in CY2024. The company’s net order book increased to ₹24,200 crore after securing orders totalling ₹4,700 crore.

For an enterprise value of ₹1,600 crore, the business signed a Business Transfer Agreement (BTA) with Escorts Kubota Ltd (Escorts) in 2024-25 to acquire its railway business. The deal was finalized on 1 June 2025. To collaborate on connected, autonomous, and electric technologies for AGVs, drones, and eVTOLs, the company has inked a memorandum of understanding (MOU) with the NMICPS Technology Innovation Hub on Autonomous Navigation Foundation at IIT Hyderabad (TIHAN-IITH) at CES 2025 in Las Vegas, USA. Through the production-linked incentive (PLI) scheme for the automobile and auto component industry in India, the company has obtained certification for another product, namely the hub wheel motor for electric two-wheelers.

Risk factor: Changes in commodity prices could have a significant effect on the company’s manufacturing costs. Even while there are mechanisms in place to monitor and manage market risks, it is not always possible to fully predict, hedge, or lessen the impact of price volatility on the overall profitability of the business through cost pass-throughs or operational enhancements.

Market update

The Nifty 50 opened flat at the start of the day, opening at 25,196.60, marginally up by 0.8 points from the closing price of 25,195.8 of the previous day. The index gained 16.25 points, or 0.06%, on Wednesday, with a day-high of 25,255.30 in the morning and closing at 25,212.05. The RSI was at 51.05, far below the overbought zone of 70, and the Nifty 50 closed below the 20-day EMA. But it closed above all three of the 50/100/200-day EMAs on the daily chart. Sensex concluded the day at 82,634.48, up 63.57 points, or 0.08%, with an RSI of 50.25. A dismal start to the earnings season and conflicting global cues are leaving investors confused, which eventually creates uncertainty and volatility in the market.

Many major indices were in green on Wednesday. The Nifty PSU Bank Index, which closed at 7,267.20, up 128.85 points, or 1.81%, was among the top gainers. The index was boosted by stocks such as Punjab National Bank, which surged 2.43%; Punjab & Sind Bank, which grew 2.05%; and Bank of Baroda, which jumped 1.95% on Wednesday. Additionally, the Nifty Media Index gained 22.75 points, or 1.31%, to close at 1,758.60.

The top gainer of this index was Network 18 Media, which jumped 13.34% after the results announcement that it turned profitable in Q1FY26. Hathaway Cable also jumped 6.35% due to good results in Q1FY26. The Nifty IT Index, which closed at 37,660.70, up 236.10 points, or 0.63%, was also among the top gainers. The index was increased by stocks such as Wipro, Tech Mahindra, and LTI Mindtree, which grew by more than 1.5% on Wednesday.

The Nifty Metal Index, however, fell 51.25 points, or 0.54%, and closed at 9,360.70. The index declined as a result of heavyweights such as Jindal Stainless Ltd, Jindal Steel & Power, National Aluminium Co., and Tata Steel Ltd tumbling more than 1%. Another significant loser was the Nifty Healthcare Index, which closed at 14,737.25, down -50.40 points or -0.34%.

Asian markets showed a bearish trend on Wednesday. Hong Kong’s Hang Seng declined -72.36 points, or -0.30%, to 24,517.76. The Kospi in South Korea closed at 3,186.38, down by -0.91% or -28.90 points. Japan’s Nikkei 225 tumbled by -14.62 points, or -0.04%, settling at 39,663.40. Shanghai’s Composite Index closed the day marginally lower at 3,503.78, down -1.22 points, or -0.03%. At 5:33pm, Dow Jones Futures were up 93.04 points, or 0.22%, on the US stock exchange at 44,120.77.

Trade Brains Portal is a stock analysis platform. Its trade name is Dailyraven Technologies Pvt. Ltd, and its Sebi-registered research analyst registration number is INH000015729.

Investments in securities are subject to market risks. Read all the related documents carefully before investing.

Registration granted by Sebi and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of Mint. We advise investors to check with certified experts before making any investment decisions.

Best stocks to buy today, 1 July, recommended by NeoTrader’s Raja Venkatraman

The Indian stock market closed the final trading session of June in the red, as investors booked profits after a strong four-day rally. Still, it marked the fourth straight month of gains, with the Nifty 50 rising 3.10% and the Sensex up 2.65% in June. On the charts, too, we note that the prices have slowly and steadily moved out of the range since March lows and are looking to head higher. Three stocks to trade today, 1 July, as recommended by NeoTrader’s Raja Venkatraman: Jtekt India, Heritage Foods and D B Corp. JTEKT India is recommended due to its strong financial performance, including good profit and revenue growth over the past three years, healthy interest coverage, and efficient cash flow management. Heritage Foods has maintained steady growth, driven by robust demand Consumer durables space. The constant demand at every reaction as seen on the charts indicate a strong buying interest at lower levels. D B Corporation has robust fundamentals and a compelling financial performance in the last quarter.

Notably, both indices have rebounded nearly 17.3% from their April lows, marking their strongest recovery in recent memory.

Three stocks to trade today, 1 July, as recommended by NeoTrader’s Raja Venkatraman:

Jtekt India (Current market price ₹ 145.53)

Why it’s recommended : JTEKT India Ltd (JTEKTINDIA) is recommended due to its strong financial performance, including good profit and revenue growth over the past three years, healthy interest coverage, and efficient cash flow management. On the charts, too, we note that the prices have slowly and steadily moved out of the range since March lows and are looking to head higher.

JTEKT India Ltd (JTEKTINDIA) is recommended due to its strong financial performance, including good profit and revenue growth over the past three years, healthy interest coverage, and efficient cash flow management. On the charts, too, we note that the prices have slowly and steadily moved out of the range since March lows and are looking to head higher. Key metrics : P/E: 48.75 52-week high: ₹ 225.25 Volume: 2.18 M

Technical analysis : Support at ₹ 134, resistance at ₹ 185.

Support at 134, resistance at 185. Risk factors : Rising transportation costs, regulatory shifts in construction norms, and price sensitivity in bulk contracts.

Rising transportation costs, regulatory shifts in construction norms, and price sensitivity in bulk contracts. Buy at : Current market price and dips to ₹ 139.

Current market price and dips to 139. Target price : ₹ 155-160 in 1 month.

155-160 in 1 month. Stop loss: ₹ 1880.

Db Corp (current market price ₹ 284.65)

Why it’s recommended : D B Corp has robust fundamentals and a compelling financial performance in the last quarter. On the price action we can observe that the price has been slowly inching higher and after consolidating near the TS line the charts are displaying a robust long body candle on Monday with volumes.

D B Corp has robust fundamentals and a compelling financial performance in the last quarter. On the price action we can observe that the price has been slowly inching higher and after consolidating near the TS line the charts are displaying a robust long body candle on Monday with volumes. Key metrics : P/E: 13.75 52-week high: ₹ 405 Volume: 244.87 K

Technical analysis : Support at ₹ 261, resistance at ₹ 325.

Support at 261, resistance at 325. Risk factors : AI powered search is driving decreasing traffic, increased competition and significant volatility in traffic patterns.

AI powered search is driving decreasing traffic, increased competition and significant volatility in traffic patterns. Buy at : Current market price and dips to ₹ 275.

Current market price and dips to 275. Target price : ₹ 295-304 in 1 month.

295-304 in 1 month. Stop loss: ₹ 270.

Heritage Foods (current market price ₹ 497.45)

Why it’s recommended : Heritage Foods has maintained steady growth, driven by robust demand Consumer durables space. However, the constant demand at every reaction as seen on the charts indicate a strong buying interest at lower levels. With a robust volume building up recently one can consider a long in this counter.

Heritage Foods has maintained steady growth, driven by robust demand Consumer durables space. However, the constant demand at every reaction as seen on the charts indicate a strong buying interest at lower levels. With a robust volume building up recently one can consider a long in this counter. Key metrics : P/E: 27.45 52-week high: ₹ 658 Volume: 821.18 K

Technical analysis : Support at ₹ 438, resistance at ₹ 580.

Support at 438, resistance at 580. Risk factors : Increased competition and potentially overvalued stock

Increased competition and potentially overvalued stock Buy at : Current market price and dips to ₹ 468.

Current market price and dips to 468. Target price : ₹ 550-565 in 1 month.

550-565 in 1 month. Stop loss: ₹ 459.

Stock Market Recap: 30 June

India’s recent market rally paused on Monday, with both the Sensex and Nifty closing lower after early weakness dragged the latter briefly below the 25,500 mark. A late rebound in PSU banks, tech, and media stocks helped pare losses, pushing the Nifty back above that level by the close.

The Sensex ended the day down 452.44 points (-0.54%) at 83,606.46, while the Nifty slipped 120.75 points (-0.47%) to settle at 25,517.05.

Broader markets once again outperformed the benchmarks: the BSE Midcap index rose 0.6% and the Smallcap index added 0.8%. The Nifty Bank index, which touched a fresh high of 57,614.50 intraday, cooled off to end 0.2% lower at 57,312.75.

Among the top drags were Tata Consumer, Axis Bank, Kotak Mahindra Bank, Hero MotoCorp, and Maruti Suzuki. On the gainers’ side, Trent, SBI, IndusInd Bank, Bharat Electronics, and Jio Financial provided support.

At the sector level, PSU banks surged 2.6% and pharma rose 0.5%, while realty, FMCG, autos, and metals saw mild pullbacks.

Also Read | Tech Mahindra: What can upset its apple cart

Investors will now watch for global cues and whether the ongoing outperformance in midcaps can be sustained.

Outlook for Trading

The market remains under pressure at higher levels, lacking the conviction needed to sustain its upward momentum. While occasional rallies are visible, persistent low participation and weak follow-through suggest that bullish trends are struggling to hold.

Geopolitical tensions—intensifying since April—have kept volatility elevated, making both trading and investing a challenging affair. At present, there are no clear signals indicating the extent or timing of any near-term correction.

View Full Image (Source: TradingView)

As highlighted in our previous note, the 24,800–24,900 zone continues to be a critical support range. The trading band is narrowing, and current option data suggests bearish undertones: the put-call ratio (PCR) has dropped to 0.65, indicating selling pressure at higher levels. Notably, call writing has now shifted lower to the 25,600 strike, establishing it as the next key resistance.

Despite sporadic attempts to push higher, the market has been unable to gather enough strength to sustain an upward move. The “max pain” level currently sits at 25,500—a zone that now needs to hold in order to maintain upward momentum. Continued dip-buying has kept bullish hopes alive, but the lack of clarity in directional cues means traders should adopt a neutral bias in the near term.

With trends turning increasingly two-sided, a balanced and pragmatic approach is essential to navigate the current market phase.

Raja Venkatraman is the co-founder of NeoTrader. His Sebi-registered research analyst registration no. is INH000016223.

Investments in securities are subject to market risks. Read all the related documents carefully before investing. Registration granted by Sebi and certification from NISM in no way guarantees performance of the intermediary or provide any assurance of returns to investors.

Disclaimer: The views and recommendations given in this article are those of individual analysts. These do not represent the views of Mint. We advise investors to check with certified experts before making any investment decisions.